Use The Energy Of The POWR Inventory Screener together with technical and volatility evaluation to discover a low danger commerce with edge in ArcellorMittal (MT).

Shutterstock.com – Inventory Information

One in all my favourite instruments within the POWR Shares Toolbox is the Inventory Screener. It does a lot of the heavy lifting that’s important in my every day commerce choice and development course of. As an choices dealer and analyst, I attempt to mix the weather of basic, technical and volatility evaluation with the POWR Screener to attempt to establish commerce concepts with a probabilistic benefit.

A tour of one of many newest potential commerce concepts will make clear tips on how to higher harness the facility of POWR inventory rankings.

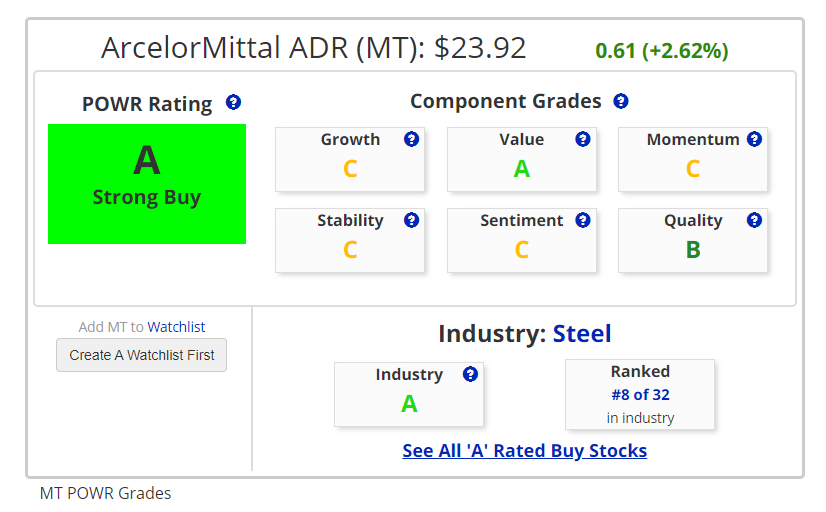

I arrange the POWR Inventory Screener to establish solely A-Rated – Robust Purchase stocks in A-Rated – Robust Purchase industries. Additionally, the display screen solely included these stocks that had a ranking part of A. Lastly, I simply wished to see these stocks that have been trading under their 20-day transferring common.

The thought course of has been to scale back danger by focusing extra on value and stocks that haven’t rallied an excessive amount of in latest days given the latest increase within the broader market. Chasing efficiency is normally not a good suggestion, significantly on this market setting.

This narrowed my listing of potential commerce candidates to 18. As a result of we’re on the lookout for potential choice trades, low-priced stocks aren’t almost as viable for choice methods. $20 is the minimal level I might think about for a real useful choices technique versus shopping for the inventory outright.

This left solely six candidates. 5 of these six actually did not have sufficient choice quantity to justify trading choices on that inventory. At all times essential to think about liquidity in choices trading. For instance, Veritiv (VRTV) traded solely 8 choices contracts on Friday and had monumental bid-offer spreads.

That left us with one potential candidate – our previous good friend ArcelorMittal (MT). The POWR choices portfolio has traded MT choices 4 occasions prior to now with stable success.

After figuring out this A-rated inventory in an A-rated business trading under the 20-day transferring common, it is at all times a good suggestion to throw in some technical evaluation.

