Dmytro Zinkevych / Shutterstock.com

How a lot cash will likely be in your Social Safety retirement examine, and the way a lot can you retain? These are burning questions for retirees.

Even retirees who proceed to work can rely closely on this long-awaited month-to-month profit.

Right here we check out the deciding components behind the dimensions of your examine and the way a lot goes into your purse or pocket.

1. Your skilled historical past

Gorodenkoff / Shutterstock.com

Gorodenkoff / Shutterstock.com

Your “retirement age” means one thing very particular to Social Safety. You possibly can cease working and have all of the retirement events you need, however so far as Social Safety goes, your retirement age is not whenever you cease working, it is whenever you begin gathering Social Safety advantages.

To calculate the quantity of your month-to-month profit examine, the Social Safety Administration (SSA) makes use of a method that takes into consideration:

- Your 35 years with the very best revenue

- While you begin receiving Social Safety advantages

The SSA explains extra underneath “Your retirement age and whenever you cease working”.

2. Your earnings historical past

JJ Gouin / Shutterstock.com

JJ Gouin / Shutterstock.com

The scale of your Social Safety checks additionally will depend on the quantity you earned in every of these 35 highest-earning years.

The method measures revenue, not work. So possibly you labored at house, raised kids or cared for the aged. With no revenue for these years, you’re at an obstacle.

If you do not have 35 years of revenue, Social Safety assigns a value of $0 for every year of no revenue. The $0 years cut back your profit quantity, so it is in your favor to earn revenue in as a lot of these 35 years as doable.

Greater than 35 years of labor can not hurt this calculation. In actual fact, you possibly can improve your month-to-month retirement examine if:

- You add years of service to switch zero years of earnings

- They exchange lower-income years with higher-income years

The SSA has particulars underneath “Social Safety Advantages”.

3. While you had been born

xtock/Shutterstock.com

xtock/Shutterstock.com

The yr you had been born is a vital milestone for Social Safety. The yr you had been born determines your ‘full retirement age’, which is a benchmark in your advantages set by the Social Safety Administration.

For these born between 1943 and 1954, the total retirement age is 66 years.

To maintain Social Safety financially robust, Congress took steps in 1983 to steadily elevate the total retirement age. So in case you had been born in 1960 or later your full retirement age is 67. For those who had been born between 1954 and 1960 your full retirement age will be discovered on this SSA desk.

4. Your age on the time of utility

Moha El-Jaw / Shutterstock.com

Moha El-Jaw / Shutterstock.com

Social Safety permits retirees to assert advantages and obtain pension checks as quickly as they flip 62.

However you can’t earn the total quantity as a consequence of you at this time; It’s important to wait till full retirement age. Making use of earlier will decrease your month-to-month profit quantity – completely.

For those who wait previous your full retirement age, you might exceed your Social Safety profit. That is additionally everlasting.

See the SSA Delayed Retirement Credit desk for particulars. Usually, you improve your month-to-month profit for every month you defer claiming till age 70.

Your month-to-month profit can develop by a maximum of 8%; You may get this by ready till your seventieth birthday earlier than claiming advantages. There is no level in ready any longer; beneficial properties cease at this age.

5. A partner who labored

wavebreakmedia / Shutterstock.com

wavebreakmedia / Shutterstock.com

You might be able to get extra from Social Safety than you’re entitled to in your labor steadiness. As? By making use of for a “partner’s pension”.

In case your partner earns extra (and receives Social Safety advantages), you might be eligible for a higher payout — as much as half your partner’s “main insurance coverage quantity,” relying on the age at which she or he filed for Social Safety.

Usually you must be a minimum of 62 years outdated for this. The profit will increase in case you wait till full retirement age.

Partner advantages could also be accessible in some instances in case you have a toddler underneath the age of 16 or obtain SSI incapacity funds.

There are restrictions and necessities. Study extra about Social Safety advantages for spouses.

6. The financial scenario

Morrowind / Shutterstock.com

Morrowind / Shutterstock.com

When you obtain Social Safety checks, your month-to-month profit is often fastened.

