Curve Finance founder Michael Erogov has moved over 23 million CRV, the native governance token of the Curve DAO, to Binance, the world’s main cryptocurrency change, over the past 5 days, The Knowledge Nerd, on December 27, exhibits. The founder moved 2.5 million CRV on December 27. This switch could ruffle buyers, elevating considerations as a result of it might point out that Erogov is probably going liquidating.

Curve founder strikes cash to Binance | Supply: The Knowledge Nerd by way of X

CRV Is Agency, Up 60% In The Final 3 Months

Whereas the founder’s sale of CRV might put downward stress, the token stays agency and is up roughly 60% from September 2023 lows. The token trades above $0.60 at spot charges, rejecting promoting stress because the each day chart exhibits.

If bulls press on, it might break above $0.72 to file new 2023 highs. The token is trending higher, rejecting bear makes an attempt amid bettering sentiment throughout the crypto scene. Though Erogov is promoting CRV, the market appears to interpret the transfer as bullish.

Curve value trending upward on the each day chart | Supply: CRVUSDT on Binance, TradingView

The spectacular revival of CRV is web bullish for the protocol, suggesting that buyers are nonetheless assured regardless of headwinds in early H2 2023 when a number of Curve swimming pools had been exploited on account of a Vyper compiler concern.

Curve Founder Offered CRV To Forestall Liquidation Of DeFi Loans

Following the hack in late July 2023, Erogov was compelled to liquidate a big chunk to forestall liquidation. On its half, the hack led to over $52 million in crypto property, together with 7.19 million value of CRV, misplaced. Within the aftermath of the hack, costs crashed.

On the time of this hack, Erogov had over $100 million in DeFi loans backed by 427.5 million CRV as collateral. As CRV costs fell, the well being of Egorov’s loans fell in tandem.

If the value of Egorov’s CRV collateral had been to fall additional, it might face liquidation. This meant that each one protocols from the place the founder had borrowed utilizing CRV as collateral would have been compelled to sell the token at spot charges to repay the mortgage. As an automatic intervention, the occasion would have seemingly brought about a cascade, even impacting abnormal holders utilizing CRV as collateral.

To keep away from this and as a type of intervention, Tron founder Justin Solar and a number of different events, together with Jeffrey Huang, made offers to purchase CRV from the Curve founder, stopping this liquidation from taking place.

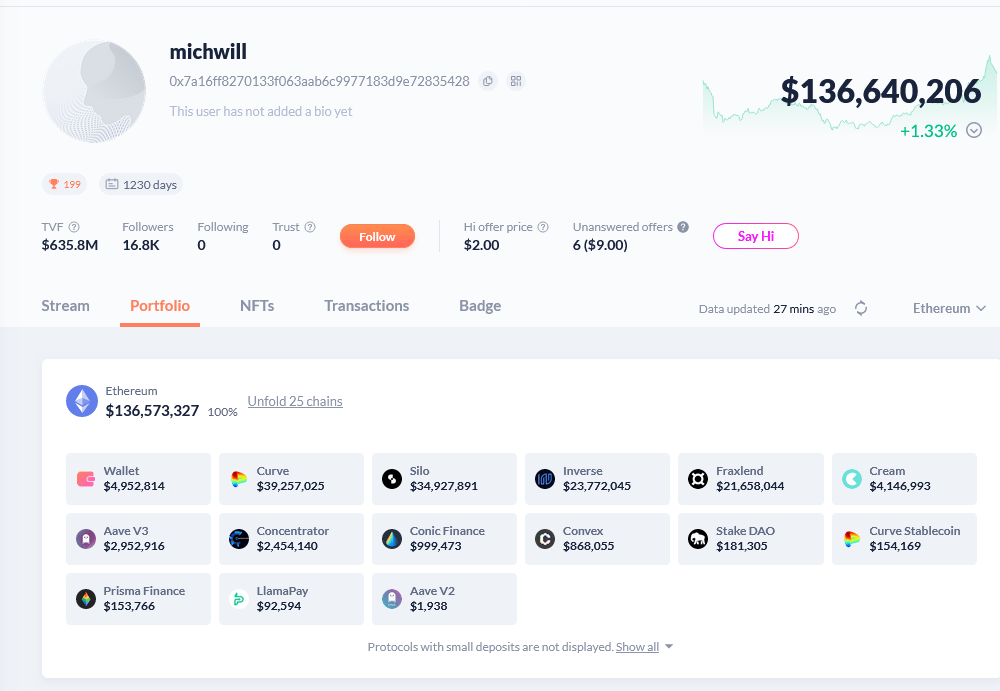

Michael Erogov portfolio | Supply: DeBank

Michael Erogov portfolio | Supply: DeBank

In response to DeBank on December 27, Erogov’s crypto portfolio was north of $136 million. Out of this, the founder owns over $38.9 million of CRV.

Characteristic picture from Canva, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, sell or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use info offered on this website solely at your individual danger.