As a freelancer, you in all probability know by now that the 2021 revenue tax return submitting deadline is April 18, 2022, so you will not have an extension like final yr as a result of COVID pandemic. Which means planning your time properly and getting your paperwork so as so you’ll be able to file your tax return on time with out lacking a chance to maximise your deductions.

When you earn revenue from freelance work, you are seemingly eligible for some necessary deductions that may scale back your tax burden. Whereas they take slightly extra time to doc and observe, deductions can prevent some huge cash in your tax invoice.

Listed here are just a few freelancers should not sleep on:

Tax deduction for self-employment

As a freelancer, it’s important to pay self-employment tax along with your revenue tax.

Self-employment tax covers your share of Social Safety and Medicare contributions that might usually be shared together with your full-time employer. The self-employment tax charge is 15.3% of internet revenue, which is the sum of 12.4% Social Safety tax and a pair of.9% Medicare tax on internet revenue.

Whereas self-employment tax is on prime of any debt chances are you’ll owe, the excellent news is that you may declare a part of the tax with the self-employed tax deduction. The deduction corresponds to 50 % of your self-employment tax and is credited to your adjusted gross revenue.

The best way to declare: Calculate your self-employment tax and deductible quantity with Schedule SE. Copy the deduction quantity from line 6 to line 14 of Schedule 1 (Kind 1040 or 1040-SR).

workplace house

Do you may have a house workplace? Then it’s best to positively benefit from the house workplace deduction.

You are in all probability a sensible choice so long as you do most of your work in your house workplace and use the house recurrently and completely for freelance work. In different phrases, when you work at your kitchen desk, it would not actually matter as a result of that is the place you eat too. However when you’ve got an area devoted to your freelance job, then you have to be coated.

There are two methods to calculate the house workplace deduction. The common technique makes use of a fancy formulation to calculate the true value of your property workplace, or you should use the simplified technique, which supplies you a regular deduction of $5 per sq. foot. The maximum space you’ll be able to write off for each prints is 300 sq. toes.

The best way to declare: In case you are utilizing the simplified technique, enter the quantity on Appendix A (Kind 1040 or 1040 SR). In case you are utilizing the common technique, use Kind 8829 to calculate the deduction quantity and enter it on line 30 of the Schedule C type.

medical insurance premiums

This can be a large deal.

If you pay your personal medical insurance premiums and people of your dependents—you’ll be able to deduct the prices. To qualify, you need to not have some other medical insurance, together with your partner’s insurance coverage. You need to even have a sure enterprise revenue and the quantity you deduct can not exceed that. When you had a enterprise loss, you can not declare the deduction. Additionally observe that this can be a deduction out of your private revenue tax, not your self-employment tax. The quantity of your deduction in 2022 is restricted to bills that exceed 7.5% of your AGI (adjusted gross revenue), which implies that the quantity of medical bills equal to the primary 7.5% of your revenue isn’t deductible (eg. (e.g. when you earn $100,000, the primary $7,500 of your medical insurance or different medical payments will not be deductible).

The best way to declare: Enter the overall quantity of eligible medical insurance premiums on line 16 of Schedule 1 (Kind 1040 or 1040-SR).

promoting

As a self-employed taxpayer, when you promote your corporation, chances are you’ll be entitled to some good tax deductions. By definition, you’ll be able to deduct any value of “getting your title out within the public area the place it’s enterprise that you just moderately count on to win sooner or later”. The kind of promoting performs a task, in fact, with lobbying bills, political events and candidates and all associated publications being good examples of bills that you just can not deduct. Nevertheless, it’s best to make clear together with your tax advisor whether or not you’ll be able to deduct the bills at your expense Gigs sponsored by Fiverr.

Eligibility: To be eligible for an promoting deduction, you need to go to Schedule C in your tax return and report your promoting spend.

Extra Exceptions

There are much more write-offs you’ll be able to benefit from as a freelancer. Simply do not forget that to be deductible it needs to be associated to your corporation. This checklist is not exhaustive, so seek the advice of an accountant or tax skilled to seek out much more methods to scale back your taxes.

- Commissions and Charges Paid

- promoting

- Web site growth and area charges

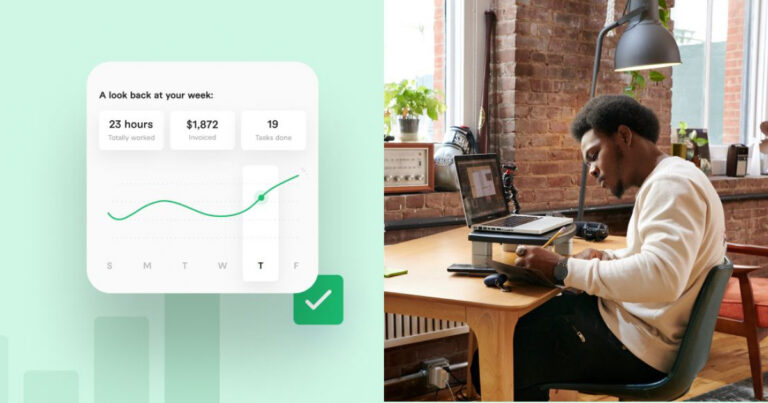

- Software and companies akin to Fiverr Workspace

- Academic bills associated to your freelance profession

- Business Journey

The best way to declare: All of those bills will be claimed on Half II of the Appendix C type. If there is no such thing as a separate merchandise for this, you’ll be able to checklist “Different bills” in Half IV.

Maximize your deductions

Documenting deductions takes time, so be sure you discover out what you are entitled to as quickly as doable so that you’re ready to apply it to your 2021 tax return no later than April 18th 2022 Take this chance to take a superb have a look at your freelance enterprise to seek out doable deductions. Your future self will thanks.