However inflation hurts these on fastened incomes, so the Social Safety Act tries to compensate with automated cost-of-living changes (COLA) — share will increase in month-to-month advantages.

These COLAs are primarily based on the nationwide inflation price. When inflation stagnates, annual COLA is tiny — or generally 0%. At this time, with higher inflation, the COLA will increase are getting greater.

Scroll down this web page to view Social Safety COLAs since 1975.

7. Whether or not you proceed to work

Pixel Fri / Shutterstock.com

Pixel Fri / Shutterstock.com

Working is an exception to the rule of thumb that Social Safety funds are decided after you apply for advantages.

Working after you begin gathering advantages can improve your Social Safety fee. Your profit method will likely be recalculated every year to replicate your new revenue.

“In case your final yr of earnings is certainly one of your highest years, we’ll recalculate your profit and pay you the rise due,” the SSA says. That is as a result of with every higher-income yr, Social Safety replaces a lower-income yr within the method.

Nevertheless, there’s a “however”. For those who’re underneath full retirement age, you would briefly cut back your profit in case you earn an excessive amount of at work.

While you attain full retirement age, the penalty will finish and your profit quantity will likely be adjusted to compensate you for the interval that advantages had been withheld.

You possibly can take a look at situations with this retirement calculator. The SSA doc Receiving Advantages Whereas Working explains extra and offers examples.

8. Whether or not you’ve got different revenue

aerogondo2 / Shutterstock.com

aerogondo2 / Shutterstock.com

Do you must pay tax in your pension revenue from social safety? Perhaps.

In case your revenue is lower than $25,000 for a single applicant or lower than $32,000 for a pair making use of collectively, you do not pay federal revenue tax in your profit checks, as SSA explains right here.

In any other case your profit will likely be taxed – as much as 50% or 85% of the entire quantity. How a lot tax you pay will depend on the way you file federal taxes and your revenue from different sources.

9. The place you reside

esfera / Shutterstock.com

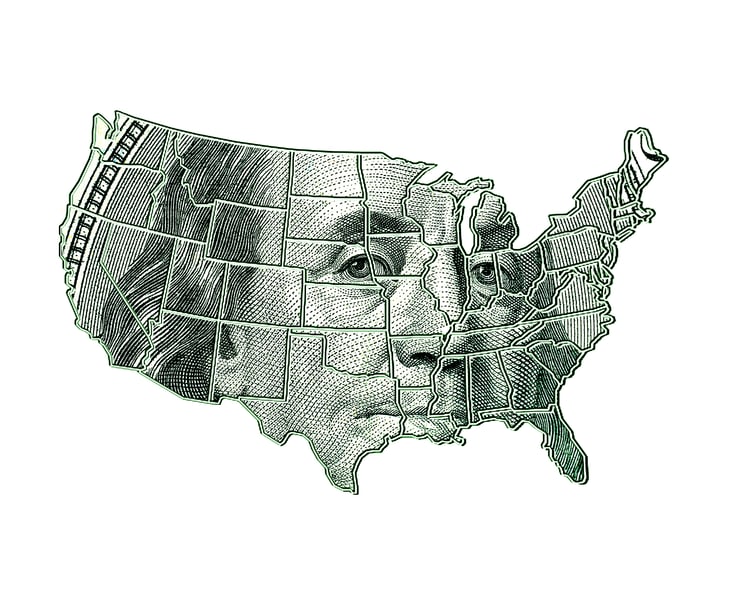

esfera / Shutterstock.com

The IRS is not the one one who desires a chunk of your profit examine. For those who reside in one of many 12 states that tax Social Safety advantages, you might also owe state revenue tax in your profit examine.

The foundations differ. Some states comply with federal laws on Social Safety taxation. Others have their very own approaches, says this AARP abstract of states’ guidelines.

Disclosure: The data you learn right here is all the time goal. Nevertheless, we generally obtain compensation whenever you click on hyperlinks in our tales.