In crypto trading, historical past typically repeats itself, or not less than rhymes. That’s why it may be essential to identify traditionally essential worth alerts and patterns. A current technical evaluation by Egrag Crypto has spotlighted such a sample for XRP, indicating a doable large worth enhance.

This evaluation hinges on the remark of a bullish crossover between the 21 Exponential Shifting Common (21 EMA) and the 55 Shifting Common (55 MA) within the 2-week chart of XRP/USD. Egrag states, “XRP Rockets: 21 EMA & 55 MA Sign Explosion: Let’s decode the XRP trajectory – my focus? Simply two pivotal weekly candles after the crossover between 21 EMA & 55MA.”

Will The XRP Value Soar To $7?

The chart supplied by Egrag Crypto highlights the XRP worth actions within the two distinct situations when this uncommon bullish sign occurred. The primary bullish crossover of the 21 EMA and 55 MA within the 2-week chart occurred in March 2017 (situation A). Following this sign, the XRP worth noticed “two hanging 2-week candles. The preliminary one surged by round 90%, trailed by an electrifying 1100% spike,” Egrag remarked.

For the second time within the historical past of the XRP worth, the sign flashed on the finish of December 2020. This time, the XRP rose by 100% within the first candle, succeeded by an 84% surge within the second 2-week candle which marked a collective 200% upswing.

XRP worth, 2-week chart | Supply: X @egragcrypto

In line with the crypto analyst, there’s a high likelihood that these situations will repeat themselves. “Drawing parallels from previous bullish runs, my opinion syncs with historic knowledge,” Egrag remarked.

Notably, the chart of Egrag additionally options an ascending development line, a bullish indicator, which XRP has examined twice, as proven by the 2 inexperienced circles in mid-2022 and early 2023. These faucets on the development line are vital, as they counsel that every contact is a check of assist the place the value finds sufficient consumers to start a brand new upward motion.

The analyst speculates that XRP may dip barely extra to faucet the ascending development line a 3rd time, which might be a precursor to a major worth rally. This potential third faucet on the development line is seen as a shopping for alternative that might precede a substantial worth surge.

XRP worth, 2-week chart (zoomed in) | Supply: X @egragcrypto

XRP worth, 2-week chart (zoomed in) | Supply: X @egragcrypto

Following this third retest of the development line, Egrag expects two doable situations based mostly on the bullish crossover of the 21 EMA and 55 MA. In situation A, the crypto analyst envisions a dramatic rise within the XRP worth, projecting a goal of $7.00, which might symbolize a staggering enhance of 1,139.35% from the present worth.

Situation B suggests a extra conservative goal of $1.80, which might nonetheless be a formidable acquire of 218.82%. The “No Return Zone,” marked in purple on the $1.80 level, is about simply above situation B’s goal. It signifies a vital threshold that might both act as a resistance zone or verify a powerful bullish momentum if the value sustains above it.

Broader Market Forces

The crypto analyst can be conscious that the Bitcoin worth historically performs a significant function for altcoins corresponding to XRP. He due to this fact notes on the present market situations, “eyes fastened on BTC as the bulk anticipates a $48K-$50K peak, probably adopted by a pullback, igniting a widespread alt season. But, what’s intriguing? A situation the place BTC skyrockets to ATH, retraces, and unleashes a really wild alt season.”

The analyst’s perspective leans in the direction of an preliminary spike to between $7 to $10, adopted by a major retracement, after which an much more substantial rise to the degrees of $20 to $30. On being queried concerning the extent of the anticipated retracement from the $7-$10 vary, Egrag Crypto answered an “aggressive $1.3-1.5” drawdown.

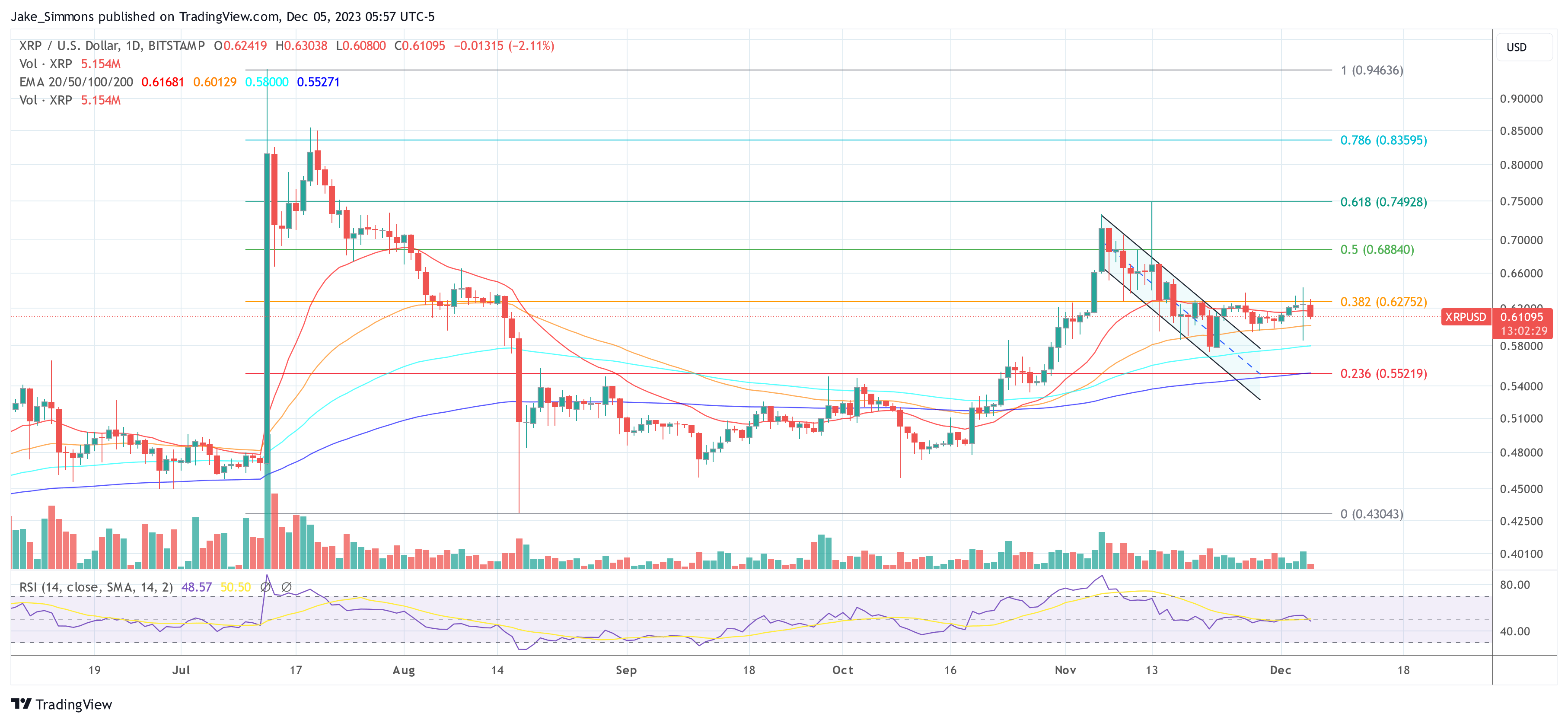

At press time, XRP traded at $0.61095.

XRP worth nonetheless hovers under the 0.382 Fib, 1-day chart | Supply: XRPUSD on TradingView.com

XRP worth nonetheless hovers under the 0.382 Fib, 1-day chart | Supply: XRPUSD on TradingView.com

Featured picture from Medium, chart from TradingView.com