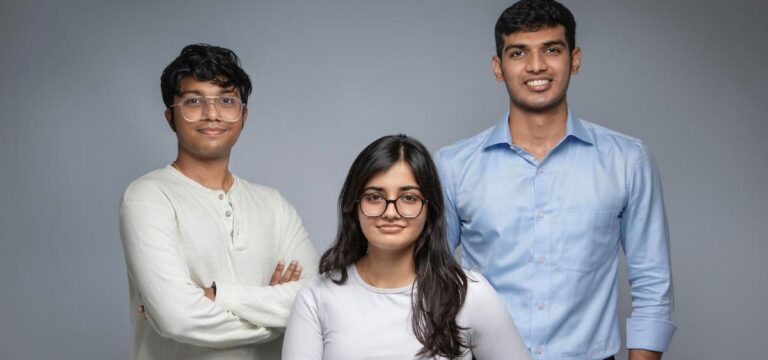

Brine Fi Founders Shaaran Lakshminarayanan (CEO), Ritumbhara Bhatnagar (CDO), and Bhavesh Praveen … [+]

Brine Fi

Does the world want one other decentralised alternate for these eager to commerce cryptocurrencies? Brine Fi, which is as we speak unveiling a $16.5 million funding spherical that values the enterprise at $100 million, insists it does. Whereas there could also be greater than 500 DEXs now plying their commerce, Brine Fi argues buyers are flocking to those platforms within the wake of the FTX collapse – and that there’s loads of room for enchancment on current venues.

Arguments over the deserves of DEXs in comparison with centralised exchanges (CEXs) are well-rehearsed. The latter provide a well-recognized really feel for buyers, significantly those that have been accustomed to dealing property reminiscent of equities on inventory exchanges, and infrequently provide a extra user-friendly buyer interface. The draw back is that with a CEX, you’re anticipated to carry your property on the alternate – and that comes with dangers provided that exchanges can and do fall over, because the collapse of FTX so spectacularly demonstrated.

“DEX volumes have remained regular post-FTX whereas volumes on centralised retail exchanges have dropped,” says Linda Jeng, Head of Web3 Technique on the Crypto Council for Innovation. “DEXs permit the person to conduct peer-to-peer trades on-chain, so if the DEX failed, the person’s transactions are recorded on-chain not on an inside ledger.”

“You’ve bought to imagine and belief in a CEX,” says Shaaran Lakshminarayanan, co-founder and CEO at Brine Fi. Should you don’t, he factors out, it’s possible you’ll favor a decentralised alternate the place you keep custody of your property and the alternate’s know-how matches consumers and sellers, with pricing automated.

Nonetheless, there may be disadvantages right here too. “Not all DEXs are created equal,” provides Jeng. “Some are extra centralized than decentralized, which could make them simpler to hack. A standard sort of DEX is computerized market maker (AMM) platforms, which might have liquidity dangers.”

“The draw back to DEXs is they could be a little much less sure and slightly costlier,” Lakshminarayanan concedes. Decentralised exchanges generally wrestle with liquidity – there could not all the time be consumers for what you wish to sell, significantly on the market value. Transaction charges on some exchanges are higher. And there could also be execution delays which depart merchants weak.

These points clarify why Brine Fi thinks there’s nonetheless a spot out there for a DEX supplier providing aggressive phrases and high ranges of service. Its trading charges begin at 0.05% and customers get paid to refer different merchants; Lakshminarayanan provides that its use of zero information proofs know-how allows it to supply execution in milliseconds, even on giant trades from institutional buyers, and larger privateness.

Brine Fi actually isn’t the one DEX on the market competing arduous on value. Platforms reminiscent of dydx additionally see price as a vital level of market differentiation. Charges do look like coming down throughout the sector. It is also value declaring that the controversy about safety is not fully binary – DEXs require a component of belief too, given the way in which they’re arrange.

However, Brine Fi thinks it may possibly enchantment to a broad vary of buyers – it factors to purchasers together with hedge funds, which are actually displaying an elevated curiosity within the sector. “We’re constructing Brine for merchants and establishments who want to transition from a CEX to a DEX, however haven’t discovered the proper DEX for his or her wants,” provides Lakshminarayanan. “It has helped us onboard a few of the largest hedge-funds, exchanges and high frequency merchants on the earth by serving to them diversify their asset allocation and mitigate counterparty dangers.”

Transaction volumes are starting to rise, with Brine Fi saying it has executed $300 million value of trades over its first month in industrial trading. It’s a good begin, although the broader context is that the numbers are a way off the most important DEXs – Uniswap and Curve, for instance – a few of that are seeing each day volumes of a whole bunch of tens of millions. Certainly, knowledge from DEX Metrics Uniswap’s current each day volumes in extra of $600 million.

Within the brief time period, Lakshminarayanan believes $20 million a day is a practical goal for the enterprise, which he based with college mates Bhavesh Praveen, Ritumbhara Bhatnagar. “We expect we may be cheaper, quicker and extra dependable than different DEXs,” he says.

The corporate’s buyers actually have religion. As we speak’s $16.5 million Collection A spherical is led by Pantera Capital, with participation from Elevation Capital, Starkware, Spartan Group, Goodwater Capital, Upsparks Ventures, Protofund Ventures and plenty of angel buyers.

Paul Veradittakit, managing companion at Pantera Capital, thinks the brand new platform has a shot at breaking by means of. “Brine tackles a few of the most vital challenges holding again institutional and mainstream person adoption in decentralised finance,” he argues. “There’s an pressing demand for a self-custodial execution layer that’s quicker, extra dependable, user-friendly, and cost-effective.”

Vaas Bhaskar, principal at Elevation Capital, an early backer of the enterprise, can also be satisfied it may possibly construct on its progress to date. “We’re excited to proceed to spend money on Brine, in its mission of abstracting complexities of blockchain know-how and making it extra accessible to finish customers and establishments,” he says.