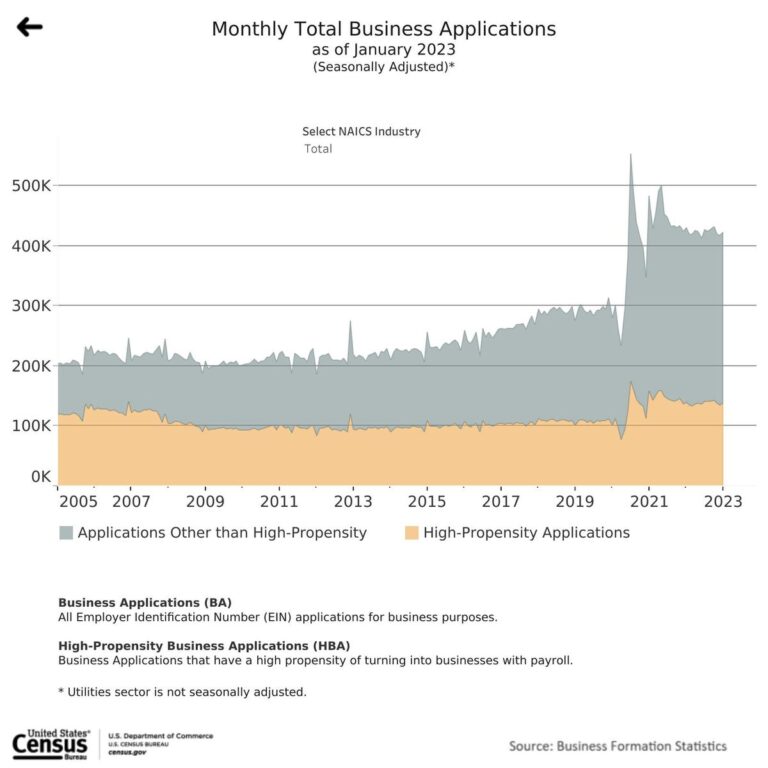

Month-to-month variety of new enterprise functions (EIN filings), each total and people with “high … [+]

US Census Bureau, Business Formation Statistics

One of many greatest upside surprises of the pandemic years was an explosion within the variety of new companies being created by People. That “startup surge,” because the Financial Innovation Group (EIG) labels it, has endured previous the formal finish of the pandemic. As proven within the chart above—from the Census Bureau’s Business Formation Statistics (BFS)—the preliminary spikes upward and downward within the second half of 2020 have since moderated. But enterprise creation within the combination stays nicely above pre-Covid ranges, a “new, considerably higher baseline,” in keeping with EIG.

Earlier than continuing, some definitions:

- “Business formation” or “enterprise creation” is outlined by the Census Bureau as an software for an employer identification quantity (EIN) with the Inner Income Service (IRS). These “enterprise functions” are sliced and diced in plenty of methods.

- “Excessive propensity” enterprise functions are EIN filings that, primarily based on varied Census standards, are deemed to have a powerful probability of hiring staff. All the opposite enterprise functions might flip into employer corporations; most of them, nevertheless, are prone to stay nonemployers for some interval of time, if not completely.

- “Projected enterprise formation” is a projection by the Census Bureau of what number of employer companies will “originate” from enterprise functions inside 4 and eight quarters of the applying.

Let’s begin with the fundamental numbers.

The Information on Business Creation

From 2005 by means of 2016, the typical annual variety of complete enterprise functions was 2.6 million. In no yr throughout that interval did the annual complete surpass 3 million. Towards the top of that timeframe, as may be seen within the Census BFS chart above, complete enterprise functions started to rise. From 2017 by means of 2019, the typical annual variety of enterprise functions rose to three.4 million, a 23% improve. Then, the surge.

Within the three-year interval from 2020 by means of 2022—even together with a drop within the early pandemic months—the typical annual quantity rose to 4.9 million. That represents an 89 % improve in comparison with the 2005-2016 interval.

On its website, the U.S. Chamber of Commerce has a slick interactive map utilizing BFS knowledge that features helpful comparability of enterprise functions—and, importantly, projected enterprise formation—by sector. Regardless that the Building sector, for instance, has had about half the entire variety of enterprise functions as Retail Commerce, it has a barely higher level of projected enterprise formation.

The rationale that Census tracks enterprise formation and initiatives future enterprise formation is that not each enterprise software will turn into an precise enterprise, not to mention one which has paid staff. The variety of “high propensity” or “seemingly employer” enterprise functions has additionally risen nicely above pre-pandemic ranges, albeit at smaller scale.

Excessive propensity, or seemingly employer, enterprise functions have additionally risen and remained nicely above … [+]

Financial Innovation Group, primarily based on Census BFS knowledge.

