Home based business journal on-line

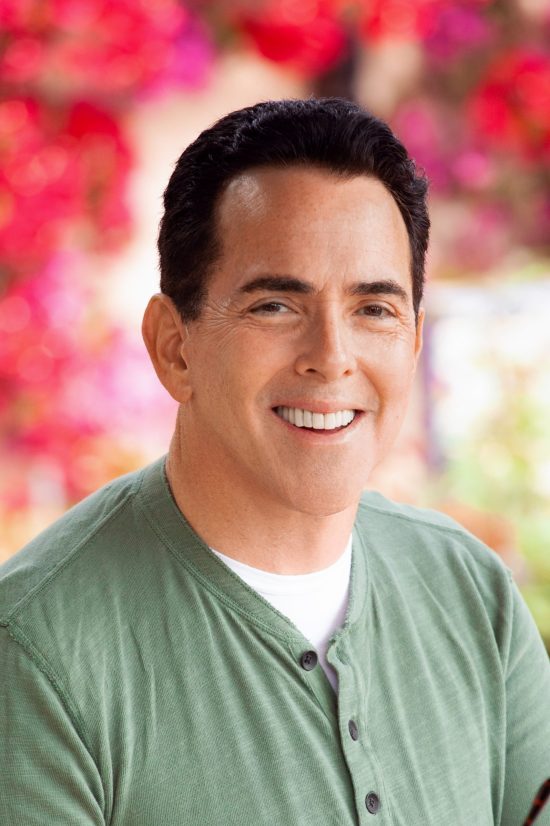

Steve Streit is a born disruptor. He introduced what was then a revolutionary thought — the pay as you go debit card that finally grew right into a financial institution holding firm, Inexperienced Dot — from the kitchen desk of his small residence to the ground of the New York Inventory Change. He isn’t carried out but. We not too long ago spoke to Streit about his newest enterprise, SWS Enterprise Capital.

What impressed you to discovered SWS Enterprise Capital?

I used to be very lucky to have the ability to settle for a enterprise thought [Green Dot] from bias to a public firm with over $1 billion in income.

As you may think about, there have been many twists and turns and many studying alongside the best way. At SWS, I wished to have the ability to use this expertise to determine doubtlessly nice startup investments and supply any assist doable to assist right now’s entrepreneurs discover their success.

How does SWS Enterprise Capital differ from different enterprise capital firms?

Our boutique measurement permits SWS to take a position opportunistically throughout industries and levels with out the constraints {that a} bigger VC might need. We concentrate on constructing a diversified portfolio of high potential firms led by nice entrepreneurs.

Your website slogan is “Powering Disruption”. Are you able to inform us extra about what this implies for SWS and the businesses it really works with?

SWS seems for firms which have strong plans to both develop merchandise which can be new to shoppers or to develop merchandise which have the potential to switch or disrupt current merchandise or enterprise fashions. Because the founding father of Inexperienced Dot Company/Inexperienced Dot Financial institution [which challenged legacy banks and helped spark the fintech boom]I do know the value that may be created when previous industries are turned inside out.

What recommendation do you’ve for younger professionals seeking to get into VC and entrepreneurship?

Nothing occurs till somebody does one thing. Too typically I speak to somebody who says, “I had the thought of doing this and that, however I by no means did.”

After all, each aspiring entrepreneur has their very own private and household dangers to think about earlier than beginning a enterprise from scratch. Nonetheless, as soon as a choice to launch has been made, you should launch and provides every little thing you’ve. Doing does not assure success, however doing nothing ensures failure.

How is the financial disaster affecting fundraising for startups?

There isn’t any query that almost all VCs and angel buyers at the moment are rather more selective in selecting the businesses to spend money on. They’re additionally extra conservative of their valuation of those firms.

That signifies that for firms seeking to follow-up rounds now, profitability — or a path to profitability — and the flexibility to enhance gross margins over time will seemingly be way more vital in securing this new funding. Buyers will at all times need to spend money on good firms, however managing danger will make the fundraising course of longer and extra tedious for all however probably the most profitable early-stage firms.

How have these turbulent instances affected your funding technique?

SWS takes a long-term funding method and our thesis stays the identical. We encourage our current portfolio firms to streamline, elevate money the place doable and train self-discipline.

Moreover, SWS continues to spend money on disruptive applied sciences pushed by formidable founders. If you need to share your organization or product with us, please contact information@swsventurecap.com or fill out our net kind at www.swsventurecap.com/contact.

The article Steve Streit – “Powering Disruption” at SWS Enterprise Capital first appeared in House Business Journal.