That is why charge hikes and decrease implied volatility make Apple a doubtlessly excellent pullback put-play.

Shares as an entire seem like bucking a significant resistance. $4200 remains to be a wall for the S&P 500.

The inventory with the biggest market cap, Apple, is actually no exception. Apple inventory is the place it was a 12 months in the past. The query is whether or not it is going to proceed to go up.

Here is a fast comparability of Apple’s then (April 2002) and now. And why may you contemplate a comparatively low-cost put buy now?

Curiosity costs

The Fed has raised rates of interest dramatically over the previous 12 months. The Fed’s rate of interest is at the moment between 4.75% and 5%. At this time final April, the fed funds charge was effectively beneath 1%.

Additionally, the 10-year authorities bond yield is way higher in the present day than it was a 12 months in the past. At that time, it yielded lower than 2.75%. Right now it’s over 3.5%. Undoubtedly a big rise in rates of interest. However stocks like Apple do not appear to care.

critiques

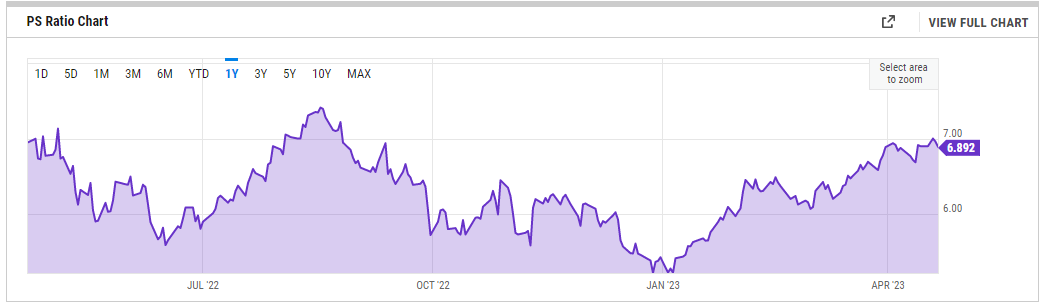

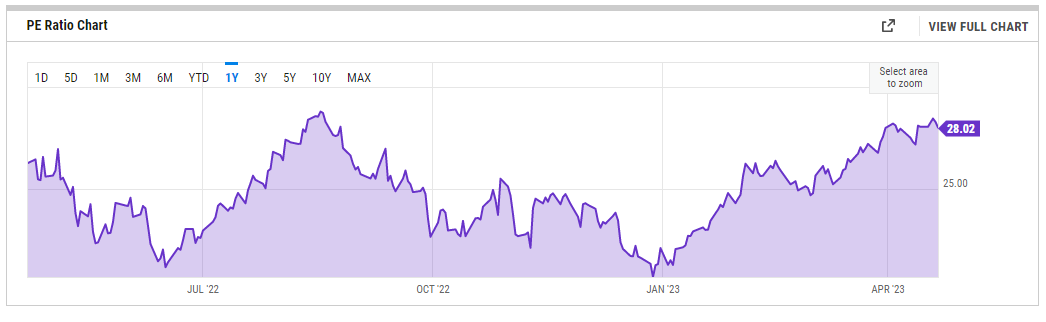

This magnitude of the rise in rates of interest ought to trigger valuation indicators reminiscent of worth/earnings (P/E) and gross sales worth (KV) to contract noticeably. As an alternative, AAPL P/E is up a full level from 27 to twenty-eight. The P/E ratio for Apple is virtually the identical because it was a 12 months in the past at just below 7.

APPL inventory has returned to comparable multiples which have signaled highs up to now. The final time P/E was this high across the twenty eighth was final August – proper earlier than a punitive pullback.

On condition that the Fed has signaled that it’s unlikely to chop charges anytime quickly, valuation multiples are unlikely to widen farther from these at the moment elevated ranges. This may create vital headwinds for the AAPL inventory worth within the coming months. Additionally, it’s attention-grabbing to notice that the magnitude of the present rally is sort of precisely the magnitude of the earlier main rally that resulted in August – as proven within the chart.