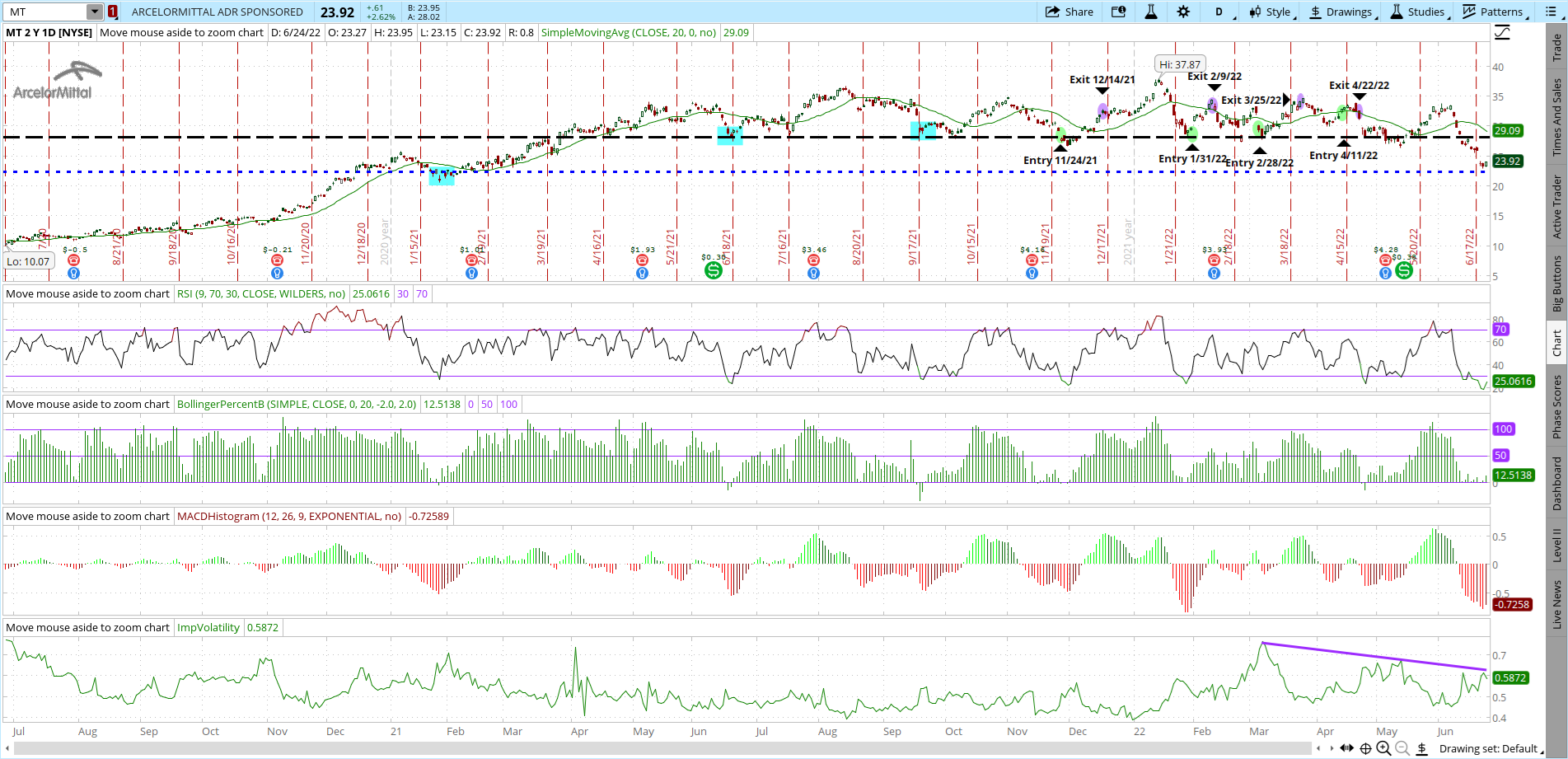

MT shares are probably the most oversold within the final two years. The 9-day RSI fell under 20 however has improved. The MACD additionally reached an excessive earlier than turning higher. Bollinger P.c B printed destructive after which turned optimistic once more. The shares are trading at a large low cost to the 20-day transferring common. Help looms at $22.50.

Beforehand, all of those indicators aligned similarly marked important short-term bottoms in MT stocks (highlighted in aqua). I additionally added that the POWR choices portfolio took a place on MT calls within the earlier 4 instances.

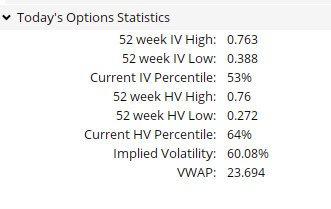

It’s fascinating to notice on the chart that the implied volatility (IV) is now properly under the highs seen in latest months. This implies choice costs are comparatively cheaper, which is an effective factor if you wish to purchase choices.

IV is on the 53rd percentile, that means choice costs are about common in value. Nevertheless, they examine favorably to precise or historic volatility (HV) of 64%.

Additionally it is helpful to conduct peer group evaluation. The POWR Inventory Business Scores is one other very great tool for merchants and buyers alike. The metal business ranks fifth total and is on the 96th percentile. MT tops the listing at #11.

