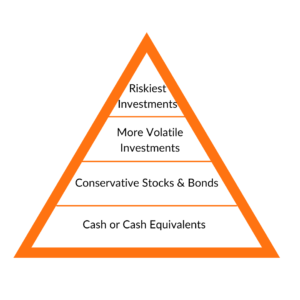

My accountant had simply given me the key to investing properly: Begin on the backside and work your manner up, level by level.

Stage #1: Money or Money Equivalents (CDs, authorities bonds, cash market funds, fundamental financial institution accounts). That’s your security web. You may have money to cowl the sudden with out falling into debt. Volatility is low, so worrying is unlikely to make you lose sleep. The chance: inflation.

your security web. You may have money to cowl the sudden with out falling into debt. Volatility is low, so worrying is unlikely to make you lose sleep. The chance: inflation.

Barbara HusonBarbara Huson is the main authority on ladies, wealth and energy. As a best-selling writer, financial therapist, trainer, and wealth advisor, Barbara has helped tens of millions take management of their funds and lives. Barbara’s enterprise background, years in journalism, grasp’s diploma in counseling psychology, intensive analysis and private expertise with cash give her a singular perspective and make her the main knowledgeable on ladies’s empowerment to satisfy their financial and private wants Potential. Barbara is the writer of seven books, her most up-to-date, Rewire for Wealth, was printed in 2021. To be taught extra about Barbara and her work, go to www.Barbara-Huson.com. www.barbara-huson.com/

Barbara HusonBarbara Huson is the main authority on ladies, wealth and energy. As a best-selling writer, financial therapist, trainer, and wealth advisor, Barbara has helped tens of millions take management of their funds and lives. Barbara’s enterprise background, years in journalism, grasp’s diploma in counseling psychology, intensive analysis and private expertise with cash give her a singular perspective and make her the main knowledgeable on ladies’s empowerment to satisfy their financial and private wants Potential. Barbara is the writer of seven books, her most up-to-date, Rewire for Wealth, was printed in 2021. To be taught extra about Barbara and her work, go to www.Barbara-Huson.com. www.barbara-huson.com/