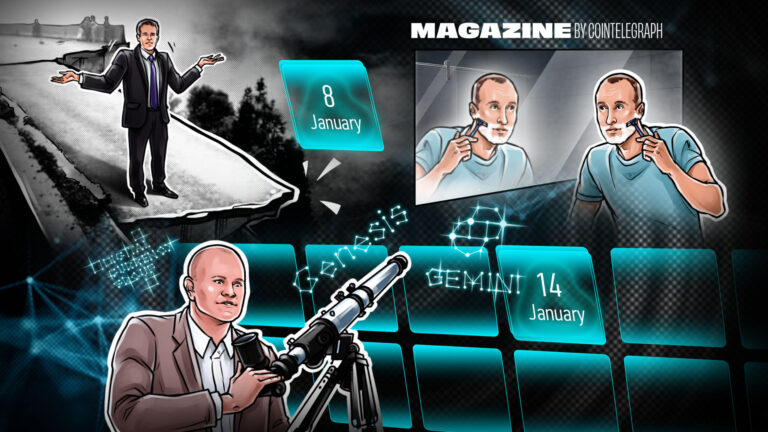

High tales of this week

Sam Bankman-Fried: “I have not stolen any funds, not to mention hidden billions.”

In a “pre-mortem overview” of FTX’s chapter, Sam Bankman-Fried denied allegations of misappropriation of shopper funds saved on the crypto trade, blaming the 2022 market crash and Binance CEO’s PR marketing campaign Changpeng Zhao answerable for the corporate’s dramatic fall in opposition to FTX. In accordance with Bankman-Fried, a run on the financial institution has led to illiquidity issues resulting in chapter. Current developments within the chapter proceedings embrace a bipartisan group of US Senators criticizing one of many regulation corporations concerned within the case over a battle of curiosity and asking the US Chapter Courtroom for the District of Delaware to nominate an impartial auditor into FTX’s operations. Additionally within the headlines for the week, FTX legal professional Andy Dietderich mentioned the corporate recovered $5 billion in money and liquid cryptocurrencies.

Gemini and Genesis are mandated by the SEC to sell unregistered securities

Crypto corporations Genesis World Capital and Gemini have been employed by the US Securities and Change Commission (SEC) to supply unregistered securities by Gemini’s earn program. Genesis and Gemini partnered for the product in 2020, providing prospects the flexibility to borrow crypto with the promise of later compensation with curiosity. The SEC said that the Gemini Earn program was a suggestion and sale of securities and will have been registered with the Commission. Tyler Winklevoss, co-founder of Gemini, mentioned the SEC’s motion was “utterly counterproductive,” noting that Gemini has been discussing the earn program with the regulator “for greater than 17 months.”

additionally learn

options

“Terra hit us extremely arduous”: Osmosis Labs’ Sunny Aggarwal

Asia Categorical

Asia Categorical: China’s NFT market, Moutai metaverse standard however flawed…

DCG owes over $3 billion to collectors and is contemplating promoting $500 million of VC portfolio

It has been a troublesome week for Genesis World Buying and selling and its mum or dad firm Digital Forex Group (DCG) as stories revealed that Genesis allegedly owes its collectors greater than $3 billion. To make up the shortfall, DCG, which additionally owns Grayscale Investments, is seeking to sell a few of its enterprise capital holdings in additional than 200 crypto-related initiatives, together with crypto exchanges, banks, and custodians in at the very least 35 international locations with a complete valuation of round $500 million.

El Salvador Passes Landmark Crypto Legislation, Paving Means for Bitcoin-Backed Bonds

On Jan. 11, El Salvador handed the landmark Digital Asset Issuance Act, which establishes the authorized framework for issuance of bitcoin-backed bonds to repay authorities debt and fund the development of a so-called “Bitcoin Metropolis.” The bonds are anticipated to deliver the nation $1 billion, half of which shall be used to construct the particular financial zone. The laws additionally creates a regulator and establishes a authorized framework for all digital belongings within the nation.

Abu Dhabi-based Venom Basis raises $1 billion fund for Web3 and blockchain

The Venom Basis, an Abu Dhabi-based blockchain platform, and Iceberg Capital introduced a brand new partnership that may allocate $1 billion to Web3 and blockchain corporations, together with decentralized purposes centered on funds, wealth administration, decentralized finance, as properly GameFi Merchandise and Providers. The funding fund will search to draw startups and tech corporations to make use of Venom’s proof-of-stake-based blockchain resolution.

