Promoting lined calls on ETFs with conservative dividend funds can decrease your danger whereas nonetheless providing actual returns for astute buyers and merchants.

Shutterstock.com – Inventory Information

The current drop in 10-year Treasury yields again effectively under 4% has made dividend-paying stocks comparatively extra engaging once more. The truth that the Fed is nearer to the tip of its current charge hikes than to the start makes higher-yielding stocks a strong guess for the months forward.

Quite than making an attempt to choose particular person stocks, shopping for a higher-yielding ETF could be a safer and extra smart strategy. Listed here are three A-rated – Sturdy Purchase dividend funds which can be contemplating shopping for, together with a lined name to think about promoting.

- Vanguard Excessive Dividend Yield ETF (VYM)

- SPDR Dividend ETF (SDY)

- iShares Choose Dividend ETF (DVY)

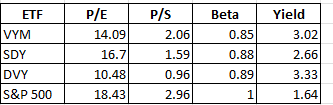

These three ETFs all have below-market danger (lower than 1.00 beta) and below-market value valuations on each a price-to-earnings (P/E) and promoting value (P/E) ratio foundation. Additionally they every boast a higher dividend yield than the S&P 500. So usually a safer guess than the general market. A fast comparability of the three dividend ETFs to the S&P 500 is proven under.

Additionally, promoting a lined name towards the dividend ETF can additional scale back danger and probably generate higher returns.

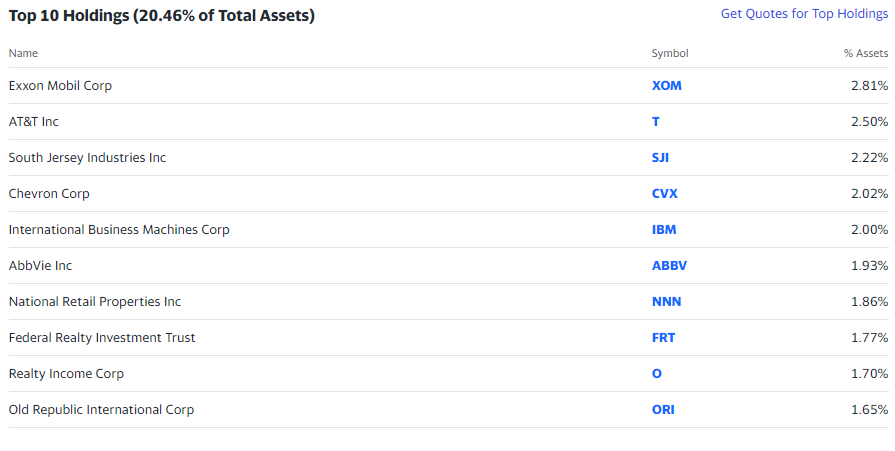

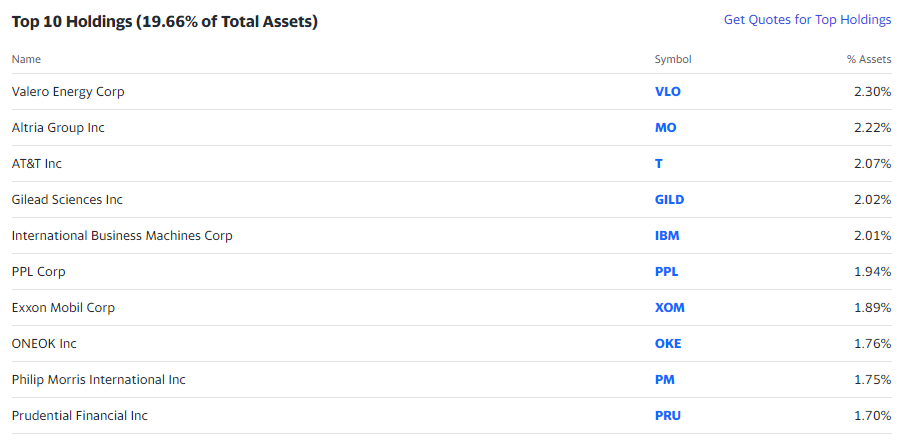

Every of the three higher-yielding ETFs has distinct parts that make up the general basket of stocks. Word that oil large Exxon Mobil (XOM) makes up a big portion of all three ETFS, however has barely totally different weighting and rating inside every fund.

Let’s take a fast stroll by way of the three.

VYM (Vanguard Excessive Dividend Yield ETF)

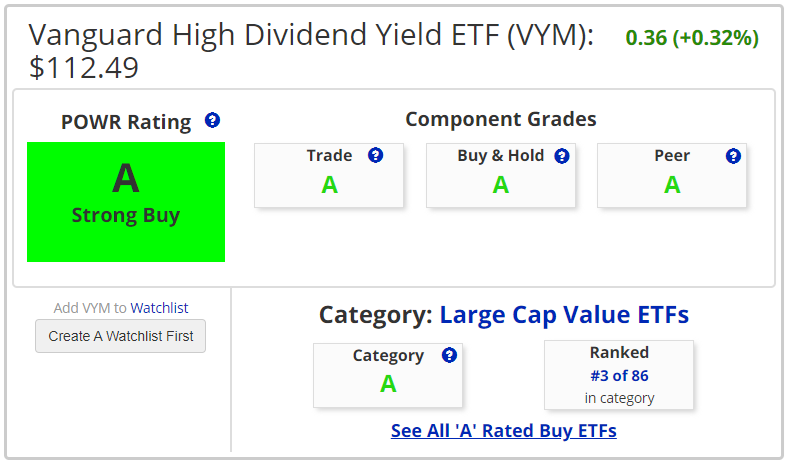

VYM has a price-to-earnings (P/E) ratio of simply over 14 (14.09) and a price-to-sales (P/E) ratio of simply over 2 (2.06). Each are at a reduction to the same multiples for the S&P 500 of 18.43 for P/E and a pair of.96 for P/E. The beta for the VYM is 0.85, which is much less danger than the general market. It has a yield of three.02%, effectively above the S&P 500’s return of simply 1.64%. It ranks #3 within the Massive Cap Worth ETF class.

