Bitcoin value has surged in latest days on BlackRock information. The massive query is whether or not the bulls can proceed to push the worth higher or are they operating out of steam. With that in thoughts, there’s at the moment a hanging resemblance in BTC’s 1-day chart to the mid-March 2023 rally.

Again then, BTC value noticed a pullback of over 22% after hitting a one-year high of $25,200. Information from the macro and crypto surroundings has been extraordinarily bearish after USDC misplaced its peg to the US dollar and a renewed banking disaster threatened. Nonetheless, amid rumors of a Silicon Valley Financial institution (SVB) bailout, BTC noticed a 46% surge. Remarkably, this occurred on a double pump with a one-day breather.

Bitcoin value rises for the second time?, 1-day chart | Supply: BTCUSD on TradingView.com

Right now, Bitcoin might be in that place once more. When bitcoin value fell under $25,000 on June 14th, the information was extraordinarily bearish (Tether FUD, SEC lawsuits and extra). But, as soon as once more, BTC was saved by bullish information: BlackRock’s proposal for a bitcoin spot ETF.

For the reason that information, BTC is up over 20%. The worth took a breather yesterday. The million-dollar query: Is the second a part of the pump coming immediately, because it was in March, or has Bitcoin already skilled the double pump (see yellow circles). On this case, June 18 might have been the equal of a one-day breather from the March rally.

Knowledge helps bitcoin bulls, however warning is warranted

In keeping with Greeks.dwell analysts, BTC choices might develop into necessary immediately. A complete of 31,000 BTC choices are expiring immediately with a put-call ratio of 0.73, a maximum ache level of $27,000 and a face value of $930 million. Fueled by the surge in BTC, the value of BTC possibility positions elevated by nearly 50% this week.

“The present inversion of BTC and ETH on every main time period IV is clear, now cross-currency IV arbitrage may be very cost-effective, BTC IV is higher than ETH within the long-term unsustainable,” the analysts be aware.

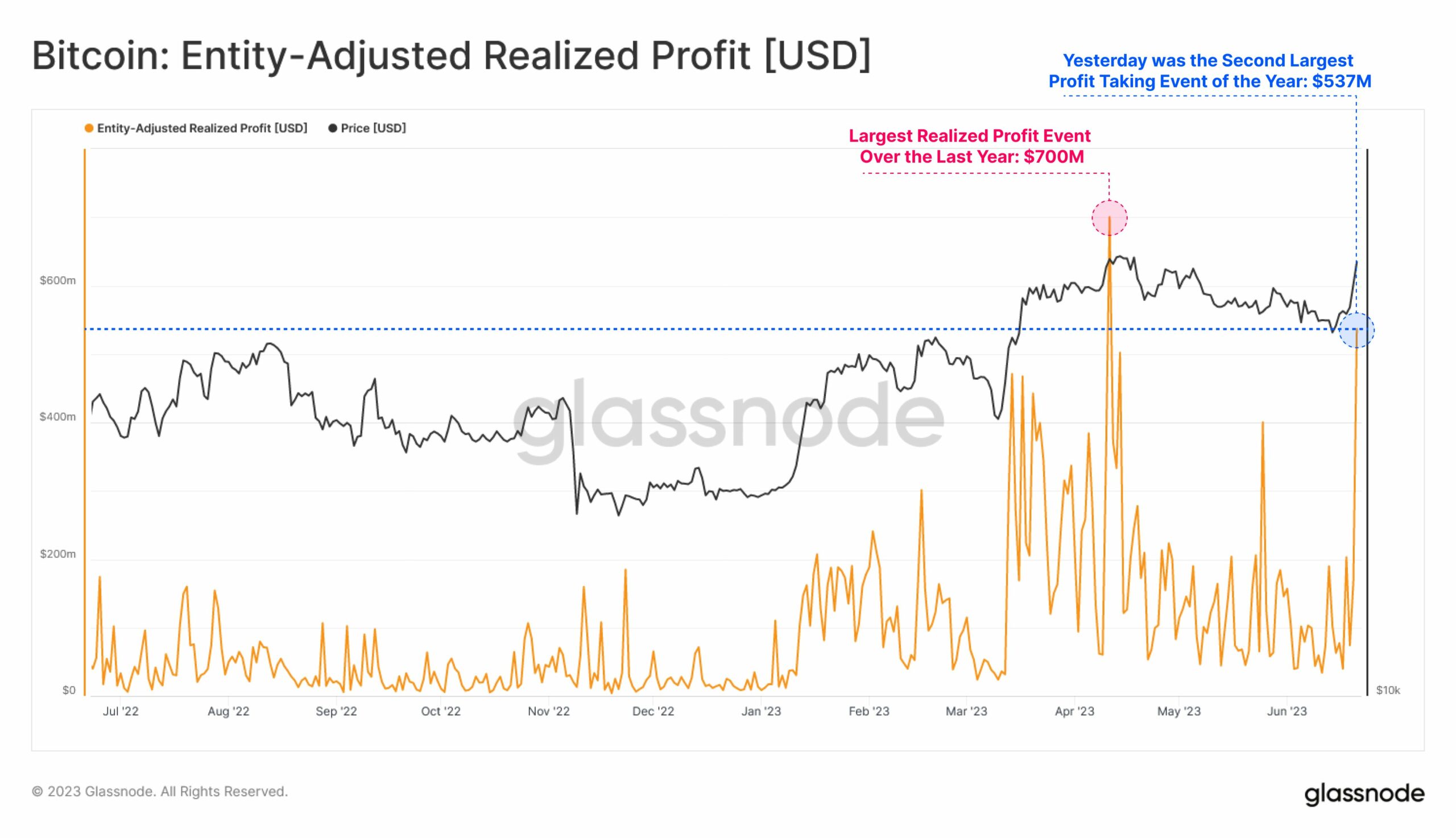

In the meantime, on-chain consultants at Glassnode defined yesterday that market individuals took a not-inconsiderable revenue of $537 million following Bitcoin’s latest rally, the second largest profit-taking over the previous 12 months.

