Bitcoin worth took a significant plunge yesterday regardless of a optimistic shock within the US Consumer Worth Index (CPI) after rumors surfaced that the US authorities had bought 9,800 BTC associated to Silk Street. Since then, the market has struggled to get well from the shock.

One group of buyers, nevertheless, reveals no concern: whales. Massive cash buyers are thought of one of the dependable indicators of when is an effective time to purchase Bitcoin. On-chain analyst Axel Adler said, “BTC accumulation and distribution – no adjustments. Massive gamers proceed to purchase BTC from smaller gamers.”

The chart beneath reveals that buyers with greater than 5,000 BTC purchased massive quantities (together with smaller buyers <10 BTC) over the past 30 and 90 days, whereas all different cohorts misplaced BTC.

Bitcoin accumulation and distribution by cohorts | Supply: Twitter @AxelAdlerJr

What Do Bitcoin Whales Know?

In fact, one can solely speculate as to what the bitcoin whales know that others don’t. Nonetheless, the very fact of the matter is that Bitcoin was trending higher yesterday after the CPI launch till the faux information (manipulation?) concerning the US authorities promoting Bitcoin.

However yesterday’s consumer worth index may have much more influence than meets the attention. For some time now, the market has been betting that the US Federal Reserve (Fed) will quickly flip round. The market is presently betting on three price cuts by the tip of the 12 months (3x 25 foundation factors to 4.25-4.50%).

Whereas the US banking disaster reinforces this guess, whales might have acknowledged the Fed’s bluff for some time. As NewsBTC editor and technical analyst Tony Spilotro lately identified by way of Twitter, the Fed (and the plenty) depend on lagging indicators.

Keep in mind: CPI is a lagging indicator. The inventory market is a number one indicator.

— Tony “The Bull” (@tonythebullBTC) Might 10, 2023

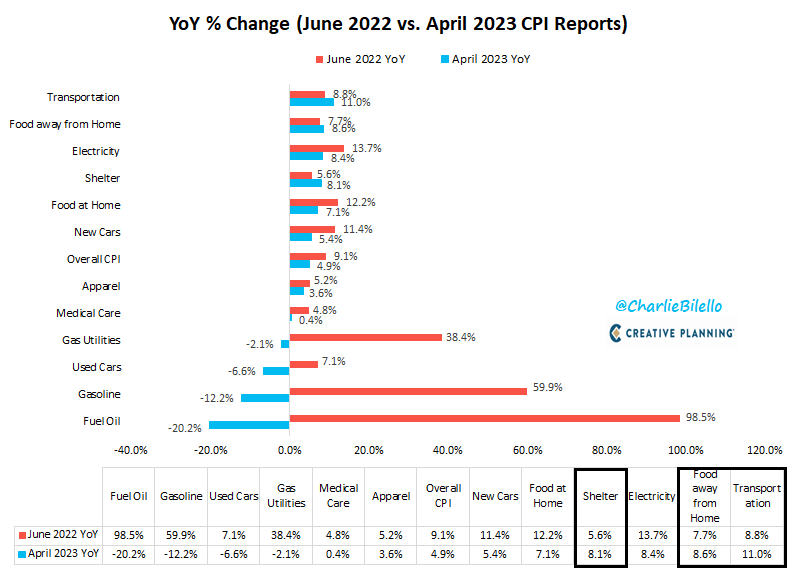

Charlie Bilello, chief market strategist at Inventive Planning, burdened on Twitter that the US CPI fell to 4.9% in April from a peak of 9.1% in June final 12 months. In accordance with the well-known analyst, the explanation for this decline is the decrease inflation charges for heating oil, petrol, used vehicles, fuel provide, medical care, clothes, new vehicles, groceries at residence and electrical energy.

Yr-on-year change in inflation | Supply. Twitter @charliebillello

Yr-on-year change in inflation | Supply. Twitter @charliebillello

Inflation charges in transportation, consuming out and lodging have risen since final June, however declines within the different key elements have offset these will increase. The truth that US core inflation (excluding meals/vitality) remains to be at 5.5% yoy is primarily on account of Shelter CPI (+8.1% yoy), in line with Bilello:

Why was Shelter’s CPI nonetheless rising when precise rental inflation had been decrease for some time? The Shelter CPI is a lagging indicator that considerably underestimates precise housing inflation in 2021 and the primary half of 2022.

Biello added that the consumer worth index for lodging recorded its first fall in April after 25 consecutive rises (on an annualized foundation), from 8.2% in March (the very best level since 1982) to eight.1% in April. Ought to lodging inflation lastly peak, it’ll have a significant influence on the general CPI, as lodging accounts for greater than a 3rd of the index.

Is deflation coming quick?

This opinion is shared by Fundstrat’s analysis director Thomas Lee. In an interview, Lee stated that inflation will fall quicker than most individuals suppose and that the Fed’s pause will probably be extra snug for buyers as it’ll end in a smooth touchdown.

For Lee, this is without doubt one of the key implications of yesterday’s April CPI report. Fundstrat’s Carl Quintanilla added:

40% of the CPI basket (by weight) is in whole deflation. That is an enormous growth. Housing and meals will not be depreciating, even when real-time measurements present this. That will add one other 50% or so in the event that they do.

A fast fall in inflation charges and a smooth touchdown, as predicted by Lee, may very well be massively optimistic for Bitcoin. Whales may use this part to bulk up whereas retail buyers sell on fears of a looming recession with high inflation.

At press time, bitcoin worth was 27,550, so it is again within the backside.

BTC worth again within the decrease vary, 4 hour chart l Supply: BTCUSD on Tradingview.com

BTC worth again within the decrease vary, 4 hour chart l Supply: BTCUSD on Tradingview.com

Chosen picture from iStock, chart from TradingView.com