Winner and Loser

Bitcoin on the finish of the week (Bitcoin) is at $19,297ether (ETH) at $1,418 and XRP at $0.37. The full market capitalization is at $916.5 Billions in response to CoinMarketCap.

Among the many high 100 cryptocurrencies, the highest three altcoin winners of the week are Gala (gala) at 125.9% Aptos (SUITABLE) at 77.52% and optimism (OP) at 45.28%.

The highest three altcoin losers of the week are Fei USD (FEI) at -2.53%, Nexo (NEXO) at -2.29% and UNUS SED LEO (LION) at 0.07%.

For extra data on crypto costs, see Cointelegraph’s Market Evaluation.

additionally learn

options

Designing the metaverse: location, location, location

options

Crypto youngsters combat for the soul of the metaverse on Fb

Most Memorable Quotes

“There are nonetheless some overhangs — DCG and Genesis and Gemini — that may play out within the subsequent quarter. It isn’t going to be nice.”

Mike NovogratzCEO of Galaxy Digital Holdings

“Historical past tells us there is not a whole lot of room for micro-currencies, which implies, you realize, now we have the US dollar and Europe has the euro and issues like that.”

Gary GenslerChairman of the US Securities and Change Commission

“So long as there may be curiosity within the crypto market, the variety of hackers won’t lower.”

Tommy DengManaging Director of Beosin

“Folks speak about them [Bitcoin] Volatility situation, however that is nothing for those who reside someplace the place your cash might simply lose half its value in a yr.”

MegasleyNigeria’s first lightning node runner

“There isn’t any means ahead so long as Barry Silbert stays CEO of DCG.”

Cameron WinklevossCo-founder of Gemini

“It was a political act and never a financial gesture. Like these rising a mustache in November to combat prostate most cancers. I put this wage in bitcoin in a chilly pockets each month and haven’t touched it.”

Christophe de BeukelaerBelgian legislator

forecast of the week

Bitcoin value is seeking to retest the 2017 all-time high close to $20,000

Bitcoin’s value has skyrocketed over the previous few days, to close $19,000 as of the tip of this week, in response to information from Cointelegraph Markets Professional and TradingView.

On-chain evaluation useful resource Materials Indicators predicts there might be a retest of $20,000. “Looks as if BTC is getting ready for a re-test of resistance on the high of 2017,” it wrote on Twitter.

In accordance with the analytics agency, “It stays to be seen whether or not we’re seeing an actual outbreak or a pretend one. Time for endurance and self-discipline.”

FUD of the week

Nexo places of work are mentioned to have been searched by the police in Bulgaria

Bulgarian regulators are rising strain on cryptocurrency lender Nexo after a gaggle of prosecutors, investigators and international brokers raided the corporate’s places of work within the Bulgarian capital Sofia on Jan. 12. The operation was launched a couple of months in the past and focused a large-scale financial legal scheme allegedly involving cash laundering and violations of worldwide sanctions in opposition to Russia. Nexo has complained concerning the actions of regulation enforcement and is getting ready a lawsuit in opposition to the authorities to say damages for the injury brought on by the abrupt police cutoff.

Rip-off Warning: MetaMask warns crypto customers about handle poisoning

Digital pockets supplier MetaMask warned customers of an “handle poisoning rip-off” by which attackers “poison” transaction histories. The assault does not enable hackers entry to customers’ wallets, however these with a behavior of copying their pockets addresses from transaction histories might doubtlessly ship funds to impersonated addresses.

Crypto.com CEO pronounces 20% downsizing that “did not consider” FTX collapse

A recent wave of layoffs has been introduced by crypto trade Crypto.com, which can scale back its world workforce by 20% following “current business occasions.” Coinbase can also be struggling to outlive the bear market, closing most of its Japanese operations underneath a restructuring plan geared toward shedding 20% of the trade’s employees.

Greatest Cointelegraph Options

“Deflation” is a foolish solution to strategy tokenomics… and different sacred cows

Novel token designs would possibly spark transient curiosity, however initiatives must study the rules of sustainable tokenomics.

Your Information to Crypto in Toronto: Crypto Metropolis

The “house” of Ethereum and Vitalik Buterin’s hometown, Toronto has embraced it sooner than most different digital belongings and is house to extra crypto initiatives than anyplace else in Canada.

Crypto layoffs surge as exchanges proceed to be affected by the prevailing bear market

Many standard cryptocurrency trading platforms, together with Kraken and Coinbase, have lately launched a brand new spherical of layoffs.

Subscribe to

Essentially the most participating learn in blockchain. Delivered as soon as every week.

editorial employees

Cointelegraph Journal writers and reporters contributed to this text.