In his newest evaluation, legendary dealer John Bollinger has expressed considerations over Litecoin’s efficiency, significantly compared to Bitcoin. Bollinger, recognized for creating the favored technical evaluation software Bollinger Bands, highlighted a worrying sample within the Litecoin market.

He remarked, “I used to be requested for an evaluation of LTCBTC. The factor that considerations me probably the most is its underperformance vs Bitcoin. From a worth perspective the controlling LTCUSD function is the two bar reversal on the decrease Bollinger Band which is usually thought-about a bearish sign by merchants.”

Litecoin worth evaluation | Supply: X @bbands

Bollinger’s Bearish Litecoin Prediction Defined

The chart of the LTC/USD pair offered by Bollinger on November 28, 2023, exhibits Litecoin’s worth motion in relation to its Bollinger Bands on each a each day and weekly scale. The worth is presently hovering round $69.566, which is considerably decrease than the higher Bollinger Band, suggesting a scarcity of bullish momentum.

The Bands kind by plotting a variety of normal deviations above and under a easy transferring common, generally enveloping the worth motion. On this chart, the each day vs. weekly candles chart exhibits that the LTC/USD worth is struggling beneath the midpoint of those bands, which is a bearish indication. The worth presently close to $69.566 is considerably under the higher band level of round $90, which represents a possible resistance level.

The Bollinger Bands (BB) on the chart are set with a 20-period transferring common with a 2 commonplace deviation vary. Bollinger’s evaluation factors to a ‘2 bar reversal’ sample on the decrease band. This sample emerges when a bar reaches a high above the previous bar however then closes under the shut of that very same earlier bar, hinting at a potential reversal from the uptrend. Such a sample happened close to the decrease band, indicating that any effort to drive the worth higher meets with resistance, and the prevailing promoting stress is taking maintain.

The Bollinger %B indicator can also be essential right here because it compares the worth of Litecoin to the vary outlined by the Bollinger Bands. A %B value under 0.5 signifies that Litecoin’s worth sits nearer to the decrease band than to the higher band, probably signaling weak spot. The chart exhibits the indicator failing to cross the 0.5 level after a plunge towards 0, signifying that the worth regularly touches or falls under the decrease band.

LTC Value Underneath Strain

The Bollinger Band Width (BBW) serves as one other indicator, measuring volatility by assessing the Bollinger Bands’ width. A narrowing of the Bands, as seen within the latter a part of the chart, suggests a lower in volatility and sometimes precedes a big worth motion. On this context, the BBW’s narrowing on the Litecoin chart may point out that the market is tensing, presumably gearing up for an impending breakout or breakdown.

When Bollinger mentions Litecoin’s underperformance relative to Bitcoin, it’s necessary to notice that Bitcoin usually leads the crypto market pattern. If Litecoin is just not maintaining with Bitcoin’s actions, it may counsel a insecurity or curiosity from merchants in altcoins (as the present rise in Bitcoin dominance exhibits) and Litecoin particularly.

In abstract, Bollinger’s technical evaluation signifies that Litecoin is in a precarious place. The worth motion on the decrease Bollinger Band, the bearish ‘2 bar reversal’ sample, the sub-0.5 Bollinger %B values, and the narrowing BBW all counsel that Litecoin might proceed to see downward stress within the close to time period.

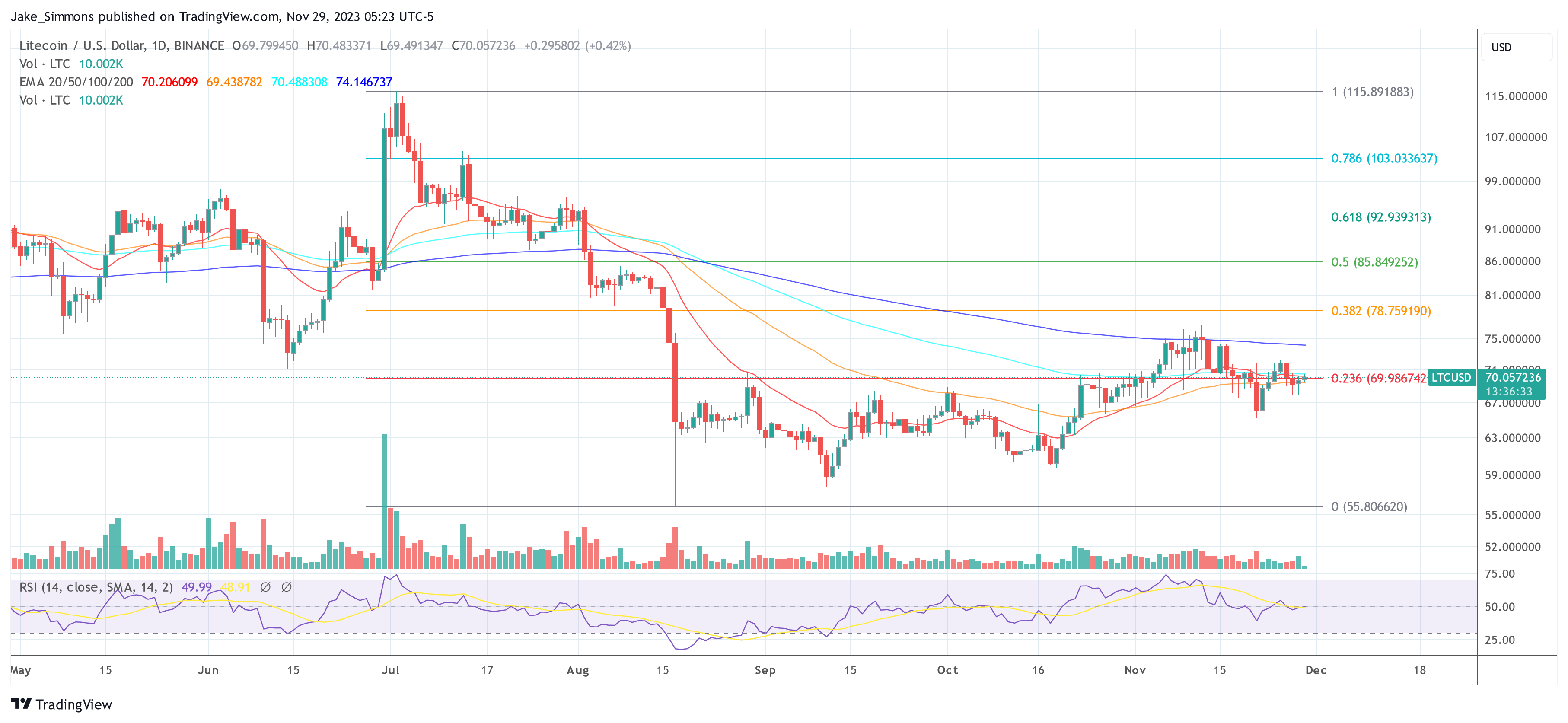

At press time, Litecoin traded at $70.05. The 1-day chart of LTC/USD exhibits that the altcoin fell under the important thing help of the 0.236 Fibonacci retracement level at $69.98 two days in the past. A retest is presently going down, a each day shut above that is of utmost significance for the Litecoin worth.

Litecoin worth, 1-day chart | Supply: LTCUSD on TradingView.com

Litecoin worth, 1-day chart | Supply: LTCUSD on TradingView.com

Featured picture from Unsplash / Kanchanara, chart from TradingView.com