The put up 11/1 Fed assembly bull rally has been very spectacular. The S&P 500 (SPY) is knocking on the door of the all time highs. Nevertheless, small caps are nonetheless a good distance away from their previous peak. Uncover why funding veteran Steve Reitmeister is pounding the desk on small caps within the weeks and months forward. Plus he shares his hand picked alternatives. Learn on beneath for extra.

Everyone knows why the market is rallying. Dovish tilt by the Fed solidifies the probability for a comfortable touchdown earlier than they decrease charges and economic system picks up steam. That’s about as bullish of a recipe as you’ll be able to have.

With that stocks are sprinting in direction of their all time highs to shut out 2023. Thus, I assumed it may be fascinating to evaluate the three key inventory indices to see how far-off from their all time highs…and what that may inform us about worth motion going into 2024.

Let’s begin with the S&P 500 (SPY) targeted on giant cap stocks:

Right here the index peaked on January 3, 2022 with a closing high of 4,796. Shares had been flirted with that level on Wednesday earlier than dramatic intraday sell off ensued. But on Thursday as soon as once more buyers purchased that dip resulting in closing the Thursday session at 4,746.

The purpose is that that is the healthiest trying index rising +23.63% this yr and solely about 1% away from the all time highs. Little question we’ll eclipse that mark pretty quickly. Only a query of whether or not that occurs by the tip of 2023 or early within the New 12 months.

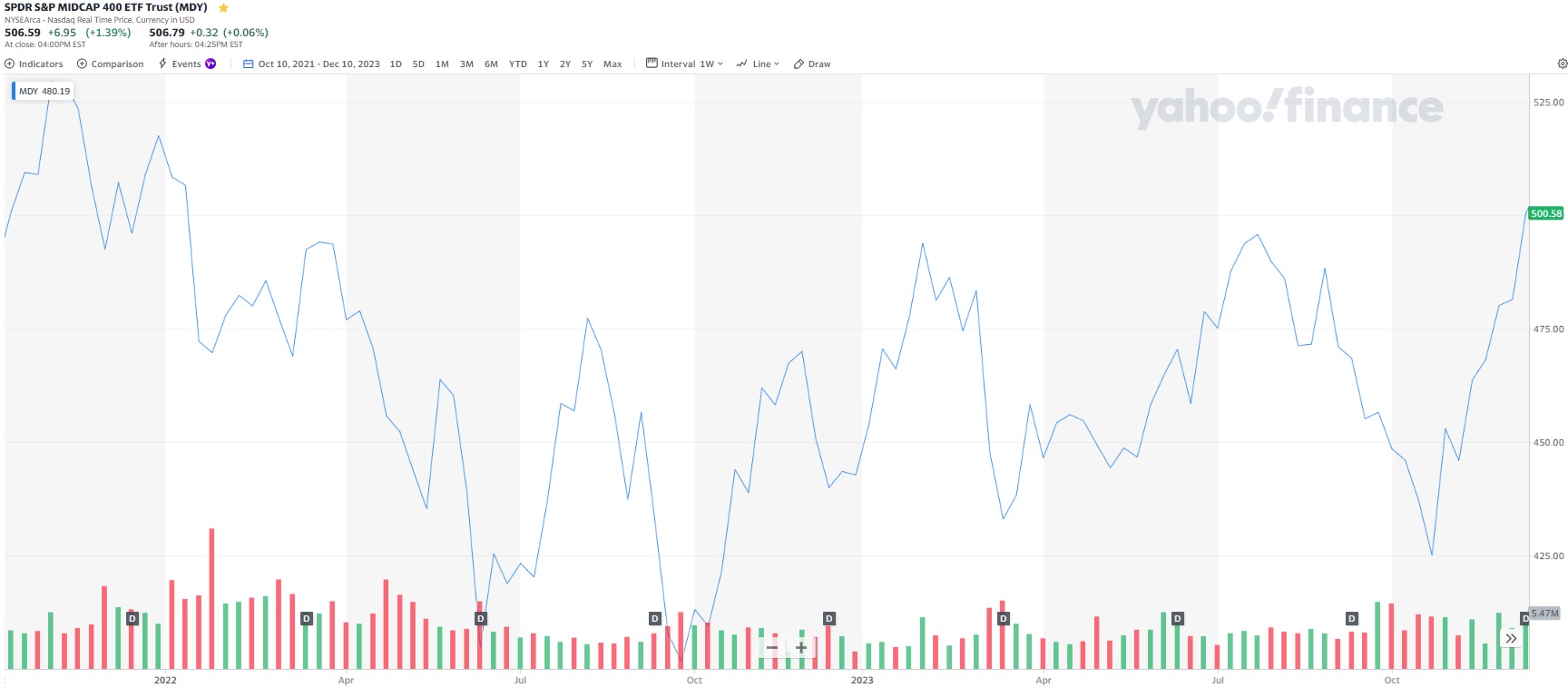

Subsequent let’s downshift to a view of the midcap stocks as represented by S&P 500 Midcap ETF (MDY).

