Bitcoin has had an eventful few weeks by way of worth motion. The world’s largest crypto is at present at a 19% enhance prior to now seven days and a 43% enhance prior to now 30 days, its highest share acquire in over a yr. Because of this, an enormous variety of BTC addresses have been pushed into the profitability zone. For the primary time in over two years, 97% of all Bitcoin addresses are actually in revenue.

Quantity Of Bitcoin Addresses In Revenue Skyrockets As Costs Surge

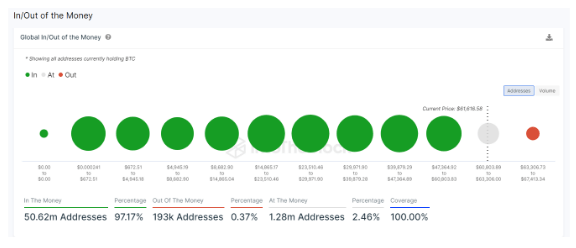

In accordance with crypto on-chain analytics platform IntoTheBlock, 50.62 million Bitcoin addresses are at present in revenue on the present worth level. This enormous determine represents over 97% of the full pockets addresses. Notably, the final time holders noticed this a lot profitability was in November 2021 when the value of Bitcoin was round $69,000, nearing its all-time high.

Notably, market playout has seen Bitcoin proceed its huge positive factors over the previous few months. Simply final month, 91% of addresses had been in revenue. Regardless of some sporadic sell-offs and profit-taking from some buyers making an attempt to interrupt even, the share of addresses in revenue continues to develop as the massive profitability means promoting strain now not has a major impact.

How Lengthy Can Bitcoin Maintain This Upward Momentum?

Bitcoin costs have skyrocketed over the previous a number of months, lately topping $60,000 once more. The highest crypto is at present trading at $62,233 on the time of this writing, and 1.28 million addresses, which account for two.46% of the full addresses, are at a break-even level.

Bitcoin is now trading at $62,233. Chart: TradingView.com

The value surge could be attributed to elevated mainstream adoption within the conventional investing world spearheaded by Spot Bitcoin ETFs. This in flip has ushered in a brand new wave of holding mentality. In February, 69,244 BTC price over $3.6 billion had been withdrawn from crypto exchanges.

Notably, those that have profited essentially the most are those that have been holding Bitcoin long-term. In accordance with IntoTheBlock, 13.6 million Bitcoins are within the possession of buyers who’ve held onto their property for over a yr.

Nevertheless, new buyers can nonetheless stay up for a continued worth surge, as Bitcoin faces nearly little to no resistance in its path. Solely 0.37% of addresses (193,000) are nonetheless ready to make a revenue on the present worth.

Most specialists stay optimistic about Bitcoin’s worth potential for the remainder of 2024 and past. With the bull run in full swing, many merchants and crypto analysts suppose Bitcoin will proceed setting new all-time highs in 2024. Worth targets for the tip of the yr vary from $100,000 as much as $300,000 per Bitcoin.

Featured picture from Pexels, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, sell or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this website fully at your personal danger.