A greater approach to play with low cost places on a probabilistic pullback in MSFT.

Microsoft (MSFT) is one among two US firms with a market capitalization in extra of $2 trillion. MSFT inventory is up over 30% over the previous few months after hitting a low close to $220 on Jan. 6.

Nonetheless, the current blistering rally is lastly beginning to decelerate. “Promote in Might and go away” applies to Microsoft as month-to-month inventory returns have been unfavorable on common during the last 5 years.

Except for the current rally receding, listed here are three different very legitimate causes to be a bit skeptical about continued energy in MSFT inventory within the coming weeks — together with a greater approach to play.

Expertise

Microsoft is beginning to falter after failing to make contemporary highs above $294. Shares hit overbought ranges on each the 9-day RSI and the Bollinger % B earlier than falling. MSFT trades at a big premium to the 20-day transferring common, which has traditionally led to pullbacks to the common. MACD simply generated a sell sign.

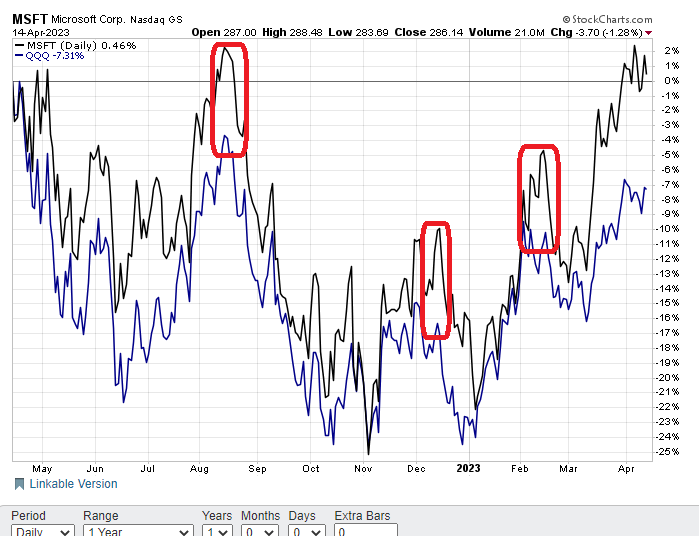

MSFT inventory additionally appears a bit overdone by comparability. Microsoft is now exhibiting a slight achieve over the trailing 12 months whereas the NASDAQ 100 (QQQ) continues to be down over 7% over the interval. Usually, MSFT and QQQ have a tendency to maneuver in tandem, which is smart on condition that Microsoft has the most important weighting within the NASDAQ 100 ETF at 12.68%.

The efficiency unfold distinction between MSFT and QQQ has as soon as once more reached an excessive.

Count on Microsoft to come back again within the coming weeks and be a significant underperformer, because it has been prior to now.

Analysis

The present price-to-earnings (P/E) ratio is again above 30x and on the highest a number of of the previous yr. The final time it hit 30x in August marked a major high for Microsoft inventory.

It is also properly above the common P/E of 27.72 over the interval. Different conventional valuation metrics reminiscent of value/income and value/free money move have seen related will increase.

It is necessary to keep in mind that rates of interest have elevated dramatically over the previous 12 months. Usually, this might have a noticeable contractionary impact on inventory valuation multiples. This makes the current enlargement in MSFT multiples much more pronounced.

Additionally, a $2 trillion firm operating all these multiples makes it tough to justify future progress charges because of the legislation of enormous numbers.