The ten largest holdings in VYM account for over 23% of complete belongings. JP Morgan (JPM) and Johnson and Johnson (JNJ) occupy the highest two spots.

Promoting the $116 July name towards the underlying purchase of VYM can take the online price down by about $5.00 (over 4%) whereas nonetheless leaving a couple of 3% upside leg open for the $116 brief strike . Additionally, so long as VYM stays under $116, you continue to recover from 3% dividend.

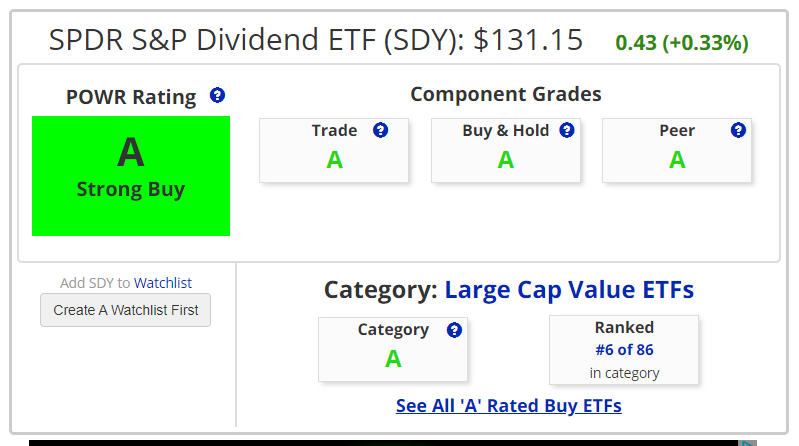

SDY (SPDR S&P Dividend ETF)

It ranks sixth amongst Massive Cap Worth ETFs.

The highest 10 holdings in SDY account for simply over 20% of the whole ETF. ExxonMobil (XOM) and AT&T (T) are the highest two.

Promoting the July name of $137 towards the underlying purchase of SDY can scale back the online price by about $5.00 (near 4%) whereas nonetheless leaving over 4% upside for the $137 brief strike . Additionally, you continue to recover from 2.5% dividend so long as the SDY stays under $137.

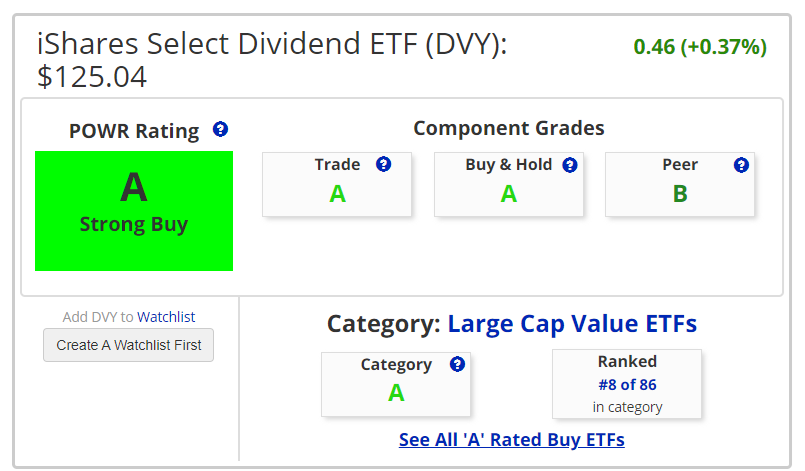

DVY (iShares Choose Dividend ETF)

DVY is ranked #8 within the Massive Cap Worth ETF class.

The highest 10 stocks for DVY are listed under. They make up nearly 20% of complete belongings. Valero (VLO) and Altria (MO) maintain the very best weightings.

Promoting the June name of $130 towards the underlying purchase of DVY can take the online price down by about $4.20 (effectively over 3%) whereas nonetheless open about 4% upside for the $130 brief strike stays. Additionally, so long as DVY stays under $130, you continue to recover from 3.3% dividend.

With the current surge in inventory costs, many merchants and buyers are on the lookout for a method to scale back danger and nonetheless get the rewards. Taking a extra conservative covered-call strategy to high-quality, higher-yielding, lower-beta ETFs is definitely a strong method to play more healthy.

POWR Choices

What do you do subsequent?

For those who’re on the lookout for the very best choices trades for right this moment’s market, take a look at our newest presentation, The best way to Commerce Choices with the POWR Rankings. Right here we present you the right way to persistently discover the best choice trades whereas minimizing danger.

If this appeals to you and also you need to be taught extra about this highly effective new choices technique, click on under to entry this up to date funding presentation now:

The best way to commerce choices with the POWR rankings

All the very best!

Tim Biggame

Writer, POWR Choices Publication

SPY shares closed at $402.33 on Friday, down $0.09 (-0.02%). Yr-to-date, SPY is down -14.31% versus a proportion achieve for the benchmark S&P 500 over the identical interval.

Concerning the Writer: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He’s a daily on Bloomberg TV and writes Morning Commerce Reside weekly for the TD Ameritrade Community. His overriding ardour is making the complicated world of choices extra comprehensible and subsequently extra helpful for the on a regular basis dealer. Tim is the editor of the POWR Choices e-newsletter. Study extra about Tim’s background and hyperlinks to his newest articles.

Extra…

The publish The best way to decrease your danger with a conservative lined name strategy to three robust dividend paying ETFs appeared first StockNews.com