Following current geopolitical occasions, the correlation between gold and Bitcoin costs has as soon as once more come underneath scrutiny by market analysts. Right here’s a complete dive into the connection and its implications.

The Gold And Bitcoin Correlation

After the current Israel-Hamas struggle, gold skilled a speedy uptick in its worth. This shift apparently mirrored actions within the Bitcoin market, emphasizing a revived correlation between the 2 belongings. Skew, a good market analyst, shared his insights on X (previously Twitter), noting on October 11 that “correlation has been slightly loosely relevant to BTC durations of 35 days + the place there’s worth disconnection between each markets.”

Nonetheless, solely days later, on October 16, he noticed a possible “re-correlation” as each Bitcoin adopted the newest gold rally. At present, the assertion stands stronger with Skew’s newest tweet, “BTC & gold correlation nonetheless there it appears. Gold could lead the following huge transfer for BTC.”

Bitcoin and gold correlation | Supply: X @52kskew

In his current insights shared within the Onramp Weekly Roundup, Bitcoin analyst Dylan LeClair emphasised the implications of the continued selloff in authorities bonds. Rising prices for long-term financing straight affect the worldwide price of capital, providing a valuation yardstick for numerous belongings.

Extra considerably, the treasury market underpins the worldwide financial ecosystem. Its present instability may stress asset costs and exacerbate the pre-existing debt cycle, doubtlessly endangering the US’s fiscal place. This precarious state contrasts sharply with the US administration’s fiscal actions, as evidenced by plans just like the “WHITE HOUSE EYES $100 BILLION UKRAINE, ISRAEL AND BORDER ASK”, suggesting an absence of fiscal restraint, in accordance with LeClair.

Gold, Actual Yields, And The Altering Panorama

Additional complicating issues, Invoice Dudley, former president of the Federal Reserve Financial institution of New York, in his current Bloomberg piece, famous the chance of the present cycle of quantitative tightening (QT) persisting till late 2025. This extended QT may heighten long-term rates of interest and threat treasury market turbulence. But, ought to extreme dysfunction manifest within the treasury market, the Federal Reserve would possibly rethink its QT trajectory.

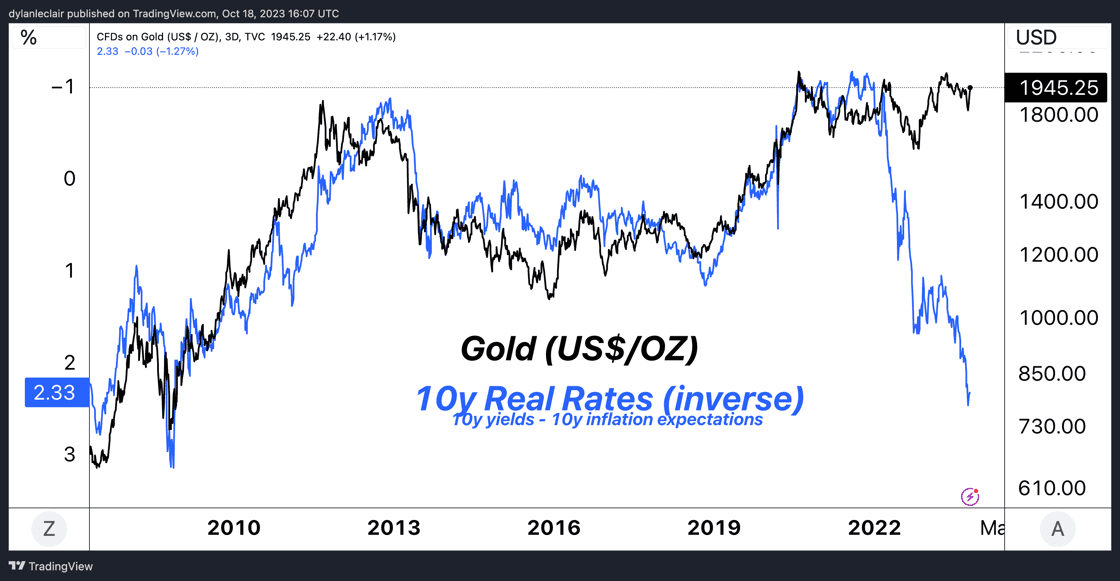

Apparently, put up the Russia-Ukraine battle and the next confiscation of Russia’s G7 reserves, gold, and actual yields have proven an atypical optimistic correlation, difficult their historic unfavourable relationship.

Gold vs 10-year actual charges (inverse) | Supply: Onramp

Gold vs 10-year actual charges (inverse) | Supply: Onramp

On this evolving geopolitical panorama the place even G7 sovereign debt isn’t resistant to confiscation, conventional ‘secure belongings’ are being reevaluated. This uncertainty mixed with the not-so-safe “threat free” yield from treasuries has bolstered gold’s place (and worth) as a counter-risk financial asset and should push Bitcoin on the same trajectory.

In accordance with LeClair:

This repositioning, nonetheless, isn’t restricted to gold alone. Bitcoin, with its distinctive benefits and rising liquidity profile, is on the same trajectory, albeit nonetheless within the very early phases of its monetization with a $500b market cap.

The Greatest BTC Value Indicator?

Underneath these present circumstances, the value of gold could also be a number one indicator for the value of Bitcoin, assuming that the correlation between the 2 belongings continues. This might suggest that Bitcoin is assessed as a “secure haven” asset like gold by a majority of traders, slightly than a “threat asset”.

Nonetheless, this view shouldn’t be shared by all. James Butterfill, the top of analysis at CoinShares, identified that the Bitcoin market has shifted its focus after the pretend information concerning a spot Bitcoin ETF approval. He remarked that traders now appear to prioritize the ETF approval over macro expectations, inserting much less emphasis on the Federal Reserve’s actions.

Because the Coin Telegraph tweet mistake on a Bitcoin Spot ETF approval, Bitcoin costs have decoupled from December rate of interest expectations – it looks as if traders are solely focussed on the ETF approval now, and never what the FED does.

At press time, Bitcoin traded at $28,450.

BTC hovers beneath $28,500, 1-day chart | Supply: BTCUSD on TradingView.com

BTC hovers beneath $28,500, 1-day chart | Supply: BTCUSD on TradingView.com

Featured picture from iStock, chart from TradingView.com