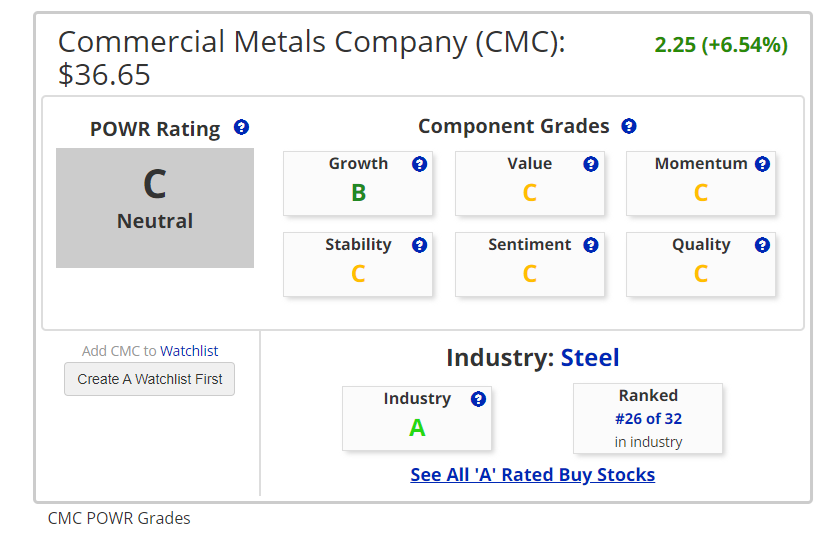

As compared, Business Metals (CMC) is only a C-rated –neutral inventory. It ranks on the backside at twenty sixth place amongst metal stocks.

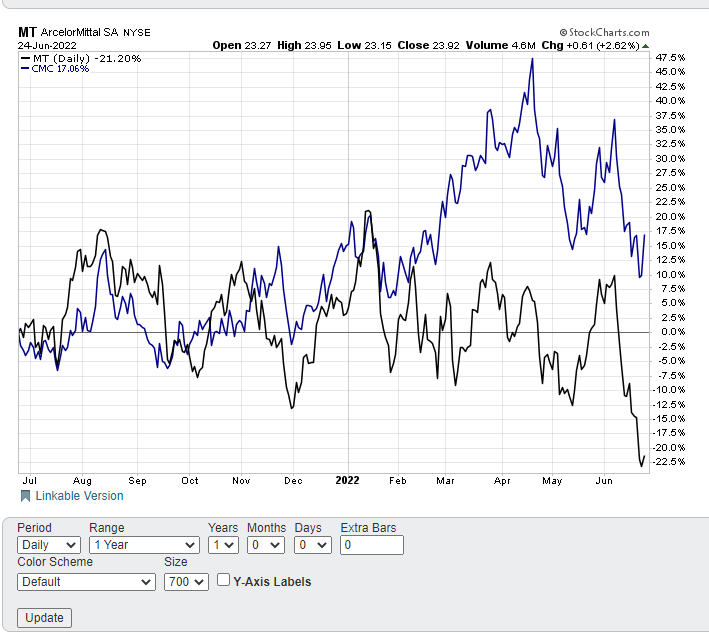

Nonetheless, CMC has been an enormous outperformer to MT over the previous few months. Over the previous 12 months, CMC is up 17%, whereas MT is down somewhat over 21%. Previous to February, each stocks have been extremely correlated. Is sensible since they’re each metal stocks. Since then, nonetheless, CMC is up about 5% whereas MT is down over 32%.

Look ahead to this divergence to begin converging with the Robust Purchase MT, which shall be a relative outperformer towards the impartial CMC within the coming weeks. There’s a good probability we’ll add some MT calls to the POWR choices portfolio very quickly.

By combining the POWR Inventory Screener with further evaluation, a complete commerce identification system could be created that can assist you discover the benefit and switch the chances in your favour. That is what we attempt to obtain each day with the POWR choices portfolio. Do not forget that trading is about chance, not certainty.

POWR Choices

What do you do subsequent?

If you happen to’re on the lookout for one of the best choices trades for as we speak’s market, take a look at our newest presentation, Easy methods to Commerce Choices with the POWR Scores. Right here we present you tips on how to persistently discover the best choice trades whereas minimizing danger.

If this appeals to you and also you need to be taught extra about this highly effective new choices technique, click on under to entry this up to date funding presentation now:

Easy methods to commerce choices with the POWR rankings

All one of the best!

Tim Biggame

Writer, POWR Choices E-newsletter

MT shares closed at $23.92 on Friday, up $0.61 (+2.62%). 12 months-to-date, MT is down -23.94% versus a -17.26% achieve within the benchmark S&P 500 over the identical interval.

Concerning the Writer: Tim Biggam

Tim spent 13 years as Chief Choices Strategist at Man Securities in Chicago, 4 years as Lead Choices Strategist at ThinkorSwim and three years as a Market Maker for First Choices in Chicago. He’s a daily on Bloomberg TV and writes Morning Commerce Stay weekly for the TD Ameritrade Community. His overriding ardour is making the complicated world of choices extra comprehensible and subsequently extra helpful for the on a regular basis dealer. Tim is the editor of the POWR Choices publication. Discover out extra about Tim’s background and hyperlinks to his newest articles.

Extra…

The submit Easy methods to Discover a Metal Inventory That is a Actual Cut price appeared first StockNews.com