studying time: 5 minutes

It is a paid article on behalf of JamDoughnut

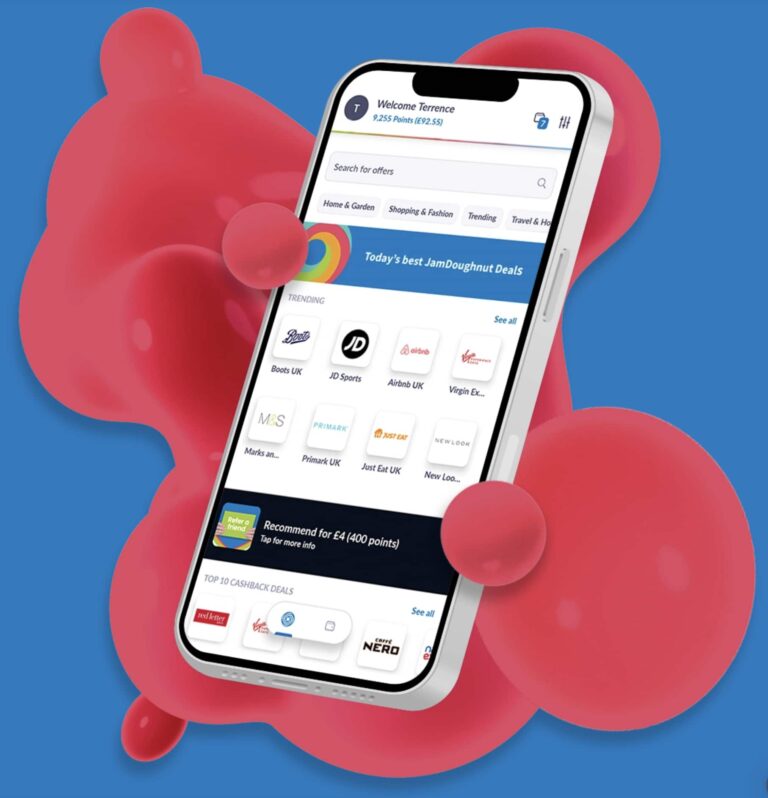

JamDoughnut is a special form of cashback app. A distinction that may have a serious impression in your financial institution stability.

Cashback websites are by now acquainted to many people, a lot so the truth is that there’s an virtually overwhelming quantity to select from. All of them do what they are saying on the tin. They reward customers with money for his or her purchases or cost for providers through the cashback website or app (typically through a referral hyperlink). However normally we have now to attend days or even weeks (generally even months) to get our rewards.

At JamDoughnut, you get your cash immediately – actually as quickly as you verify your buy.

how superior is that Right here at MoneyMagpie, we had been so impressed that we determined to strive it out for ourselves.

How does it work?

1. Purchase a present card

In contrast to different cashback websites or referral apps, JamDoughnut provides you cashback while you buy a present card or present certificates for the shop or service you select to buy at. So as a substitute of utilizing your debit or bank card, purchase a present card and use that to finish your buy. (There are lots of of manufacturers to select from.)

You should utilize your present card within the app, on-line or on the high road. You too can share or give away your present card. (One essential level, nevertheless, is that the present playing cards are non-refundable, so be certain that before you purchase.)

2. EARN POINTS

Each time you purchase a present card, you earn factors that convert to money. These factors accumulate in your JamDoughnut Jar (pockets).

The variety of factors you’ll be able to earn is completely different for every model or store. It may be between 3% and 20%. On common, it is round 7-8% of your complete buy. You may see precisely what share you’ll be able to earn beneath the image for every model.

You may store at common manufacturers like Morrisons, Boots, Currys and Airbnb!

3. FILL YOUR WALLET

Your JamDoughnut pockets is often known as a Jar. When you attain £10 or extra you’ll be able to withdraw the funds out of your pockets. It even tells you what number of extra factors it’s essential to earn to succeed in the £10, which is an effective incentive to maintain utilizing the app.

It’s actually that straightforward! Purchase your present playing cards, begin incomes factors immediately and withdraw your money (£10 or extra) out of your pockets everytime you like.

OUR EXPERIENCE

Our intrepid purchaser, Rach, tried it.

“The app is on the market for iOS and Android. I’ve an Apple telephone so I searched the App Retailer for JamDoughnut, discovered it and downloaded it with no issues.

Subsequent it’s essential to register. This took lower than a minute. No password was required, I simply clicked on a hyperlink they despatched to my electronic mail and cellular phone quantity

I used to be then taken to a web page that confirmed me all of the retailers and eating places and so on accessible. There are such a lot of to select from! It helps that they fall into classes like: Well being & Health; Residence & Backyard; buying & style; Deliver away; Journey & Trip.

I lately moved, so I tapped Residence & Backyard. The app lists all types of shops and web sites – from Bloom & Wild, B&M, B&Q, Ikea and Wayfair (to call just a few).

As I used to be scrolling, it occurred to me that Sunday is Mom’s Day, so I believed I would give Bloom & Wild a strive. The very first thing that caught my consideration was that because it was my first buy, I instantly obtained a bonus within the type of an additional or free 200 factors, that means £2 was added to my pockets.

The directions are clear and easy. Faucet ‘Purchase Protected’, enter the quantity I needed to spend and as soon as my cost is full I used to be despatched a code to make use of on-line on the Bloom & Wild cashier. The app additionally defined that something I did not spend could be accessible to spend at a later date.

I paid for my present card by way of my checking account which was a easy click on after which verify. Take note, although, that you’re going to get much less cashback — as much as 50% much less — should you store by way of Apple Pay as a substitute of utilizing your checking account.

Lastly, I used to be instructed in daring that my cashback could be credited to my JamDoughnut Jar or pockets instantly. Additionally clarified that I can use different coupons and/or loyalty codes with my JamDoughnut code to maximise financial savings and reductions.

All in all – very uncomplicated. I used to be impressed! What I significantly favored was that after I clicked “Purchase Safely” the app instructed me precisely how a lot I might get again from any quantity accessible on the present card.

I do not actually use different cashback websites as I are likely to overlook they exist however I’ll positively be utilizing JamDoughnut once more.”

OUR JUDGMENT

We predict it is a sensible tackle a well-established method to generate profits whereas buying. Very often we hear from individuals who have signed as much as cashback websites however have to attend a ridiculous quantity of time to reap the rewards. With JamDoughnut, you do not have to attend or do not forget that you are owed a certain quantity after which waste time monitoring it down or continuously checking to see if it is in your account.

There’s a actually good vary of common high road retailers, eating places and bars to select from.

As our purchaser famous, it is extremely straightforward to make use of. We additionally checked out their evaluations on TrustPilot and so they rating a really spectacular 4.8 out of 5 and 93% of customers gave them a 5-star score.

We additionally discovered that their refund coverage was higher than shopping for a present card, so even when shopping for as a present or cashback you might have higher safety than and that is proven by their evaluations on TrustPilot that we learn.

Lastly, we predict this is also a improbable method to reduce the finances. For instance, you would purchase an Asda present card for £30 and that is your buying finances proper there. Not solely does it enable you to maintain your pocket cash, you get paid for it too! (An Asda present card provides you 3.4%, which is £1.02 for £30).

Click on right here for extra details about the app and the right way to obtain it to your telephone.

Disclaimer: MoneyMagpie just isn’t a licensed financial advisor and as such the knowledge contained herein, together with any opinion, remark, suggestion or technique, is for informational, leisure or instructional functions solely. This shouldn’t be construed as financial recommendation. Anybody considering of investing ought to do their very own due diligence.