The Non-Fungible Tokens (NFT) trade has been a hub for innovation and progress over the previous 12 months, however because the mid-point of 2023 approaches, the market is displaying indicators of maturing and transformation. In keeping with a latest report In keeping with DappRadar, NFT gross sales may fall beneath $1 billion for the primary time this 12 months.

NFT market faces headwinds

In keeping with the report, the NFT market is displaying indicators of a possible shift in Might 2023, with trading quantity reaching $333 million on $2.3 million in income, a development that might see trading quantity drop within the first Month of this 12 months is beneath 1 billion US {dollars}.

Lower in NFT trading quantity. Supply: DappRadar

Regardless of this drop in income, the NFT trade continues to indicate sturdy exercise and engagement: the variety of Each day Distinctive Lively Wallets (dUAW) related to NFT exercise reached 173,000, up 27% month-on-month.

Nonetheless, in response to DappRadar, the NFT market is going through main challenges as many merchants sell their giant NFT holdings at a loss to take part within the memecoin frenzy. This has led to a rise in on-chain exercise, which has pushed Ethereum gasoline charges above $100 and negatively impacted the amount of low-value NFT transactions on the blockchain.

Nonetheless, the NFT market remains to be witnessing vital developments and occasions. Elon Musk’s Might 10, 2023 tweet referring to the Milady Maker assortment triggered a rise in trading quantity, which reached $13.95 million, doubling the variety of trades in the identical week.

As well as, the Pudgy Penguins venture secured $9 million in seed funding, launching the Pudgy Toys assortment, which achieved complete retail gross sales of $7.89 million the next week.

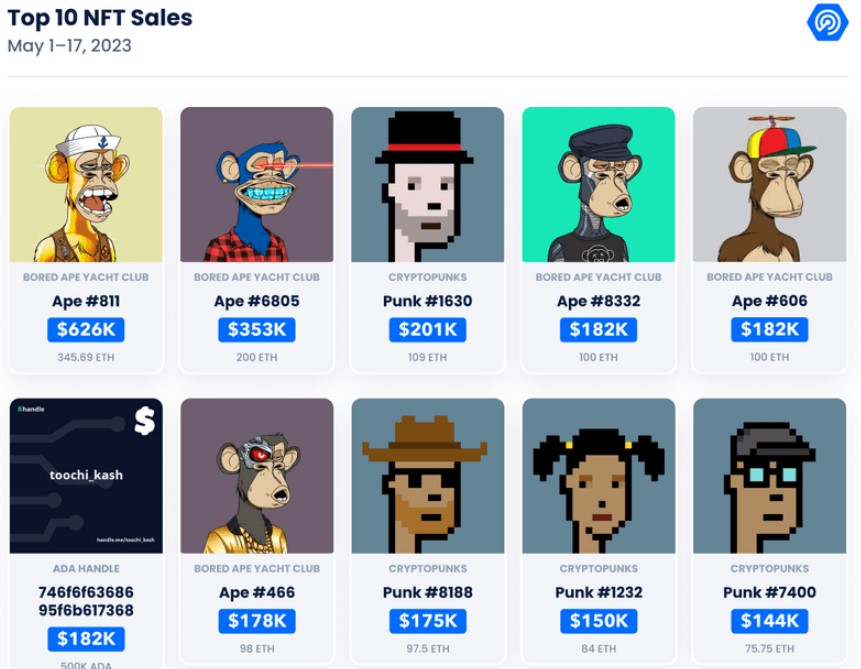

Moreover, the highest ten NFT gross sales present that the likes of Bored Ape Yacht Membership and CryptoPunks are dominating the NFT panorama. Nonetheless, in sixth place, a brand new entrant has emerged – an ADA deal with, a private crypto area on the ADA blockchain, which offered for $182,089, equal to 500,000 ADA.

NFT prime gross sales. Supply: DappRadar.

NFT prime gross sales. Supply: DappRadar.

Bitcoin ordinals vs. NFTs

Bitcoin Ordinals, a brand new type of digital asset, has change into a scorching subject within the decentralized app (dapp) neighborhood since its launch by software program developer Casey Rodarmor on Jan. 21. With over 7.4 million ordinals minted, this protocol has a big following on the time of writing.

Ordinals differ from NFTs in that they retailer all of their knowledge instantly on-chain, therefore incomes the label “digital artifacts”. This function makes ordinals a possible technical improve from NFTs and a shift in Bitcoin’s cultural panorama.

Nonetheless, the rise of ordinals and the BRC-20 token commonplace, which permits meme cash to be deployed on the Bitcoin blockchain, has raised considerations amongst Bitcoin Maxis. These improvements have strained the Bitcoin community, resulting in a backlog of unconfirmed transactions and elevated charges. The surge in transaction demand brought on charges to extend to $31 on Might 8, 2023, in response to DappRadar’s report.

Regardless of the challenges, the elevated exercise has elevated miner charges and elevated the general safety of the Bitcoin blockchain. The rise in charges signifies that increasingly persons are utilizing Bitcoin for non-financial functions, corresponding to creating and trading ordinal numbers and speculating with tokens.

The Ordinals protocol has resulted in fascinating collections and spectacular gross sales, with Ordinal Punks and TwelveFold being notable examples. These collections noticed trading quantity of 11.85 BTC and 14.9 BTC respectively during the last 30 days, indicating high curiosity and engagement within the new digital asset.

The launch of Bitcoin Ordinals represents an thrilling improvement within the NFT house, opening up new alternatives for creating and trading digital property. Nonetheless, it additionally underscores the necessity for steady innovation and upgrades to fulfill the challenges posed by elevated exercise and demand on the Bitcoin community.

BTC value has been transferring sideways on the 1-day chart. Supply: BTCUSDT on TradingView.com

Chosen picture from iStock, chart from TradingView.com