- Magna produces auto components and techniques for the highest 50 automotive manufacturers worldwide

- Magna will start manufacturing of its Fisker’s EVs in November

- Russia and a powerful US dollar weighed closely on earnings within the second quarter of 2022

- The corporate sees a rebound within the second half of 2022 pushed by semiconductor provide and stimulus measures in China

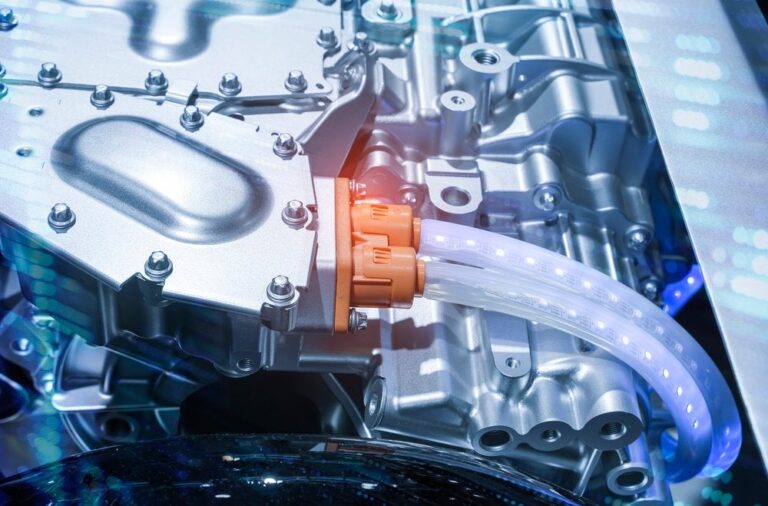

World auto components maker Magna Worldwide (NYSE: MGA) is just not a family title, however it’s nonetheless the most important automotive provider in North America and the fourth largest on the earth. The corporate has contracts with over 50 world prospects, together with the world’s largest automotive manufacturers similar to Ford (NYSE: F) and Basic Motors (NYSE: GM), in addition to main European corporations similar to Volkswagen (OTCMKTS: VWAGY) and BMW. The corporate manufactures every part from doorways, seats, classic and electrical powertrains and transmissions to the manufacture of full vehicles. Magna is a one-stop store and the world’s largest automotive contract producer with an annual manufacturing capability of over 200,000 autos.

MarketBeat.com – MarketBeat

Driving on the automotive megatrends

They’re on the forefront of automotive business traits similar to electrification, electrical autos (EVs), power storage techniques, autonomous driving, mobility and connectivity. Whereas the majority of its practically $39 billion in gross sales comes from its legacy auto enterprise, it is positioned to capitalize on auto business megatrends. Tesla’s (NASDAQ: TSLA) unique killer, Fisker (NYSE: FSR), will start manufacturing of its much-anticipated electrical autos in November. Magna takes over the whole manufacturing of the electrical autos. Whereas going through ongoing headwinds from provide chain constraints, inflationary price pressures and a powerful US dollar, they’re additionally reaping tailwinds from robust auto demand and low vendor inventories. The inventory is a one-stop store for buyers searching for a diversified key participant using the auto business megatrends.

Enticing pullback ranges

Utilizing the rifle charts within the weekly and day by day time frames offers a complete view of the MGA inventory worth. The weekly Rifle chart collapse was triggered by the rejection of the breakout try at $65.24 Fibonacci (fib) level. The weekly downtrend has a falling 5-period transferring common resistance (MA) at $53.39, adopted by a weekly 15-period MA resistance falling at $57.69 whereas the weekly stochastic stands out the 20 band falls. The inventory failed on three makes an attempt to remain above the weekly worth Market construction low (MSL) Purchase set off at $62.99, inflicting shares to fall in direction of weekly decrease Bollinger Bands (BBs) at $46.55. The day by day rifle chart was in a downtrend, led by the falling 5-period MA resistance at $49.54, adopted by the 15-period MA at $53.18. Each day decrease BBs are at $45.35. The day by day stochastic has crossed up however is flat on the 10-band. It wants to interrupt the 20 band to achieve upward momentum. Enticing pullback ranges stay at $46.26, $44.25 Fib, $41.99 Fib, $38.32 Fib, $34.65 Fib and $31.02 Fib.

Restoration within the second half of 2022

On July 29, 2021, Magna reported its second quarter 2022 outcomes for the quarter ended June 2022. The corporate reported earnings per share (EPS) of $0.83 excluding one-time gadgets in comparison with beating analyst consensus estimates of $0.92, a (-$0.09). Income rose 3.6% year-on-year (YoY) to $9.36 billion, beating analyst estimates of $8.92 billion. The corporate reported a 2% improve in gentle automobile manufacturing, largely as a consequence of a 14% soar in gross sales in North America. Foreign money translation impacted earnings (-$629 million) and decrease gross sales in Russia. Increased enter prices, Russia and operational inefficiencies in Europe resulted in a (-41%) decline in adjusted earnings per share (-41%) from $1.40 to $0.83 and diluted earnings per share of (-0.54 $) versus $1.40 in the identical interval final 12 months. This was impacted by a non-cash impairment (-$1.24) on its funding in Russia. Nevertheless, the corporate is optimistic for a restoration within the second half of the 12 months. Magna grew its full-year 2022 income to $37.6 billion to $39.2 billion, up from the earlier steering of $37.2 billion to $38.9 billion versus analyst estimates of $37.75 billion.

threatening headwind

Magna CEO Swamy Kotagiri expects provide chain points to proceed into 2022. These embody semiconductor shortages in China-made components with COVID lockdowns. The enter prices had been and stay high. Nevertheless, he reminded analysts: “The stronger US dollar relative to different currencies by which we function, significantly the euro, is negatively impacting our reported outcomes and there may be some danger that high inflation and rising rates of interest will have an effect on automobile customers.”

Robust tailwind

The corporate is experiencing robust auto demand with low vendor inventories and tight provide. Semiconductor provide shortages are anticipated to ease within the second half of 2022. The easing of COVID lockdowns in China and a authorities stimulus package deal ought to enhance provide chains and enhance automotive demand.