The crypto market is pushing higher as Bitcoin, Ethereum and different main cryptocurrencies flip important factors of resistance into assist. ETH worth is at present main the market rally because it posted a 40% acquire prior to now 7 days to commerce at $1,500.

Associated Studying | Solana offers 70% extra shine – can SOL preserve the lights on?

However, BTC’s worth is extra conservative however has began to indicate essential beneficial properties. On the time of writing, BTC is trading at $22,800 with a 14% acquire over the identical interval and is on monitor for extra beneficial properties.

ETH worth exhibiting minor beneficial properties on the 4-hour chart. Supply: ETHUSDT Buying and selling View

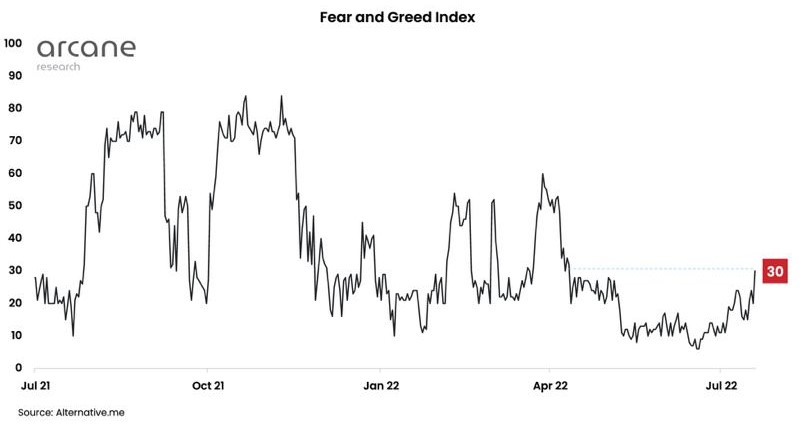

On account of the bullish momentum, the Worry and Greed Index has damaged out of its 74-day section and moved to excessive worry ranges, in accordance with a report from Arcane Analysis. Once more, this confirms the profitability of taking lengthy positions when this index consolidates round these ranges.

As seen within the chart under, the Crypto Worry and Greed Index has returned to its Q1 2022 ranges. This indicator crashed in Could when Bitcoin’s worth broke under $30,000 and hit a multi-year low of round $17,500.

Supply: Arcane Analysis

Supply: Arcane Analysis

Regardless of the present bullish momentum, the index remains to be floating within the worry zone, suggesting that BTC, ETH and the crypto market must observe the index and name again its costs for Q1 2022 earlier than extra market members turn into extra optimistic. Arcane Analysis discovered the next:

As sentiment improves, the Worry and Greed Index stays deep in worry territory and different helpful sentiment indicators from the derivatives market counsel that market members stay cautious.

The chart above suggests the sector is at an inflection level because it surges above 30 within the Crypto Worry and Greed Index. A break above these ranges might verify a change within the present market pattern.

Why the crypto market might use this window of alternative

Within the short-term, the crypto market has an opportunity to increase bullish momentum. The components driving BTC and ETH to yearly lows seem like softening.

This contains the US Federal Reserve (Fed), which is making an attempt to stem inflation by elevating rates of interest. The financial establishment has entered a blackout interval, which means its officers won’t be making any public statements till the subsequent Federal Open Market Committee (FOMC) assembly.

Inflation, as measured by the Consumer Value Index (CPI), seems poised to sluggish. As NewsBTC reported, this metric has loved a 40-year surge however might take a step again as oil, copper and others pattern decrease. CPI stress is extremely depending on commodity costs.

Associated Studying | Polygon worth skyrockets 60% – is MATIC nearing $1 goal?

The crypto market is outwardly additionally receiving assist from conventional stocks. The 2 sectors have been correlated because the downtrend started, and as such, BTC and different cryptocurrencies may gain advantage from a inventory bounce to earlier ranges.

#Shares proceed to rise, bringing #Bitcoin with them. When the markets appropriate 70-90%, load up the chance and commerce it. Did it in March 2020 and can do it once more. Even only a reduction rally is a big win at this level.

— IncomeSharks (@IncomeSharks) July 19, 2022