The month-to-month common of high-propensity enterprise functions between June 2020 and January 2023 was 36% higher than between July 2004 and Could 2020. That’s much more employers: 1.2 million extra, to be precise, relative to the pre-Covid pattern.

The 2022 Business Openings Report from Yelp corroborates the general tendencies tracked by Census and presents, primarily based on knowledge from its platform, further perception into the micro-dynamics. In response to Yelp, new enterprise openings “reached an all-time high” in 2022, “largely pushed by new residence and native providers companies.” Different varieties, reminiscent of new eating places, have been nonetheless decrease than pre-pandemic ranges. New enterprise openings, per Yelp, have been 12% higher in 2022 than in 2019. That’s a extra modest improve than proven in Census knowledge, the place high-propensity enterprise functions have been 28% higher in 2022 than in 2019. But it surely’s a helpful reminder of what the Census knowledge present: functions versus precise enterprise openings on Yelp.

Why Is It Occurring?

That’s the rapid query introduced by the entrepreneurship knowledge. And, what explains not merely the spike in 2020 and 2021 however the persistence of the surge by means of 2021 and 2022?

Varied explanations have been put forth. It’s attainable that the homeowners of the tens of millions of small companies that closed within the early months of the pandemic in 2020 began completely new companies later that yr or in 2021. This might mainly be “alternative” entrepreneurship. Layoffs within the spring of 2020 might have shoved many towards entrepreneurship. Because the Chamber places it: “Many people laid off on account of pandemic shutdowns turned their concepts and hobbies right into a enterprise that could possibly be run from residence.”

Extra broadly, the Chamber posits: “Entrepreneurs clear up issues, and when America skilled enormous issues in a concentrated time body throughout the COVID-19 pandemic, entrepreneurs rose to the event. New financial wants and altering consumer preferences created extra circumstances for brand spanking new companies to begin.” This appears true relating to altering consumer preferences, as non-store retailers (learn: e-commerce) have dominated the enterprise software improve.

The Yelp knowledge level towards extra prosaic however no much less insightful explanations. In its knowledge, sectors reminiscent of Lodges & Journey, Automotive Providers, and Occasion Providers noticed numerous new enterprise openings. E-commerce companies might have pushed enterprise creation in 2020 and 2021, however new enterprise creation in 2022, at the very least in keeping with Yelp, was pushed by everybody’s want to get again to these issues we missed throughout the pandemic.

We additionally know that enterprise capital investments into startups hit all-time highs in 2021 and early 2022. Whereas the Census BFS knowledge don’t permit us to qualitatively distinguish VC-backed startups from different varieties of companies, it does get away enterprise functions from companies. These additionally spiked in 2020 and have remained at an elevated level, although they’ve fallen in latest months again towards pre-pandemic pattern. Some researchers have used the actual fact of a enterprise being an organization as a mark of high quality and financial affect, so a rise in company formations could possibly be constructive. Apparently, nevertheless, the spike in high-propensity enterprise functions has been largely pushed by “different” functions, not these from companies.

(Right here’s one other query for contemplation, by the way in which: why have been high-propensity enterprise functions (together with these by companies) so high between 2005 and 2007? They have been a a lot bigger share of total enterprise functions than in recent times. One reply is the housing bubble, however that wouldn’t essentially clear up the higher share puzzle.)

One other manner of placing the “why” query is thru a geographic lens. It’s one factor to take a look at sectors and sub-sectors; the surge in non-store retailers would strike most individuals as fully unsurprising. However take Mississippi, which has skilled an enormous spike in enterprise functions. In 2019, in keeping with the EIG evaluation, the state ranked twenty second in seemingly employer enterprise functions per capita; in 2022, it ranked seventh. The Chamber highlights Hinds County, the state’s most populous and the place the state capital Jackson is situated. Hinds had probably the most enterprise functions (of every kind) in Mississippi. So let’s refine our why query: why did so many extra folks in Hinds County, Mississippi, file new enterprise functions in comparison with 2019?

(In response to the Yelp knowledge, Dwelling Providers and Native Providers drove new enterprise openings in Mississippi.)

New Entrepreneurial Hotspots?

The state-level knowledge from Census and analyzed by EIG, the Chamber, and others gives a great way to discover a few of the nuances of the enterprise software surge. Whereas each state skilled a rise in enterprise functions (complete and from seemingly employers) from 2019 to 2022, the surge has been removed from even. In some states, enterprise functions in 2022 have been 10-20% higher than in 2019, a decent improve. In others, the distinction was a lot bigger: South Carolina, for instance, noticed a 51% improve in seemingly employer enterprise functions. (It must be famous, nevertheless, that in Yelp’s report, seven states noticed fewer new enterprise openings in 2022 than in 2019.)