Right here we now have a closing high made about 2 months earlier than the big caps on November 16, 2021 at 515.53. MDY was nicely beneath that mark many of the yr, however has performed numerous catch up for the reason that November 1st Fed assembly that sparked this finish of the yr rally that broadened out past the big caps.

This index is simply lower than 2% beneath its all time highs. Good odds to eclipse within the days remaining in 2023. But when not then straightforward hurdle to make early in 2024.

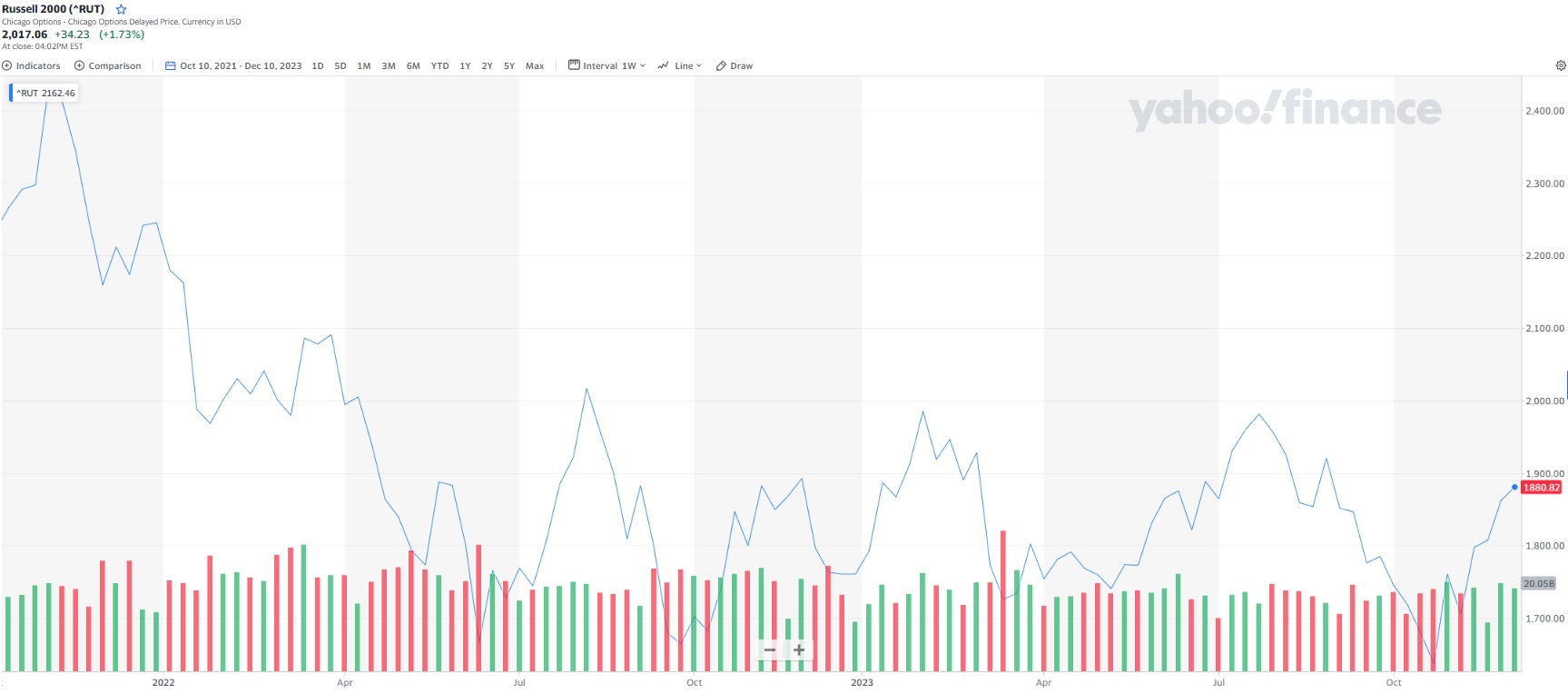

Lastly, we’ll take a gander on the small cap stocks greatest represented by the Russell 2000 index:

This index topped out at 2,442 all the best way again on November 8, 2021. Even with the rotation to small caps of late, the index solely closed at 2,017 on Thursday. Which means we’re nonetheless 17% beneath the all time highs.

This underperformance by small caps is just not a latest phenomenon. Moderately you would actually return 4 years with pretty constant outperformance of enormous cap stocks.