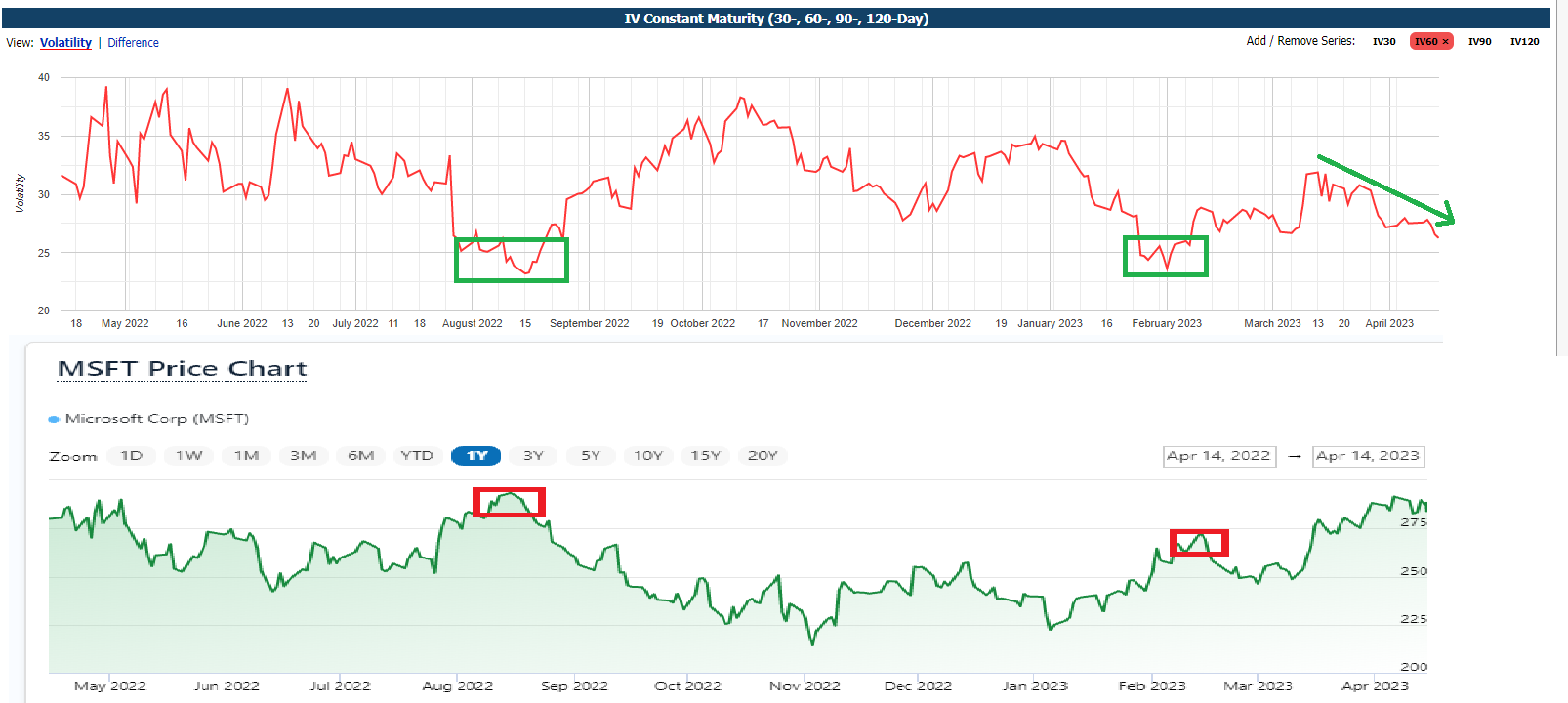

Implied Volatility

Implied volatility (IV) has fallen sharply on MSFT choices over the previous month. It’s now at its lowest level since February and is approaching the yearly lows of final August.

Discover how IV’s lows virtually precisely match current highs in Microsoft inventory. Implied volatility could be a useful market timing software.

Implied volatility is simply one other manner of describing the value of choices. A comparability from a few yr in the past helps shed some gentle.