If we cross-reference the Census BFS knowledge with different Census knowledge, the state-level image will get murkier. Take Mississippi, once more. In response to the Chamber, Mississippi ranked ninth within the nation in 2022 in enterprise functions per capita. Iowa, in contrast, ranked fiftieth. But Iowa can boast a higher variety of projected enterprise formations than Mississippi as a result of it has a higher charge of enterprise functions turning into employer companies. Simply because a state skilled a surge in enterprise functions doesn’t imply it’s the brand new entrepreneurial frontier.

A comparability with the Kauffman Indicators of Entrepreneurship, additionally primarily based on Census knowledge, gives helpful nuance into enthusiastic about each the macroeconomic affect of the enterprise software surge and the way it might play out in a different way throughout the nation. Take the highest 5 states in enterprise functions per capita in 2022: Wyoming, Delaware, Florida, Georgia, and the District of Columbia. Let’s take away Wyoming and Delaware as a result of, as EIG observes, they “have lengthy been most well-liked states for enterprise incorporation” so the high development charges there might not inform us a lot about potential financial affect or native context. The subsequent states up are Colorado and Nevada. If we take a look at these 5 states’ knowledge on different entrepreneurship indicators, we see some variations. Let’s take a look at simply Florida for example.

- Prime state in Kauffman’s “charge of recent entrepreneurs”

- Above common “alternative share of recent entrepreneurs”

- Prime state in “startup early job creation”

- Under common “startup early survival charge”

- Low relative charge of enterprise functions turning into employer companies

- Above common development in new enterprise openings (Yelp).

Thus, Florida has a high charge of precise enterprise creation and jobs instantly generated therefrom, however a lot of these enterprise gained’t survive (relative to different states) and, in comparison with others, a decrease share will turn into employer companies. Comparable discrepancies are seen in different states.

Is Business Creation Completely Increased?

In response to some, sure. EIG, for instance, says “the sturdiness of the surge means that it’s capturing a real renaissance in entrepreneurial exercise throughout america.” Its evaluation helpfully scans analysis on the utility of enterprise functions as an indicator and what different datasets present about modifications within the enterprise panorama. Their conclusion: “the accessible proof means that these tendencies [in business applications] are indicative of real entrepreneurial exercise.”

John Dearie, of the Middle for American Entrepreneurship, is extra skeptical. In a latest interview, Dearie reminds us that, previous to the pandemic, new enterprise creation in america was in “precipitous decline.” The typical variety of employer corporations created every year had stalled and charges of entrepreneurship had dramatically decelerated. Concerning the pandemic surge, Dearie mentioned his “instincts inform me that we haven’t seen sufficient to declare that the form of entrepreneurship America wants—disruptive, innovation-driven, productivity- and growth-driving entrepreneurship—has actually turned the nook.” In truth, Dearie is “considerably skeptical concerning the longer-term significance of the spike” due to the sectoral composition of recent companies. Many e-commerce companies don’t essentially fall into the “disruptive, innovation-driven” class.

A few of the knowledge definitely help Dearie’s factors. A surge in automotive restore outlets might not scream entrepreneurial resurgence to these on the lookout for “disruptive” enterprise creation. The massive share of enterprise functions from these which are unlikely to be employers additionally weighs in his favor. On the similar time, nevertheless, we all know that a big share of employer corporations every year transition from nonemployer standing. That’s why the Census Bureau projections enterprise formation: a few of these non-high propensity enterprise functions will turn into employers, too.

And what about all that enterprise funding? One can definitely quibble that the knowledge of VCs shouldn’t essentially be equated with “productivity- and growth-driving entrepreneurship”—witness the billions in crypto enterprise funding that has successfully gone into an incinerator—but it surely ought to point out one thing, proper? Within the final three years, for instance, about $30 billion every year has been invested in biotech firms by means of VC offers. Absolutely a few of that’s “innovation-driven”?

EIG’s perspective that the pandemic surge in enterprise functions marks a “renaissance” of “real” entrepreneurship can also be persuasive. Definitely the persistence by means of 2022 of high ranges of enterprise functions from seemingly employers demonstrates that one thing is occurring past simply the short-term results of the pandemic. But we additionally know that, previous to Covid-19, a few of what contributing to the long-term fall in enterprise creation have been elements reminiscent of altering demographics. The U.S. inhabitants is rising slowly and getting older; that long-term pattern has not reversed.

What’s your vote? A brand new, completely higher level of entrepreneurship? Or, a brief blip that can eventually subside?