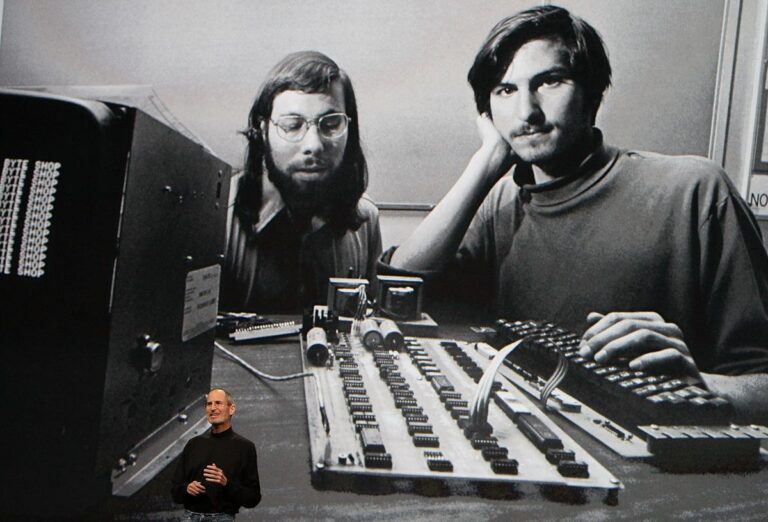

Steve Jobs’ primary mistake: The flawed means of doing enterprise. (Photograph by Justin Sullivan/Getty Photographs)

Getty Photographs

Steve Jobs was one of many best entrepreneurs of the final 100 years – and one of many happiest. His largest mistake might have destroyed Apple. Fortunately he acquired a second likelihood.

Jobs’ largest mistake was not insisting on management when he co-founded Apple. Maybe:

· He initially had no selection and was able to be fired from Apple.

· He wasn’t financially sensible and did not know find out how to begin Apple whereas staying in management – like Walton, Gates, Dell, Bloomberg, Bezos, Zuckerberg and 94% of unicorn entrepreneurs did with their ventures.

· He did not thoughts shedding management as a result of he did not anticipate somebody to fireplace him.

Jobs misplaced management as a result of he selected the flawed enterprise path, particularly the trail used to start out and construct the corporate, and was fired from the corporate he helped discovered. An important lesson for you is to decide on the correct enterprise path in your firm. Not like jobs, you could not get a second likelihood.

What’s the proper enterprise monitor in your firm – and for you? How will you discover it? These are questions each entrepreneur ought to ask themselves.

Business tracks for unicorn entrepreneurship

The 4 enterprise tracks embrace:

· Observe for small and medium-sized enterprises (SMEs).: Most entrepreneurs fail or construct small to medium sized companies. These firms can construct on current traits or on new traits. They’re on the sting of the development and aren’t the central gamers dominating the business. The query for small enterprise homeowners is whether or not, with the correct technique and abilities, they’ll construct a unicorn — in the event that they need to. VCs aren’t normally curious about ventures with small objectives.

· Product primarily based unicorn monitor: Within the pattern of $85 billion entrepreneurs I funded, interviewed, or analyzed, 1% constructed product-based unicorns (The Fact About VC). VCs are early financiers in these ventures, and these product-based unicorns are run by skilled CEOs employed by the VCs. This monitor is predicated on a product whose potential is apparent even earlier than the corporate begins. Such merchandise are primarily used within the biotechnology and medical gadget industries. For instance, a confirmed remedy for most cancers could appeal to funding to change into a unicorn. Genentech adopted this technique by utilizing VC after the expertise proved itself.

· Technique primarily based unicorn monitor: 5% of the billion dollar entrepreneurs within the pattern had been unicorn starters, the place entrepreneurs begin the enterprise and show the unicorn potential of the technique earlier than in search of VC. The VCs substitute the entrepreneur with knowledgeable CEO because the entrepreneur doesn’t have confirmed management abilities. This monitor requires entrepreneurs to have startup abilities to develop and show the unicorn technique. Entrepreneurs like Pierre Omidyar (eBay) and Jobs I (when Steve Jobs co-founded Apple and was fired) match into this class.

· Abilities-Primarily based Unicorn with entrepreneurs underneath management: These unicorns are based by billionaire entrepreneurs and constructed by them – the founding entrepreneurs retained management of the corporate. 18% used VC after Management Aha and stayed as CEO. 76% constructed their unicorn with no VC, stayed on as CEO, diminished dilution and retained extra of the wealth they created. VC-delaying billion-dollar entrepreneurs embrace Invoice Gates and Jeff Bezos. VC-avoiding UEs embrace Sam Walton, Michael Dell, and Michael Bloomberg.

Jobs was very lucky that between the time he left Apple and when he returned, none of Apple’s CEOs knew what to do with Apple. And when Apple was on the point of failure, the board requested him to return again. And he constructed one of many largest firms on the earth with the iPod, the iPhone and the iPad.

MY OPINION: You will not be as fortunate as Jobs. With out financially savvy abilities, your potential unicorn will not be constructed, or it could be acquired by the VCs and the CEO they rent and will by no means change into a unicorn – 94% of billion dollar entrepreneurs have retained management, in comparison with 6% who’re have been changed by skilled CEOs. You’ll preserve little or no of the wealth created by your organization as you’re being diluted by the VCs and the CEO. Unicorn entrepreneurs who had been eliminated as CEO retained a smaller share of the wealth created than VC delayers and VC avoiders. Learn to develop and keep in management like 94% of unicorn entrepreneurs did.