Implied Volatility (IV)

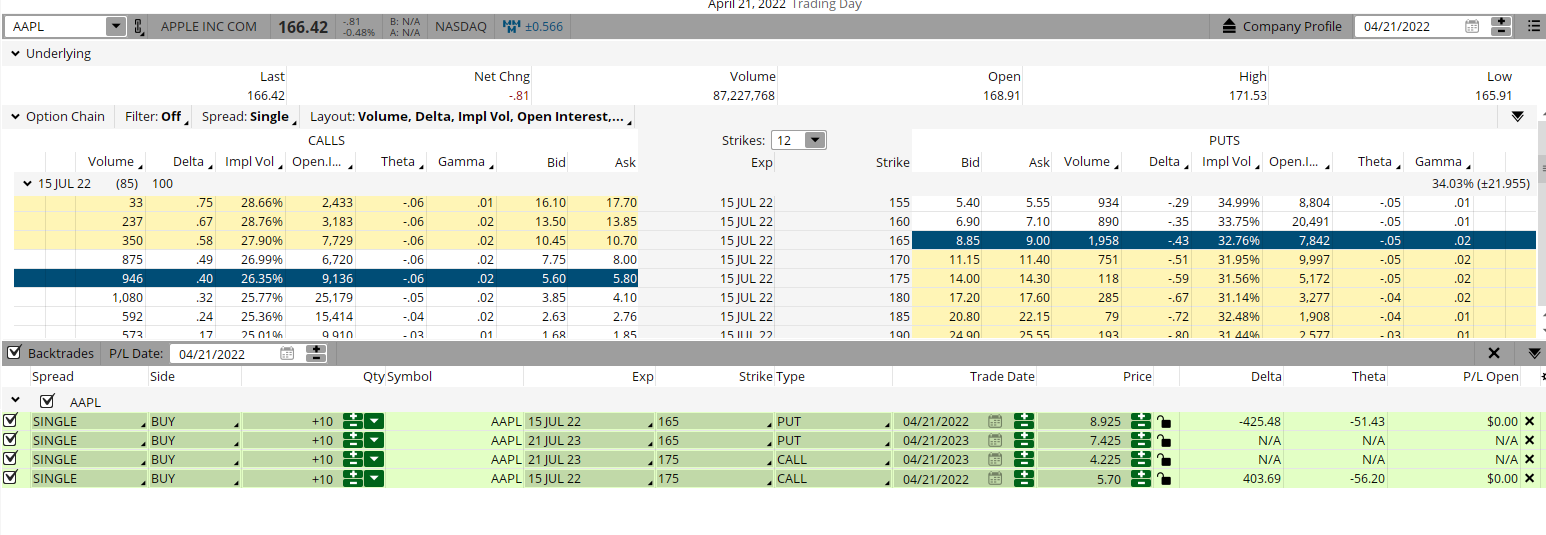

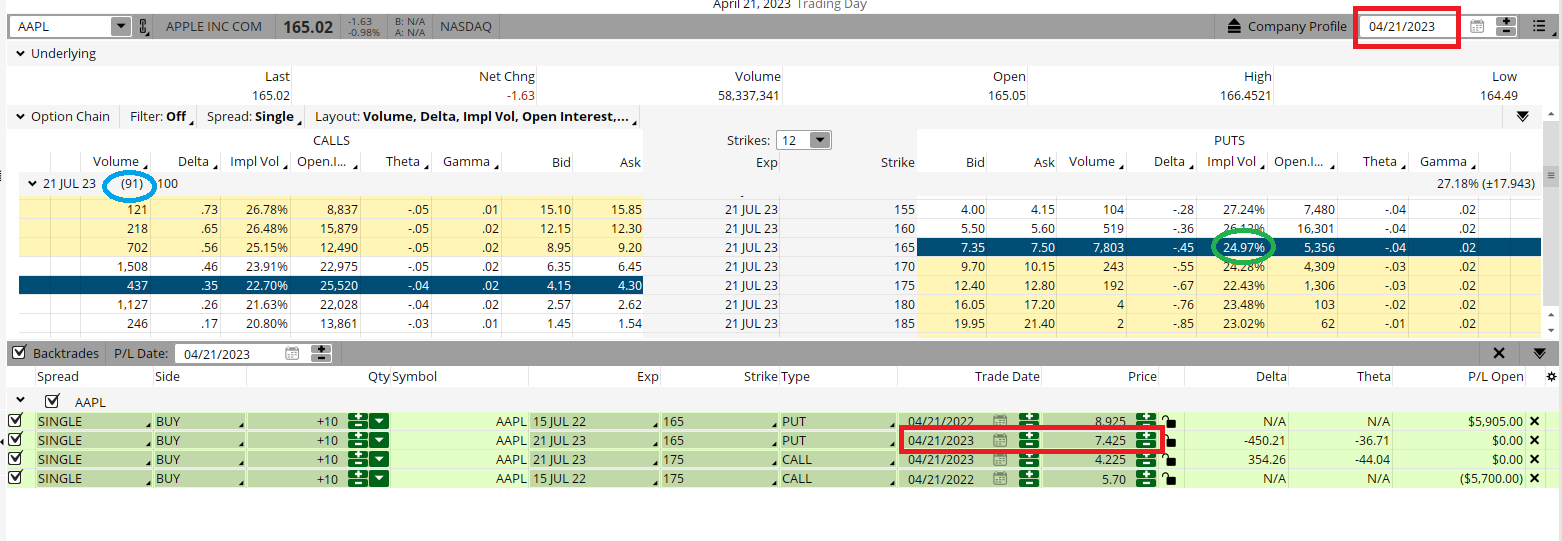

Implied volatility is down considerably on Apple choices in comparison with a 12 months in the past. Again then, at-the-money places for $165 had an IV of just below 33 in July. Right now, comparable at-the-money places are trading at an IV of round 25. This 25% drop in IV means choice costs are less expensive in the present day than they have been 12 months earlier (for calls and places).

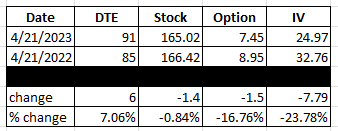

How less expensive? The next desk summarizes the whole lot.

every now and then

- Now the July places of $165 have 91 days till expiration (DTE). Then the identical places had 85 DTE. All the identical, places needs to be barely dearer in the present day as they’ve 6 extra days to expiration (7.06% up)

- Now AAPL inventory closed at $165.02. Then Apple closed at $166.42. All issues being equal, places needs to be barely dearer in the present day because the inventory is $1.40 down (0.84%).

- Now the AAPL July $165 places are priced at $7.45. Then the AAPL July $165 places have been priced at $8.95. Why are places in the present day a lot cheaper (16.76%) than places a 12 months in the past?

- Now IV is at 24.97. Then IV was at 32.76. So the large drop (23.78%) in implied volatility makes what ought to now be barely dearer as a consequence of extra DTE and decrease inventory worth now less expensive primarily based on a a lot decrease IV.

