Because the crypto group’s anticipation heightens for the upcoming Bitcoin halving, Changpeng Zhao (CZ), CEO of Binance, lately elucidated his observations across the historic patterns tied to this quadrennial occasion. Highlighting the evolving sentiments and speculations, CZ spotlighted the dominant themes earlier than and after the halving occasions.

CZ noticed that the previous months to the halving are typically characterised by heightened discourse, numerous sentiments, and amplified expectations inside the cryptocurrency sphere. “The few months main as much as the Bitcoin halving, there can be an increasing number of chatter, information, nervousness, expectations, hype, hope, and so on.,” he said.

Addressing the generally held perception that Bitcoin’s worth will witness a right away uptick post-halving, CZ dispelled such notions primarily based on historic patterns. “The day after the halving, the Bitcoin worth gained’t double in a single day. And folks can be asking why it didn’t,” he remarked, addressing the rapid aftermath expectations.

Whereas the short-term reactions post-halving could also be tempered, CZ make clear a longer-term development the place Bitcoin typically reaches new all-time highs (ATHs) inside the 12 months that follows. In reference to the market’s skill to shortly transition from skepticism to marvel, he quipped, “Individuals have quick reminiscences.”

Nonetheless, CZ urged warning, emphasizing that historic patterns shouldn’t be construed as definitive indicators for future behaviors, noting, “Not saying there’s confirmed causation. And historical past does NOT predict the longer term.”

A Extra In-Depth Evaluation Of Bitcoin Halving

As Bitcoinist reported, famend crypto analyst Rekt Capital lately revealed an in-depth evaluation of the Bitcoin halving, providing a extra granular view of the potential phases surrounding the occasion which is simply 197 days and some hours away in line with Binance’s estimates.

Reflecting on historic patterns, the analyst prompt a potential deeper retrace for Bitcoin within the 140 days main as much as the halving. Drawing historic parallels, Rekt Capital emphasised, “You possibly can debate whether or not 2023 is extra like 2015 or extra like 2019… Doesn’t change the truth that BTC retraced -24% in 2015 and -38% in 2019 at this identical level within the cycle (i.e. ~200 days earlier than the halving).”

Bitcoin halving evaluation | X @rektcapital

Anticipating market dynamics because the halving nears, Rekt Capital postulated that roughly 60 days earlier than the occasion, traditionally a pre-halving rally will doubtless emerge. This section, marked by investor enthusiasm and elevated expectations as CZ places it, is usually characterised by shopping for into the halving anticipation.

However this enthusiastic section doesn’t final. Across the halving occasion, the market typically exhibits pullback habits below the motto “purchase the rumor, sell the information”. Highlighting this development, the analyst cited the -38% dip witnessed in 2016 and the -20% decline in 2020, moments when the market re-evaluated the halving’s short-term implications.

Subsequent to this, Rekt Capital predicts a multi-month re-accumulation section, typically marked by investor fatigue attributable to stagnation. Nonetheless, breaking out of this section usually heralds Bitcoin’s entry right into a parabolic uptrend, doubtlessly culminating in new all-time highs.

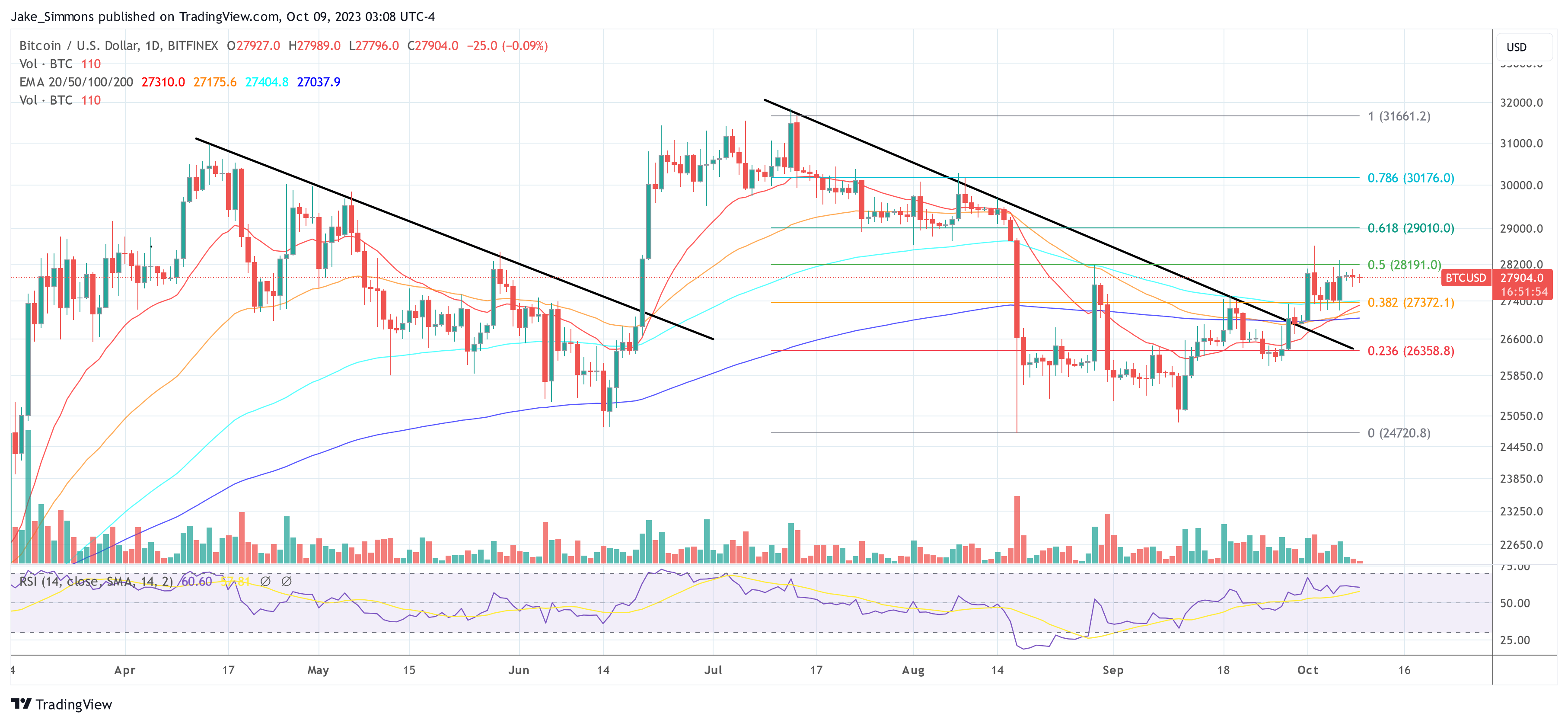

At press time, BTC traded at $27,904.

BTC worth stalls under the 50% Fib, 1-day chart | Supply: BTCUSD on TradingView.com

BTC worth stalls under the 50% Fib, 1-day chart | Supply: BTCUSD on TradingView.com

Featured picture from Moneyweek, chart from TradingView.com