Bitcoin: Firm Adjusted Realized Achieve | Supply: Twitter @glassnode

Bitcoin: Firm Adjusted Realized Achieve | Supply: Twitter @glassnode

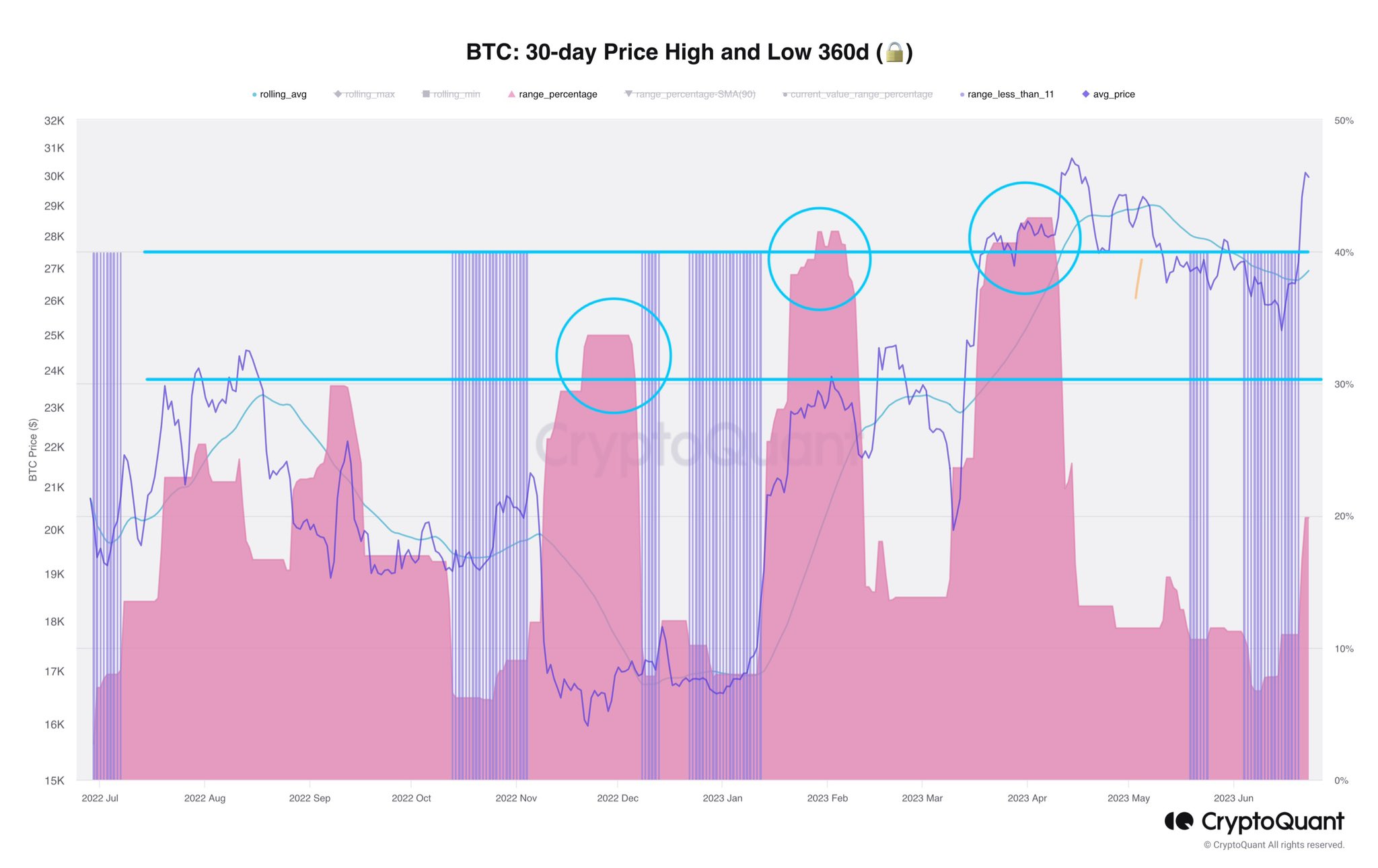

Nonetheless, different on-chain information introduced by analyst Axel Adler Jr. reveals that there’s nonetheless potential for a second surge. As Adler writes, intervals of low volatility (blue spikes) have been adopted by speedy value actions (pink) up to now. These rallies had been bigger than these seen by BTC over the previous few days. Adler remarked:

Final 12 months such fluctuations reached as much as 30-40%. We’re at the moment witnessing one other pink surge!

Bitcoin volatility | Supply: Twitter @AxelAdlerJr Crypto dealer @DaanCrypto additionally sees additional upside given the spot premium: “The bitcoin spot premium is already again. Tops do not often appear like this. The yearly high of $31,000 is the principle curiosity.”

Bitcoin volatility | Supply: Twitter @AxelAdlerJr Crypto dealer @DaanCrypto additionally sees additional upside given the spot premium: “The bitcoin spot premium is already again. Tops do not often appear like this. The yearly high of $31,000 is the principle curiosity.”

[UPDATE: 10:40 am EST]: BTC choices expiry is now not obtainable and has not had a serious affect on the worth.

Chosen picture from iStock, chart from TradingView.com