In an period the place the boundaries between conventional finance (TradFi) and crypto proceed to blur, the tokenization of real-world property (RWAs) stands out as one of many hottest developments. This development, which permits tangible property like autos and actual property to be purchased and offered as tokens on a blockchain, guarantees to revolutionize the effectivity and pace of asset transactions.

Simply final week, BlackRock, the world’s largest asset supervisor, has positioned itself on the forefront of this motion with the launch of a $100 million tokenization fund, which has already attracted over $240 million in funding inside its first week.

Larry Fink, CEO of BlackRock, has been vocal concerning the potential of tokenization, stating that RWAs “might revolutionize, once more, finance.” This remark has contributed to a notable surge within the valuation of a number of RWA crypto tokens in current weeks. In gentle of those developments, crypto analysts from Layergg have recognized a particular crypto mission that they consider might garner vital curiosity from BlackRock.

Why BlackRock Might Select Aptos

The mission in query is Aptos, which has been earmarked for its potential within the RWA house. In response to Layergg’s evaluation shared on X (previously Twitter), the narrative surrounding RWA and tokenization, bolstered by BlackRock’s involvement, suggests a nascent but quickly rising curiosity on this sector.

They spotlight that mid to low cap RWA tasks listed on Binance have carried out exceptionally properly, indicating a broader market curiosity spurred by narrative-driven funding methods. Nevertheless, the favourite crypto mission for BlackRock might be Aptos.

A more in-depth take a look at Aptos reveals a number of elements that may make it a horny companion for BlackRock. Firstly, Aptos is poised to make a major announcement associated to RWA in April, coinciding with the Aptos DeFi DAYS occasion from April 2 to five.

Aptos DeFi Days | Supply: X @layerggofficial

This announcement is alleged to contain a partnership with a world asset administration agency, probably BlackRock. “A partnership with a world asset administration agency is anticipated to be introduced. It’s speculated that this may occasionally embrace BlackRock,” the analysts remarked.

The idea for this hypothesis contains Aptos CEO Mo Shaikh’s earlier tenure at BlackRock, suggesting pre-existing business connections that would facilitate such a partnership.

Aptos founder Mo Shaikh | Supply: X

Aptos founder Mo Shaikh | Supply: X

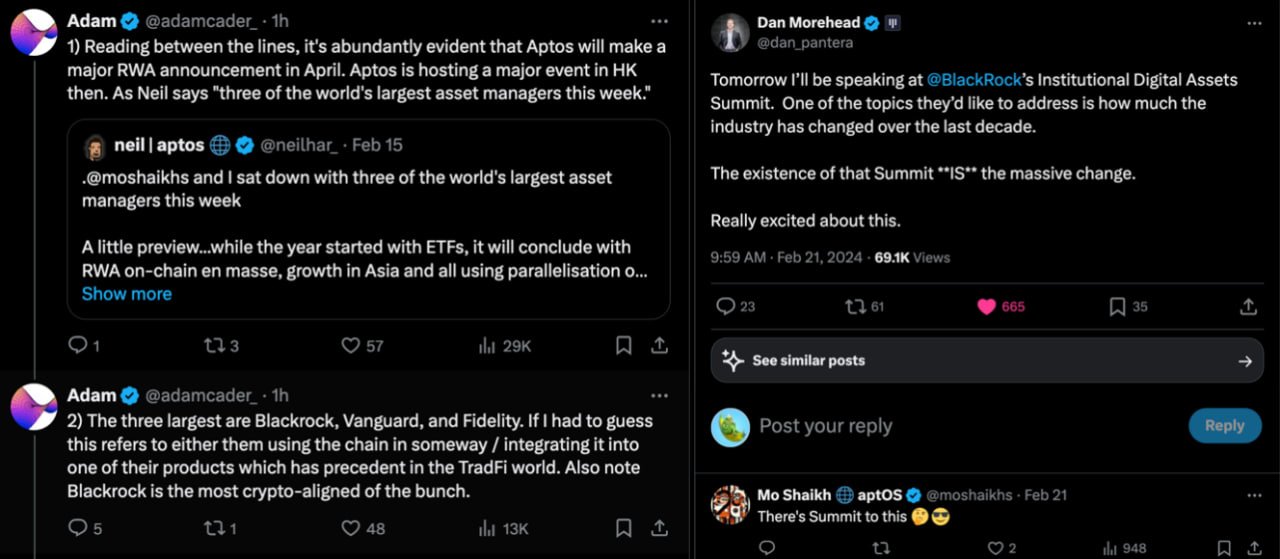

Furthermore, Aptos founder Mo Shaikh & head of ecosystem at Aptos Labs Neil H hinted at this early on. In mid-February Shaikh revealed by way of X: “I sat down with three of the world’s largest asset managers this week A bit preview…whereas the 12 months began with ETFs, it should conclude with RWA on-chain en masse, progress in Asia and all utilizing parallelisation on Aptos See you in Hong Kong.”

On February 21, Shaikh additionally commented on a put up on X by Dan Morehead, founder and managing companion at Pantera Capital. Morehead said, “Tomorrow I’ll be talking at BlackRock’s Institutional Digital Property Summit. […] The existence of that Summit **IS** the large change. Actually enthusiastic about this.” Mo Shaikh mysteriously commented, “There’s Summit to this.”

Clues from the Aptos founder | Supply: X @layerggofficial

Clues from the Aptos founder | Supply: X @layerggofficial

Apart from that, Adam Cader, founding father of Thala Labs just lately said by way of X that “one thing is cooking for Aptos. I’m a co-founder of the most important utility on the community, and right here’s my checklist of upcoming vital ecosystem extensive catalysts.” Cader referenced Shaikh’s assertion and added that Blackrock, Vanguard, and Constancy are the three largest asset managers on the earth.

“If I needed to guess this refers to both them utilizing the chain not directly / integrating it into one in all their merchandise which has precedent within the TradFi world. Additionally be aware Blackrock is essentially the most crypto-aligned of the bunch,” he stated by way of X.

Crypto Revolution: Will APT Comply with AVAX?

However that’s not all. Aptos has been hinted to discover partnerships with different main asset administration corporations, together with Franklin Templeton, which has beforehand invested in Aptos (tier 3) and deliberate to make the most of its blockchain for cash market funds.

Such strategic alliances might place Aptos equally to how Avalanche benefited from its partnerships within the Mission Guardian initiative (JPMorgan and Wisdomtree), experiencing a considerable worth enhance post-announcement. “Avalanche noticed a worth enhance of greater than 4x following the ‘Mission Guardian’ information,” Layergg famous.

They concluded, “If a partnership with BlackRock proceeds, extra ‘Massive partnerships’ will naturally comply with.”

At press time, APT traded at $17.59, up 87% over the previous 5 weeks.

APT worth eyes its ATH, 1-week chart | Supply: APTUSD on TradingView.com

APT worth eyes its ATH, 1-week chart | Supply: APTUSD on TradingView.com

Featured picture from Pensions & Investments, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, sell or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this website fully at your personal threat.