Dogecoin (DOGE) finds itself at a essential juncture. The $0.06 help level, a longstanding stronghold for consumers since early June, now faces rising promoting strain that would probably ship DOGE sinking under this key level.

Assist and resistance zones, just like the $0.06 mark, are pivotal in assessing the course of worth actions within the crypto world, as they usually dictate the market sentiment.

In current months, DOGE has weathered a bearish pattern, however this very important help level has managed to carry agency and mitigate the extent of the downtrend. Nonetheless, a number of retests of the help zone have raised considerations about DOGE’s weakening construction, signaling a possibility for bears to capitalize on the scenario.

Dogecoin Value And Technical Indicators

As of the most recent information from CoinGecko, DOGE is at the moment trading at $0.061140, displaying a modest 0.4% acquire over the past 24 hours however a 1.2% dip over the previous seven days. Two technical indicators, the On Steadiness Quantity (OBV) and the Relative Power Index (RSI), present additional perception into the market’s dynamics.

The OBV, which had been on an uptrend in October, has just lately exhibited a drop in trading quantity. This decline means that promoting strain has intensified prior to now few hours, inflicting concern amongst buyers.

DOGE reached a market cap $8.6 billion immediately. Chart: TradingView.com

The RSI, one other essential indicator, has dipped under the impartial 50 level, reaffirming the presence of promoting strain. These developments put DOGE at a pivotal crossroads, with each short-term bullish and bearish eventualities in play.

In response to a worth report, if consumers can efficiently defend the $0.06 help level, DOGE might see a short-term goal vary of $0.064 to $0.067. Nonetheless, if sellers handle to breach this essential help, their near-term goal turns into $0.055, probably deepening the bearish sentiment.

Market Volatility Vs. Derivatives Buying and selling

Along with the worth fluctuations, the Dogecoin market has been marked by appreciable volatility these days. But, regardless of the turbulence, new derivatives merchants have remained conspicuously absent.

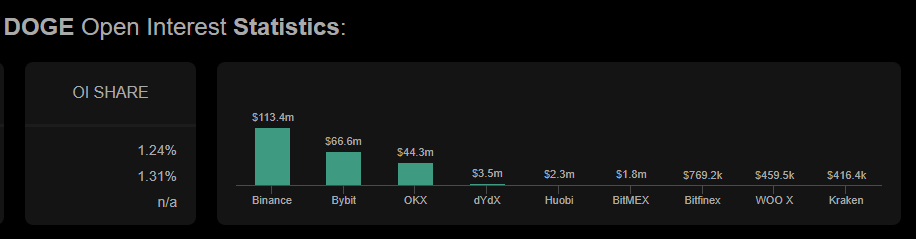

Supply: Coinalyze

DOGE’s futures Open Curiosity (OI) has been hovering within the $232 million to $222 million vary for the previous week. Sometimes, rising open curiosity signifies an inflow of latest capital into the market, which regularly solidifies prevailing traits. Nonetheless, the present pattern suggests dealer indifference, presumably because of the uncertainty surrounding DOGE’s speedy future.

Merchants ought to carefully monitor whether or not the present key help can stand up to the strain, and the OBV and RSI indicators present important insights into the evolving market dynamics. The following few days might be essential in figuring out whether or not DOGE can regain its bullish momentum or succumb to additional bearish strain.

(This website’s content material shouldn’t be construed as funding recommendation. Investing includes threat. Once you make investments, your capital is topic to threat).

Featured picture from Tuttnauer