Bitcoin has been the buzz of the city these days because it continues to push previous key value ranges, leaving many to marvel how high it will possibly go. Present technicals and fundamentals point out that the most recent rally has stable foundations, and there are good causes to assume there’s extra upside forward for the main cryptocurrency.

The most recent rally has been fueled by completely different on-chain sentiments starting from whale accumulation to the rise in Bitcoin whales. Two of an important market elements fueling this rally are spot Bitcoin exchange-traded funds (ETFs) and the rise in CME margins, based on analysts at QCP Capital, a crypto asset trading agency.

BTC’s value traits to the upside on the every day chart. Supply: BTCUSDT on Tradingview

Robust Inflows Into Spot Bitcoin ETFs Driving Demand

Most of Bitcoin’s value motion since October 2023 has been centered round spot Bitcoin ETFs, giving traders a simple technique to achieve publicity to the main cryptocurrency. Notably, the value of BTC has doubled since BlackRock’s first submitting for a spot Bitcoin ETF.

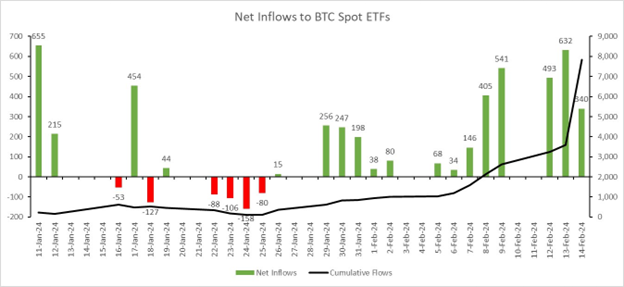

The primary day of trading for these ETFs broke trading quantity information, with $4.6 billion value of shares being traded. Analysts at QCP Capital famous that the inflows began to flip constructive in the direction of the top of January after per week of main outflows from Grayscale’s Bitcoin Belief GBTC. Issues appear to have settled, and the whole inflows into these have now even eclipsed the once-dominant ProShares BTC futures ETF.

Supply: QCP Capital

Supply: QCP Capital

Analysts on the trading agency additionally famous the present improve in CME margin requirement as a sign of continued BTC value development. Notably, the rise on this CME margin throughout numerous exchanges resulted in widespread quick overlaying Lunar New 12 months weekend.

Consequently, the spot value for BTC and ahead spreads surged. Spreads at the moment are round 11-12%, indicating a powerful bullish sentiment as merchants are prepared to pay higher premiums.

One other market issue contributing to the surge was the sell-and-buy-the-dip that performed out after the most recent consumer value index (CPI) report got here out higher than anticipated. Headline CPI was 3.1% precise in comparison with 2.9% anticipated, and Core CPI was 3.9% precise in comparison with 3.7% anticipated, resulting in a minor sell-off of dangerous belongings, which was short-lived.

Bullish BTC Momentum Set To Proceed

The rally in Bitcoin is exhibiting no indicators of slowing down, and traders are beginning to accumulate with a Concern Of Lacking Out. Current on-chain knowledge exhibits that Bitcoin whales have bought over 100,000 BTC value $5 billion previously 5 days. The variety of whales holding greater than 1,000 BTC now stands at 2,121, a rise of 74 new wallets in February.

In a latest CNBC interview, Ric Edelman, founding father of the Digital Property Council of Monetary Professionals, predicted this influx into spot Bitcoin ETFs would proceed over the following two years and attain $150 billion by the top of 2025. Curiosity in Bitcoin will improve as extra institutional traders get on board, cementing Bitcoin as an asset class amongst conventional traders.

Cowl picture from Dall-E, chart from Tradingview

Disclaimer: The article is offered for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, sell or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this website fully at your personal danger.