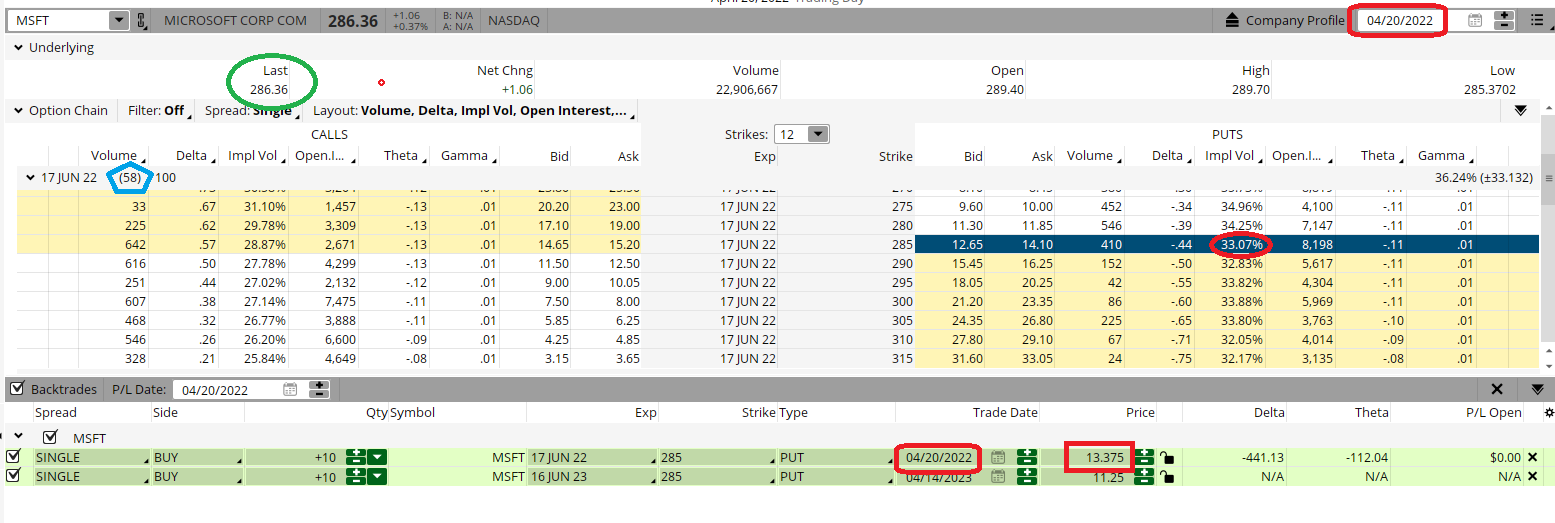

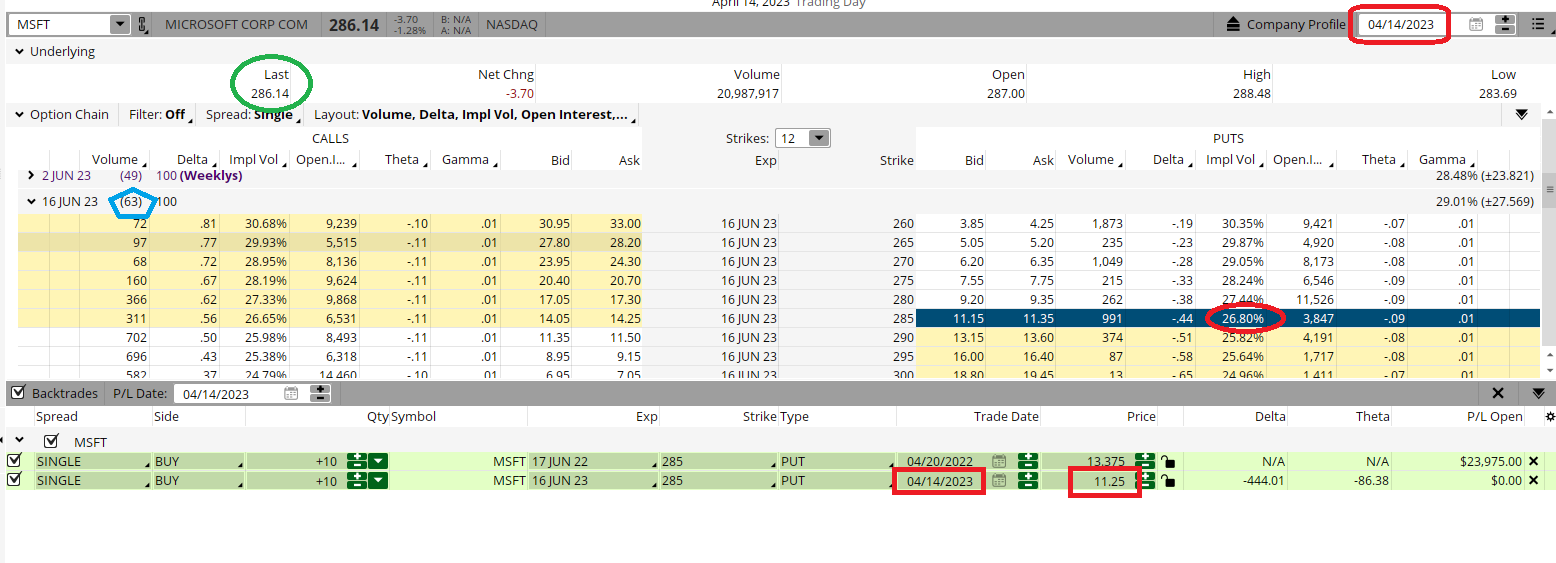

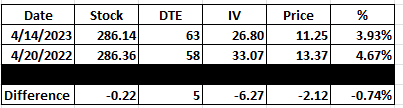

Under are the choice montages for the June choices from final Friday April 14 and one yr in the past April 20, 2022. We’ll use June’s $285 at-the-money places for our instance.

Comparability of the 2:

- The inventory value was virtually equivalent – $286.14 on Friday and $286.36 a yr in the past on April 20. So barely decrease share value on Friday.

- Days to Expiration (DTE) had been related – 63 days from Friday and 58 days from 12 months in the past. So 5 days longer till the tip on Friday.

All issues being equal, Friday’s June $285 places ought to be barely dearer than the June $285 places a yr in the past because the inventory value is decrease and has extra time to expiration.

However not all is equal – IV is way decrease now (26.80) than it was a yr in the past (33.07). This a lot decrease IV makes the present June places of $285 over $2.00 cheaper than the $285 places a yr in the past.

The next desk summarizes every thing.

The % column merely takes the choice value divided by the inventory value to create one other helpful comparability. June’s $285 places are actually lower than 4% of the inventory value, whereas the identical places would value over 4.5% again then.

Microsoft is technically overbought and essentially overvalued. Low implied volatility (IV) ranges are another excuse to be bearish. Low IV values additionally imply choice costs are cheaper.

Buyers seeking to hedge or merchants seeking to speculate can definitely brief MSFT shares. However that may be costly and dangerous.

