Bitcoin has been trending up since hitting a neighborhood low under $25,000 on September eleventh. Yesterday’s rally to $27,435 marked a ten% enhance from the current low. As NewsBTC reported, the rally was largely led by the futures market and an enormous enhance in open curiosity of over $1 billion, greater than half of which was flushed out when BTC fell again under $27,000. Regardless of this, BTC is up round 7.5% from final week’s low. A cause to be bullish?

Glassnode Report Sheds Gentle On Market Sentiment

In accordance with Glassnode, the Realized HODL Ratio (RHODL) serves as a vital market sentiment indicator. It measures the stability between investments in just lately moved cash (these held for lower than every week) and people within the fingers of longer-term HODLers (held for 1-2 years). The RHODL Ratio for the yr 2023 is flirting with the 2-year median level. Whereas this means a modest inflow of recent buyers, the momentum behind this shift stays comparatively weak.

Bitcoin RHODL ratio | Supply: Glassnode

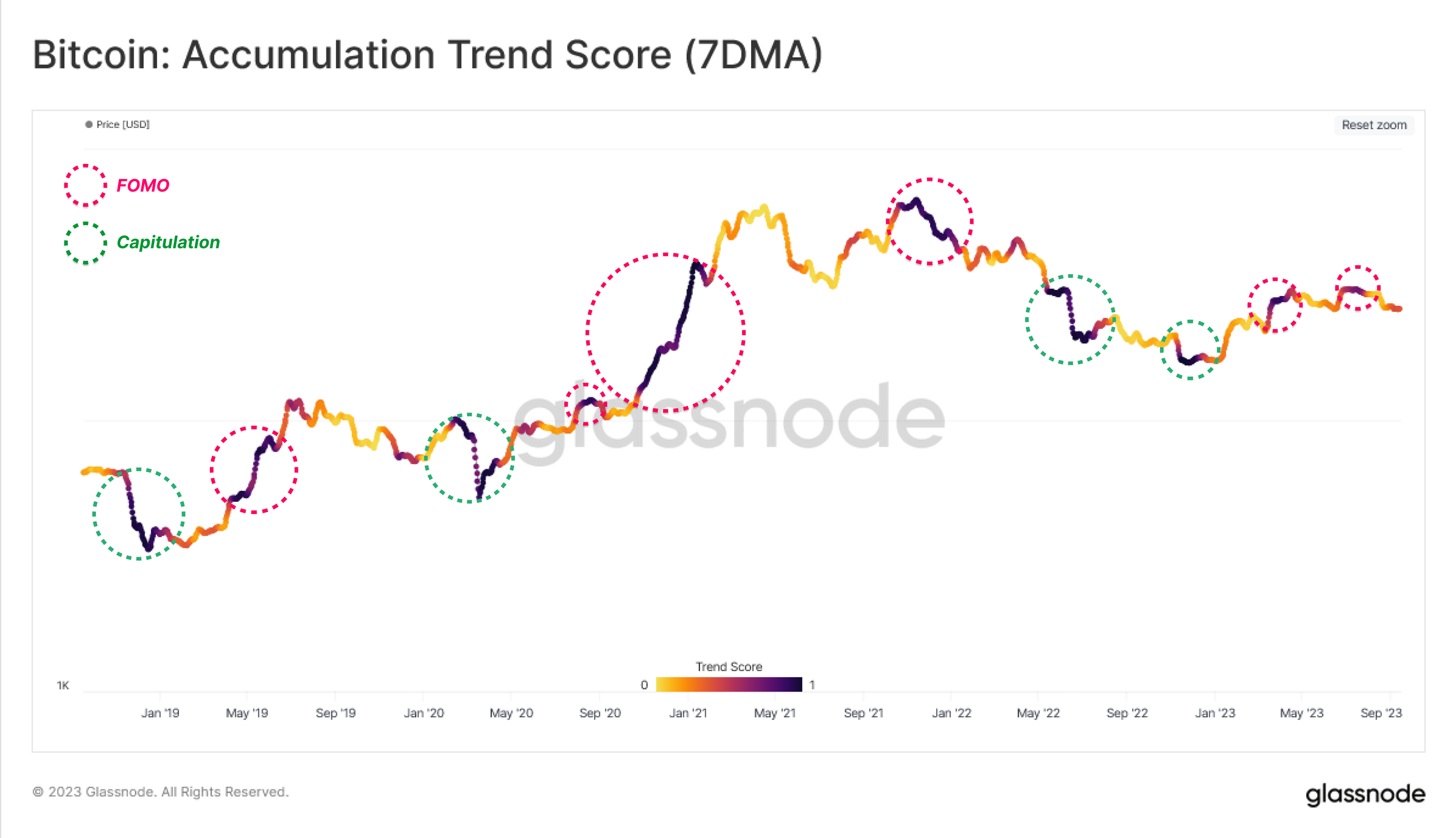

Glassnode’s Accumulation Development Rating additional elaborates on this pattern. It reveals that the present restoration rally of 2023 has been considerably influenced by investor FOMO (Concern of Lacking Out), with noticeable accumulation patterns round native value tops exceeding $30,000. This habits contrasts sharply with the latter half of 2022, the place newer market entrants confirmed resilience by accumulating Bitcoin at lower cost ranges.

Bitcoin accumulation pattern rating | Supply: Glassnode

Bitcoin accumulation pattern rating | Supply: Glassnode

The Realized Revenue and Loss indicators additionally reveal a posh image. These metrics measure the value change of spent cash by evaluating the acquisition value with the disposal value. In 2023, durations of intense coin accumulation have been usually accompanied by elevated ranges of profit-taking. This sample, which Glassnode describes as a “confluence,” is just like market habits seen in peak durations of 2021.

An evaluation of Quick-Time period Holders (STH) uncovers a precarious scenario. A staggering majority, greater than 97.5% of the availability procured by these newcomers, is at the moment working at a loss, ranges unseen because the notorious FTX debacle. Utilizing the STH-MVRV and STH-SOPR metrics, which quantify the magnitude of unrealized and realized earnings or losses, Glassnode elucidates the intense financial pressures current buyers have grappled with.

