The worth of Bitcoin presses on in the direction of the upside and, as soon as once more, touched a vital resistance near $38,000. The cryptocurrency might pattern sideways at its present ranges within the brief time period, main analysts to search out the help level that would face up to a spike in promoting stress.

As of this writing, Bitcoin trades at $37,160 with sideways motion within the final 24 hours. BTC held a 2% revenue the earlier week, whereas Cardano (ADA) and Solana (SOL) took the lead within the present value motion.

BTC’s value traits to the upside on the day by day chart. Supply: BTCUSDT on Tradingview

The Historical past Of Bitcoin Reveals Mega Backside For The Present Cycle?

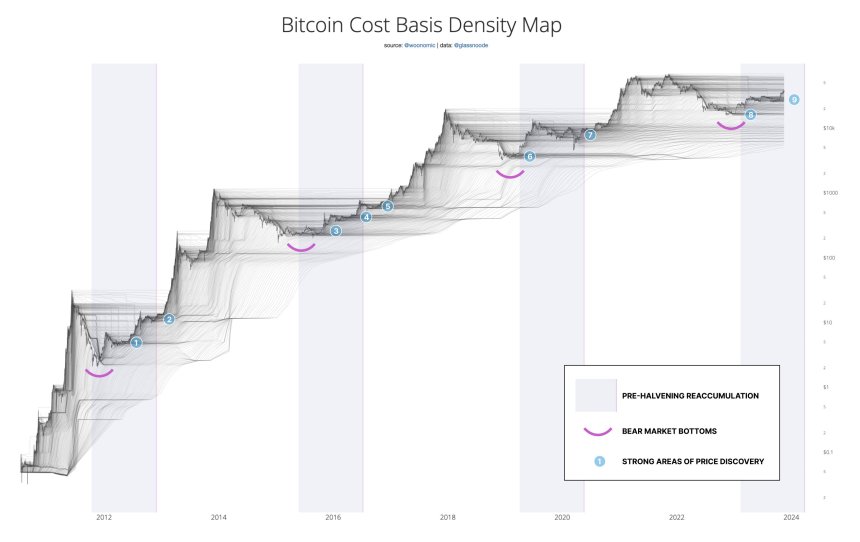

On-chain analyst Willy Woo shared a prediction on his social media channels primarily based on the Bitcoin Price Foundation Density. The analyst investigated the BTC provide dynamics to search out the place the cryptocurrency might maintain off the bears.

Based mostly on his findings, the analyst acknowledged that Bitcoin is unlikely to revisit the $30,000. As seen within the chart under, every time in BTC’s historical past that the provision moved to long-term buyers, the cryptocurrency traits to the upside with out returning to this value level: $30,000 for the present cycle.

Supply: Willy Woo through X

Supply: Willy Woo through X

The analyst set 3 situations to substantiate this sample: first, Bitcoin should be exiting a bear market; second, there should be indicators of a “high agreed value;” lastly, the cryptocurrency should be about to undergo a “Halving Occasion.”

Throughout the latter, the provision rewards for mining BTC are reduce in half together with its manufacturing, which regularly results in “provide shocks,” in line with some analysts. Halving occasions coincide with the BTC bull run, however different analysts warned in opposition to corresponding Bitcoin bull runs with the discount in its provide.

The Greatest Narrative Driving The Bull Run

Nevertheless, Woo claims that the potential approval of a Bitcoin Alternate Traded Fund (ETF) is likely to be the extra vital catalyst for the cryptocurrency. If the US Securities and Alternate Commission (SEC) approves the product, billions of {dollars} stream into the cryptocurrency.

The analyst added:

Bitcoin is much from a commodity market at saturation. What we’re seeing throughout the 13 yrs of this chart is BTC’s widespread adoption. The community had 10,000 customers in 2010, immediately there’s effectively over 300m individuals utilizing it as a retailer of value know-how. That is solely going to climb with a spot ETF.

The vast majority of customers replying to Woo’s forecast highlighted his 2021 prediction. At that time, the analyst additionally set some ranges that had been supposed to carry in opposition to a selloff however shortly folded in opposition to unprecedented promoting stress.

It stays to be seen if this prediction will undergo the identical destiny or if the Bitcoin value can maintain above $30,000 for the subsequent bull cycle.

Cowl picture from Unsplash, chart from Tradingview