After per week of shifting sideways, the Bitcoin worth is lastly experiencing some motion; bulls are pushing for probably the most fast important resistance. The rising uncertainty within the macroeconomic panorama helps the spike in worth motion, however optimist operators might need been too quick at leaping to their positions.

As of this writing, Bitcoin trades at $29,700 with sideways motion within the final 24 hours and a 2% revenue over the previous week. Different cryptocurrencies within the prime 10 are experiencing related worth motion, however Solana stands out with a 6% revenue on related timeframes.

BTC’s worth shifting sideways on the day by day chart. Supply: BTCUSDT Tradingview

Why Is The Bitcoin Worth Up At present, However Might Be Down Tomorrow

All eyes are set on tomorrow’s US Consumer Worth Index (CPI) information, the proxy to gauge inflation on this nation’s fiat foreign money. A current report highlights optimistic expectations for this occasion, as most buyers count on inflation to proceed its decline.

This would possibly permit the Federal Reserve (Fed) to decelerate on its rates of interest hike program, lastly giving Bitcoin room to interrupt and flip $30,000 into assist. Nevertheless, the report notes that any surprises might set off the alternative impact.

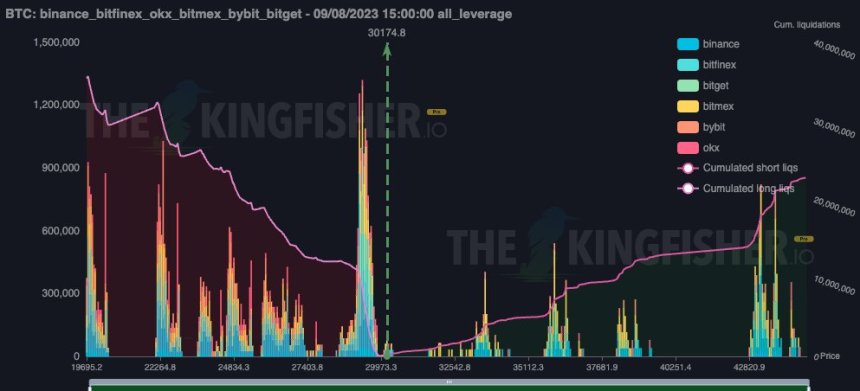

On this situation, information from crypto analyst agency The King Fisher reveals a focus of lengthy liquidity sitting between the $27,000 to $29,000 ranges. As seen within the chart beneath, this liquidity might function as a magnet erasing BTC’s achieve and pushing it into assist.

BTC longs round $27,500, and $28,500 could possibly be a hazard for a rally. Supply: TheKingFisher on X

BTC longs round $27,500, and $28,500 could possibly be a hazard for a rally. Supply: TheKingFisher on X

Conversely, optimistic CPI information might have little to no influence on BTC, permitting it to proceed in its present vary. As NewsBTC

Analyst Keith Alan from Materials Indicators believes Bitcoin bulls are combating to regain management over the 50-day shifting common (MA). Whereas the analyst expects bullish momentum might weaken, a push into the area round $30,200 to $30,000 is probably going. Alan acknowledged:

That doesn’t imply we are able to’t see a push to the $30.2k – $30.5k vary immediately. Actually I feel there’s an excellent probability we might see that, and if we do, I’ll take some extra revenue on my scalp. What I’m expecting is the place we shut immediately and had been bid liquidity is available in as native assist.

Cowl picture from Unsplash, chart from Tradingview