Market Confidence Stays Low

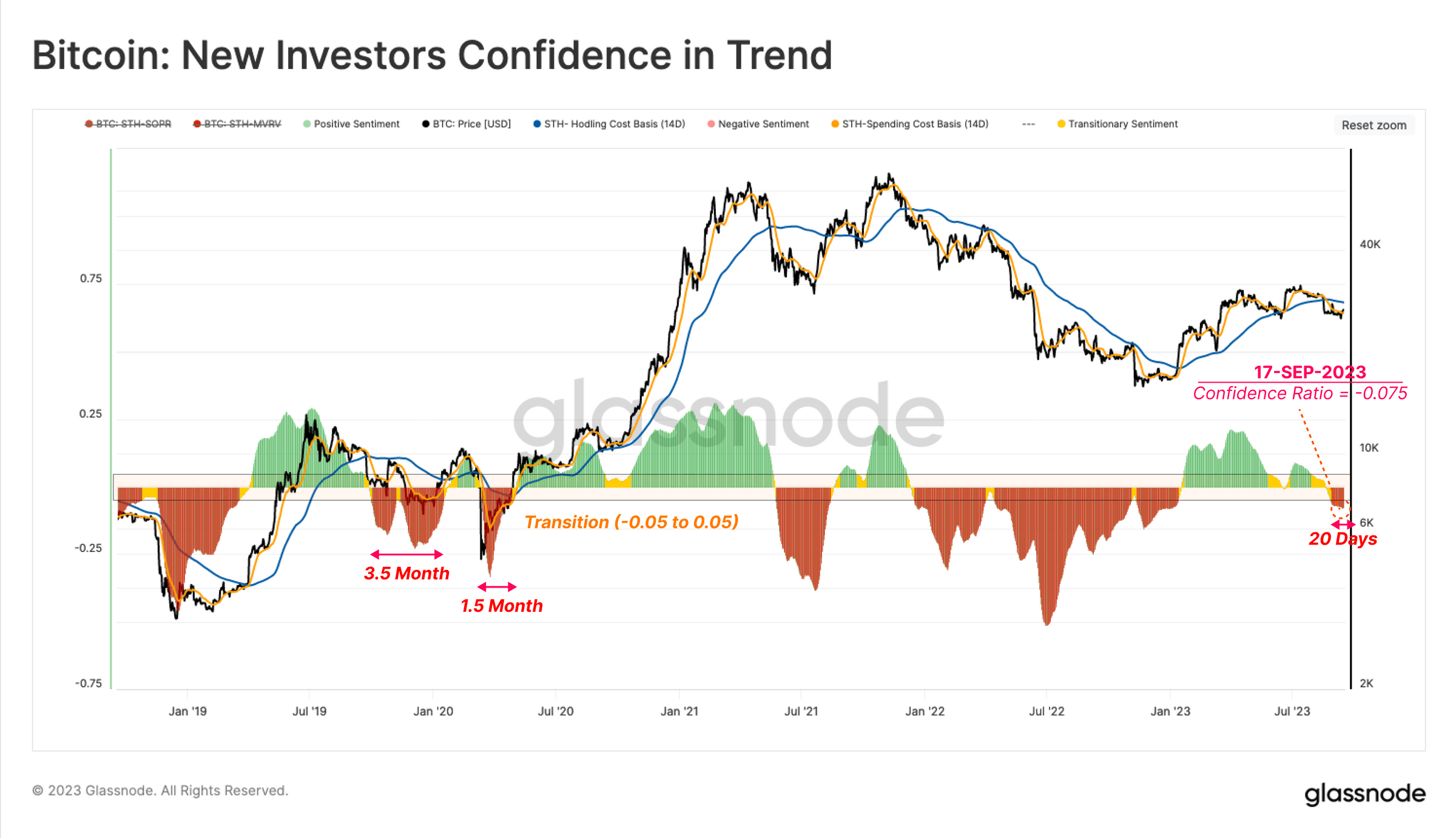

The report additionally delves into the realm of market confidence. A detailed examination of the divergence between the associated fee foundation of two investor subgroups — spenders and holders — provides a sign of prevailing market sentiment. Because the market reeled from the worth plummet from $29k to $26k in mid-August, an overwhelmingly destructive sentiment was evident. This was manifested as the associated fee foundation of spenders fell sharply under that of holders, a transparent sign of prevalent market panic.

To supply a clearer visualization, Glassnode has normalized this metric in relation to the spot value. An important commentary is the cyclical nature of destructive sentiment throughout bear market restoration phases, normally lasting between 1.5 to three.5 months. The market just lately plunged into its first destructive sentiment section since 2022’s conclusion.

At present, the pattern lasts 20 days, which might imply that the tip has not but been marked by the current rally, if historical past repeats itself. Nonetheless, if there’s a sustained bounce again into optimistic territory, it could possibly be indicative of renewed capital influx, signifying a return to a extra favorable stance for Bitcoin holders.

New investor confidence in pattern | Supply: Glassnode

New investor confidence in pattern | Supply: Glassnode

In conclusion, Glassnode’s on-chain knowledge reveals a Bitcoin market that’s at the moment in a state of flux. Though 2023 has seen new capital getting into the market, the inflow lacks sturdy momentum. Market sentiment, particularly amongst short-term holders, is decidedly bearish. These findings point out that warning stays the watchword, with underlying market sentiment providing combined indicators in regards to the sustainability of the present Bitcoin rally.

At press time, BTC traded at $26,846 after being rejected on the 23.6% Fibonacci retracement level (at $27,369) within the 4-hour chart.

BTC falls under $27,000 , 4-hour chart | Supply: BTCUSD on TradingView.com

BTC falls under $27,000 , 4-hour chart | Supply: BTCUSD on TradingView.com

Featured picture from iStock, chart from TradingView.com