Given the present state of affairs, it may be higher to contemplate a put buy on Microsoft with an outlined danger. It hasn’t been cheaper shortly, and the loss is proscribed to the price of the choice — what we have simply seen is lower than 4% of the price of the inventory.

POWR Choices

What do you do subsequent?

In case you’re in search of one of the best choices trades for right now’s market, take a look at our newest presentation, The best way to Commerce Choices with the POWR Scores. Right here we present you how you can persistently discover the best choice trades whereas minimizing danger.

If this appeals to you and also you wish to study extra about this highly effective new choices technique, click on beneath to entry this up to date funding presentation now:

The best way to commerce choices with the POWR scores

All one of the best!

Tim Biggame

Writer, POWR Choices Publication

MSFT shares closed at $286.14 on Friday, down -$3.70 (-1.28%). 12 months-to-date, MSFT is up 19.61% versus an 8.26% achieve for the benchmark S&P 500 over the identical interval.

In regards to the Writer: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He’s an everyday on Bloomberg TV and writes Morning Commerce Dwell weekly for the TD Ameritrade Community. His overriding ardour is making the complicated world of choices extra comprehensible and subsequently extra helpful for the on a regular basis dealer. Tim is the editor of the POWR Choices publication. Discover out extra about Tim’s background and hyperlinks to his newest articles.

Extra…

The submit Three huge causes Microsoft may be prepared for a stomp appeared first StockNews.com