Isobel Lawrance

Might 24, 2023

studying time: 2 protocol

UK inflation is falling

New figures present UK inflation for the yr to April fell to eight.7%. That is down from March’s 10.1% and returns to single digits for the primary time in eight months. Whereas this got here as a aid to many, inflation remains to be barely near the 8.2% beforehand forecast.

Nonetheless, as meals costs within the UK proceed to rise at their quickest tempo in 45 years, inflation is falling at a slower tempo than analysts anticipated. Meals inflation is presently at 19.1% and is about to interrupt report speeds.

A fall in inflation is sweet information. Nonetheless, this doesn’t imply that costs are falling – it merely implies that the speed of worth will increase is slowing down. Inflation measures the speed at which prices are rising – not the prices themselves. It might probably take a couple of months for decrease costs to point out up on grocery store cabinets.

In response to information from the Workplace for Nationwide Statistics (ONS), whereas greens like potatoes are costlier than this time final yr, many staples have fallen in worth. This consists of common clients from grocery shops corresponding to bread, fish, cereal, eggs and milk.

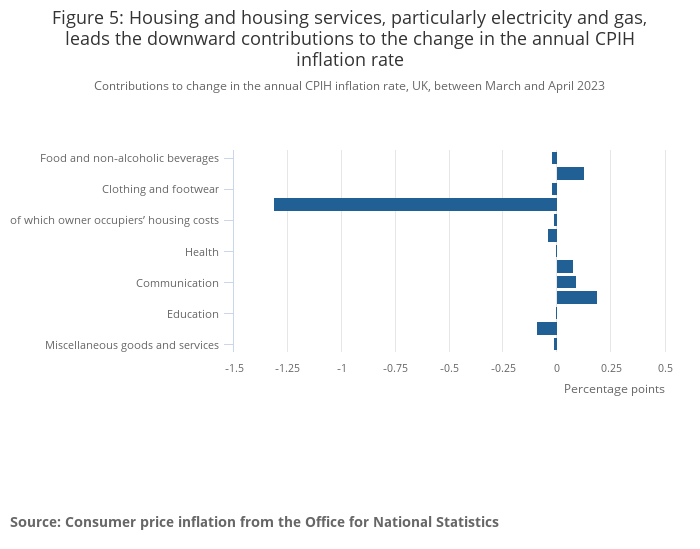

The price of housing and housing companies has fallen, which has considerably contributed to the autumn within the inflation fee. Likewise, gasoline and electrical energy costs have been a driving power behind the autumn in headline inflation.

Commenting on the newest inflation numbers, Chancellor Jeremy Hunt stated:

“Though it is constructive that [inflation] is now within the single digits. Meals costs are nonetheless rising too quick. We should resolutely stick with the plan to convey down inflation.”

Ian Stewart, Chief Economist at Deloitte stated:

“Inflation within the UK has peaked however is proving extra cussed and agency than anticipated. Rising inflation charges within the core and companies sectors spotlight the danger that home inflationary pressures will persist even because the shock from high vitality prices and different commodity costs abates.

“As development continues and recession fears ease, the setting is about for one more fee hike subsequent month, and maybe at the least yet one more by year-end.”

The complete ONS press launch might be discovered right here.