But the additional we return in time…the extra we perceive that small caps sometimes outperform giant caps by a pleasant margin. Very true throughout bull markets as buyers concentrate on development and upside potential.

The purpose being that this latest rotation to small stocks has legs and never too late to affix the get together. The secret’s WHICH small caps have the perfect alternative to outperform?

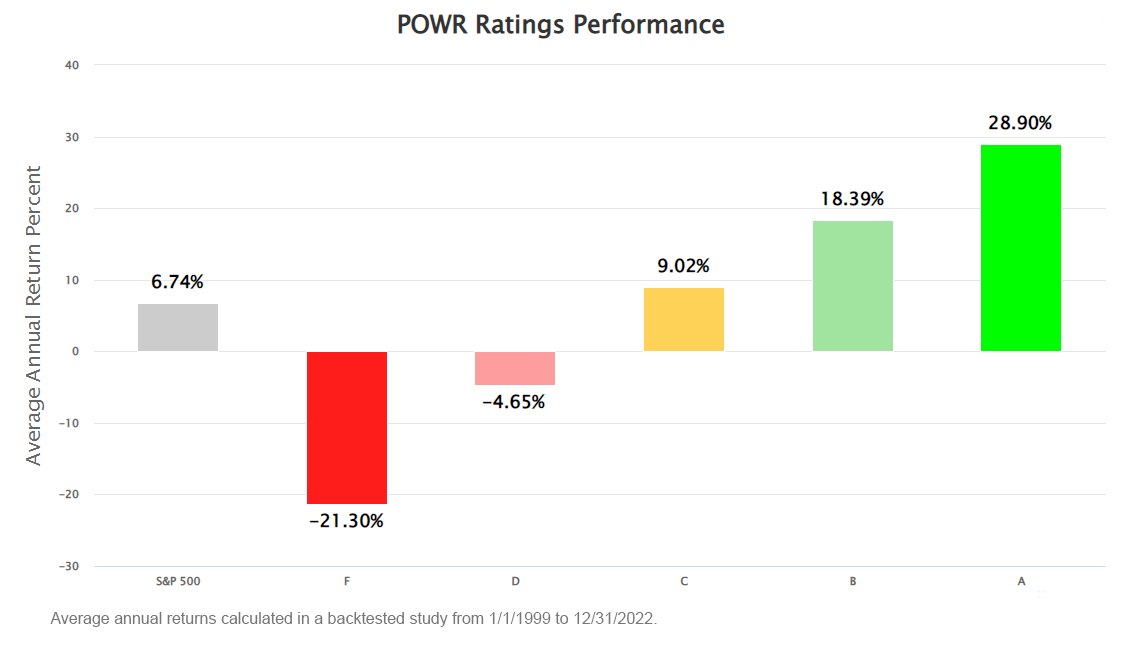

That could be a large benefit we now have with the POWR Rankings system that analyzes 118 components for each inventory. Which means it does as deep of a dive on a mega cap like Apple because it does on a hidden gem beneath $1 billion market cap.

Having these 118 components of the corporate in our favor is what results in large outperformance. Like 4X higher than the S&P 500 for our A rated POWR Shares going all the best way again to 1999.

Lengthy story brief, it would be best to lever up on small caps with the perfect POWR Rankings. And that’s exactly what you will discover within the subsequent part…

What To Do Subsequent?

Uncover my present portfolio of 11 stocks packed to the brim with the outperforming advantages present in our unique POWR Rankings mannequin.

This contains 4 small caps lately added with large upside potential.

Plus I’ve added 2 particular ETFs which might be all in sectors nicely positioned to outpace the market within the weeks and months forward.

That is all based mostly on my 43 years of investing expertise seeing bull markets…bear markets…and the whole lot between.

If you’re curious to study extra, and need to see these 13 hand chosen trades, then please click on the hyperlink beneath to get began now.

Steve Reitmeister’s Buying and selling Plan & High Picks >

Wishing you a world of funding success!

Steve Reitmeister…however everybody calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Complete Return

SPY shares rose $0.15 (+0.03%) in after-hours trading Thursday. 12 months-to-date, SPY has gained 25.48%, versus a % rise within the benchmark S&P 500 index throughout the identical interval.

Concerning the Creator: Steve Reitmeister

Steve is healthier recognized to the StockNews viewers as “Reity”. Not solely is he the CEO of the agency, however he additionally shares his 40 years of funding expertise within the Reitmeister Complete Return portfolio. Be taught extra about Reity’s background, together with hyperlinks to his most up-to-date articles and inventory picks.

Extra…

The put up When Will Shares Break to New Highs? appeared first on StockNews.com