Bitcoin has been trading sideways round its present level with no clear path on shorter timeframes. The cryptocurrency has seen its strongest promoting stress in years however has held agency round its 2017 all-time high.

Associated Studying | Crypto Buying and selling Volumes In India Drop Due To Heavy Taxation, What’s Forward?

On the time of writing, Bitcoin is trading at $20,140 with a 4% achieve over the previous 24 hours. The general sentiment available in the market has turned extra optimistic, as NewsBTC reported yesterday, because the Crypto Worry and Greed Index climbs again from Excessive Worry ranges.

BTC is transferring sideways on the 4-hour chart. Supply: BTCUSD commerce view

In keeping with Senior Commodity Strategist Mike McGlone, Bitcoin and the crypto market are near their 2018 drawdown ranges. On the time, the rising asset class skilled the same bearish pattern that pushed BTC’s worth down 75% in opposition to its ATH .

At that time, the $3,000 worth level turned a serious backside that caused a multi-year accumulation section. In 2020, as world markets had been in turmoil because of the COVID-19 pandemic, BTC bottomed once more at almost $3,000.

After that, the cryptocurrency began a brand new rise in worth discovery. Macro circumstances are completely different this time, and Bitcoin might retest its yearly low of round $17,000, however McGlone suggests it has reached a degree the place long-term holders may gain advantage within the second half of 2022:

(…) because the Bloomberg Galaxy Crypto Index approaches the same decline because the 2018 backside and Bitcoin’s low cost to its 50- and 100-week transferring averages just like earlier institutions, we see that danger vs.

Since its inception, BTC’s worth has traditionally discovered a backside round earlier all-time highs. McGlone claims there are circumstances for $20,000 to behave as this pivot assist level in 2022 as a result of a drop in “danger motion” versus the normal market.

Bitcoin at $20,000 can look again at $2 in 2011, $200 in 2015 and $3,000 in 2018. Bitcoin and Ether danger measures are falling relative to stocks and the potential for US regulation (Lummis-Gillibrand crypto plan) is exhibiting basic maturing.

Bitcoin Quick-Time period Outlook Reveals Enchancment?

On shorter timeframes, Bitcoin has managed to remain above $20,000 regardless of the decline in conventional markets and US dollar energy. The US forex is nearing a 20-year high as buyers proceed to de-risk given the present macroeconomic circumstances.

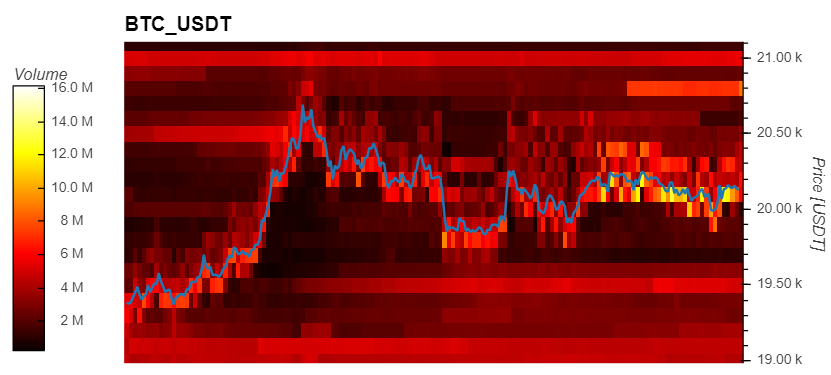

Materials Indicators (MI) knowledge data round $20 million in bid orders for BTC’s worth of $20,000 to $19,000. These ranges ought to function assist in case of additional draw back as BTC whales proceed to build up.

The value of BTC with bid orders round $20 million (yellow and pink beneath the value). Supply: Materials Indicators

The value of BTC with bid orders round $20 million (yellow and pink beneath the value). Supply: Materials Indicators

Associated Studying | TA: Bitcoin Faces One other Rejection, Can Bulls Save the Day?

Bigger BTC buyers have purchased into the cryptocurrency’s worth motion over the previous week. Addresses with 100 to 100,000 BTC added 30,000 BTC throughout this era.

Over the previous week, addresses with 100 to 10,000 $BTC have added round 30,000 #BTC to their holdings, whereas 40,000 #Bitcoin have been withdrawn from identified #cryptocurrency wallets. pic.twitter.com/vRC7cJYvbZ

— Ali Martinez (@ali_charts) July 4, 2022