studying time: 3 minutes

It is a paid article commissioned by Creditspring

A nationwide debt company has warned {that a} staggering variety of households might be turning to bank cards and loans this winter “to shut the hole between their earnings and their spending.”

As power payments soar and the price of dwelling soar, it has been reported {that a} whopping two-fifths of individuals are already behind on a number of of their family payments. The big financial strain on individuals throughout the county is growing at an alarming fee. In the present day, virtually a fifth of low-income households owe cash to costly lenders. In truth, in accordance with the Financial institution of England, over 14 million individuals are excluded from mainstream financial providers this 12 months due to poor credit score – and that quantity is rising quick.

The wrestle to get individuals away from harmful mortgage sharks and tackle unpayable loans is larger than many people understand. Many individuals take out loans they can not afford and rapidly discover that the repayments alone will put them additional within the pink. Excessive-priced lenders sometimes haven’t any regard for debtors’ financial well-being, which has disastrous penalties for individuals’s funds and infrequently pushes them right into a spiral of debt that’s inconceivable to interrupt out of.

As an alternative of sufficient authorities assist, the accountability now lies with lenders to make sure they lend responsibly and defend debtors.

Enter Creditspring

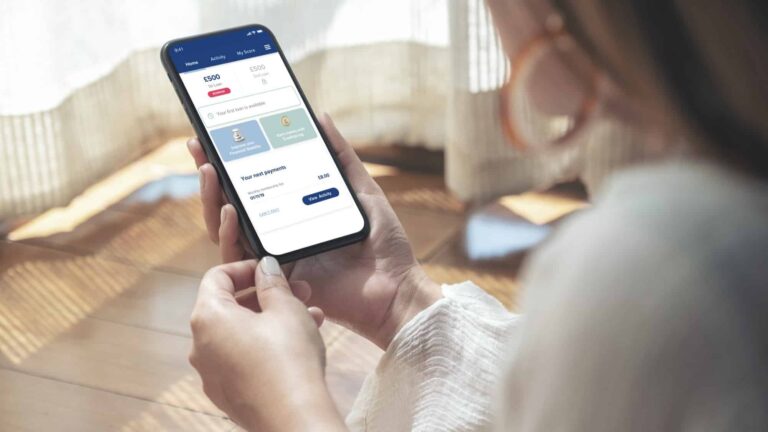

Launched in 2016 as a brand new breed of accountable lender, Creditspring has since revolutionized the lending market by making borrowing simple and safe. It provides inexpensive credit score to individuals who fall within the near-prime section, whereas offering them with the instruments to enhance their long-term financial stability.

It includes a subscription mannequin – a fixed-cost, low-risk lending answer that provides members entry to 2 loans per 12 months with clear repayments, capped prices, and no hidden charges or complicated APRs. Assume Netflix for credit score — you already know precisely how a lot you are paying, and that quantity is fastened.

This mannequin additionally means individuals know the price of borrowing upfront and most significantly, there are not any late charges. It makes it simple for individuals to evaluate the true value of borrowing and eliminates the danger of falling right into a debt spiral.

The best way Creditspring operates and gives credit score is very vital now that the nation goes via a interval of nationwide financial instability. It allows individuals to entry accountable credit score with out the danger of financial injury – one thing that “close to prime” debtors are sometimes unavailable.

Is there ever a state of affairs the place borrowing will be “secure”?

“It is vital to appreciate that utilizing credit score, significantly to cowl important bills, carries dangers, particularly for somebody with much less financial energy who might even see an costly mortgage as the one possibility accessible,” mentioned Sue Anderson, Spokesperson for StepChange debt aid company.

Nonetheless, only a few lenders take this under consideration. To make sure secure lending, Creditspring makes use of in-depth credit score checks – together with open banking know-how – to precisely measure an applicant’s creditworthiness. This results in persistently extra knowledgeable and accountable lending choices that defend debtors.

It additionally has a number of free instruments, such because the Stability Hub and Spring Rating, which offer members with weekly one-on-one assist and actionable tricks to encourage extra knowledgeable financial decision-making. Creditspring works intently with main debt charity, StepChange, to make sure candidates and members can simply entry skilled financial help once they want it.

That Advantages of utilizing Creditspring

By avoiding costly lenders, Creditspring saves its members a mean of £117 a 12 months in borrowing prices – which works out to greater than £17 million for its membership base. Along with saving cash, 90% of members noticed improved financial stability and 82% improved their credit score rating after becoming a member of. Good credit score has an impression on different areas of financial well-being, for instance it could make it simpler to acquire a mortgage with extra aggressive rates of interest.

Creditspring has a 4.8 score on Trustpilot, which is in stark distinction to analysis displaying {that a} third of individuals assume lenders are fraudulent and dishonest. Evaluating these two stats exhibits that Creditspring actually is the lender doing it in a different way. It’s the lender that disrupts the market and builds belief with UK debtors by prioritizing their financial well-being.

Disclaimer: MoneyMagpie is just not a licensed financial advisor and as such the data contained herein, together with any opinion, remark, suggestion or technique, is for informational, leisure or academic functions solely. This shouldn’t be construed as financial recommendation. Anybody considering of investing ought to do their very own due diligence.