On-chain knowledge reveals Bitcoin miners have deposited giant quantities to exchanges. Here is what that might imply for the value of the asset.

Bitcoin miners have just lately deposited giant sums of cash to exchanges

In a CryptoQuant publish, an analyst identified that BTC miners just lately transferred cash from their wallets. The related indicator right here is “miner outflow,” which measures the overall quantity of bitcoin miners withdrawing from their general provide.

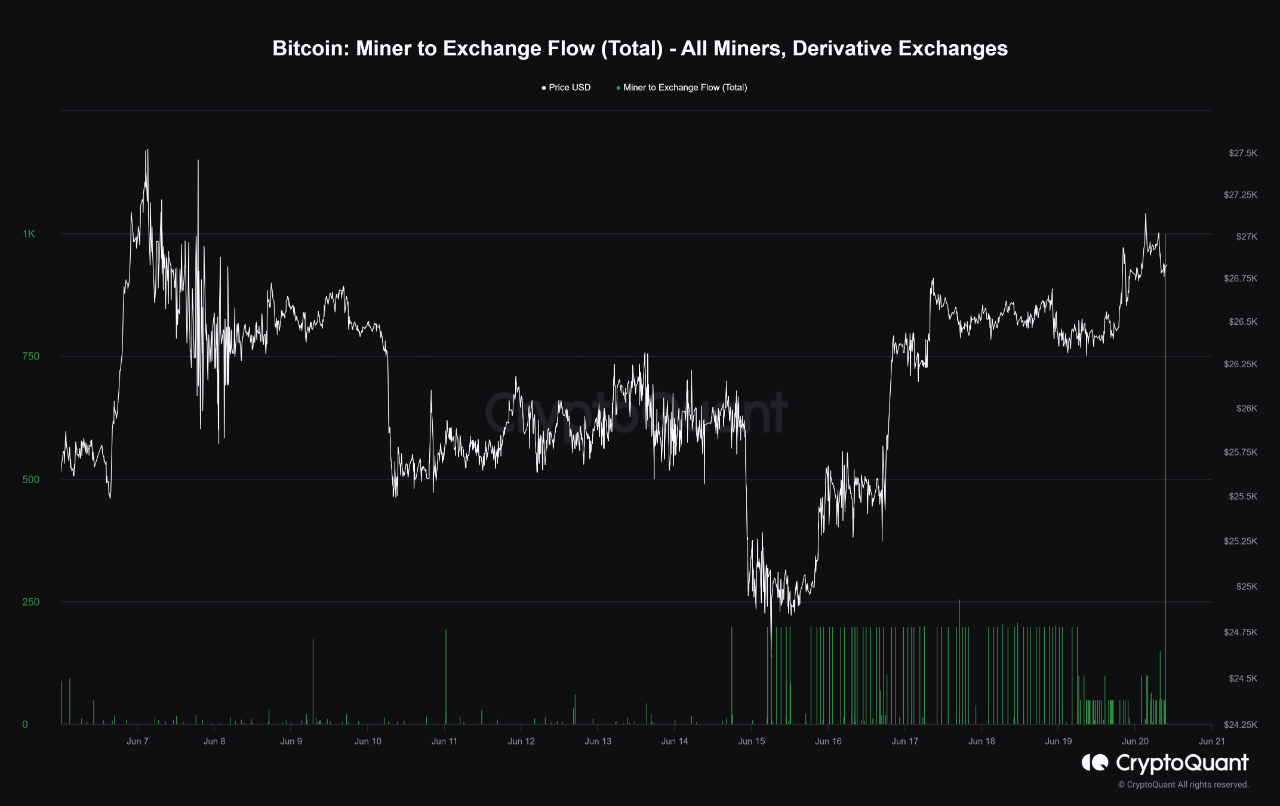

The counter metric, “miner influx,” naturally tracks reverse coin movement. Here’s a chart displaying the development in each bitcoin miner outflow and influx over the previous few days:

It seems just like the value of one of many metrics has elevated in the previous few days | Supply: CryptoQuant

The chart above reveals that over the previous day, bitcoin miners outflow has seen a rise whereas influx has remained comparatively low. This is able to imply that the miners transferred a web quantity of cash from their wallets throughout this era.

On the whole, when miners withdraw cash from their wallets, there’s at all times a threat that they’re doing so to sell these cash. After all, such a sale can have a destructive influence on the value of the cryptocurrency.

One approach to higher guess the intent behind these withdrawals is to see if the cash’ vacation spot is a central trade platform.

The chart additionally reveals the trade movement knowledge for the bitcoin miner. Particularly, this indicator tracks the cash flowing into the trade’s wallets from these chain checkers’ holdings.

This indicator, too, recorded a pointy improve concurrently with the rise in miner outflows. The power of each ideas can also be virtually the identical; each are simply over 1,000 BTC. Thus, virtually all outflows of the previous day appear to have flowed in the direction of inventory exchanges.

Nonetheless, realizing that there have been deposits on exchanges solely tells us a part of the story, because the indicator used right here doesn’t point out what sort of platforms the inflows have been made to.

A modified model of the indicator, which solely captures deposits on derivatives exchanges, reveals that the transfers have been virtually completely made to the derivatives platforms.

The value of the metric appears to have elevated lots these days | Supply: CryptoQuant

When miners plan to sell their cash, they make deposits on spot exchanges. Since this time they’ve despatched their bitcoin to derivatives platforms as an alternative, it appears probably that the intention behind their transfers may not have been to sell in any case.

What influence this might have in the marketplace; Sometimes, opening extra derivatives positions will end in higher value volatility. Nonetheless, this volatility could be both bullish or bearish relying on the general sentiment.

BTC value

On the time of writing, Bitcoin is trading round $27,400, up 6% over the previous week.

BTC has seen an upleg as we speak | Supply: BTCUSD on TradingView

Featured picture by Michael Förtsch on Unsplash.com, charts by TradingView.com, CryptoQuant.com