Traders and merchants seeking to quick stocks like Apple ought to contemplate the advantages of shopping for low-cost places. Defining the danger and reducing the price of a pullback makes extra sense now than it has at any time up to now 12 months.

POWR Choices

What do you do subsequent?

When you’re in search of one of the best choices trades for in the present day’s market, try our newest presentation, Tips on how to Commerce Choices with the POWR Rankings. Right here we present you the best way to constantly discover the best choice trades whereas minimizing danger.

If this appeals to you and also you wish to study extra about this highly effective new choices technique, click on beneath to entry this up to date funding presentation now:

Tips on how to commerce choices with the POWR rankings

All one of the best!

Tim Biggame

Writer, POWR Choices Publication

Shares closed at $412.20 on Friday, up $0.32 (+0.08%). Yr-to-date, it is up 8.20% versus a proportion achieve for the benchmark S&P 500 index over the identical interval.

In regards to the Creator: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He’s a daily on Bloomberg TV and writes Morning Commerce Stay weekly for the TD Ameritrade Community. His overriding ardour is making the advanced world of choices extra comprehensible and subsequently extra helpful for the on a regular basis dealer. Tim is the editor of the POWR Choices publication. Discover out extra about Tim’s background and hyperlinks to his newest articles.

Extra…

The put up Apple inventory has been flat for a 12 months, however just a few issues have modified appeared first StockNews.com