In early 2009, bitcoin trading was peer-to-peer, initially through PayPal. Nonetheless, it was only some months earlier than the primary ramp was launched. Mt. Gox and earlier variants had been, as anticipated, rudimentary and centralized. Lower than a decade later, crypto trading is a vibrant business, with billions being moved each day.

Exchanges are essential channels to maneuver billions of property between customers and chains. Because the business expands and crypto good points acceptance, its position will solely improve. This surge is particularly noticeable when decentralized finance (DeFi) takes heart stage and irresistible affords are dangling.

DeFi and the position of liquidity aggregators

In lower than three years, DeFi has billions in Whole Worth Locked (TVL), with demand coming from the subsphere’s value proposition.

DeFi, because the title suggests, is the decentralization of finance by good contracts that enable customers from world wide to entry funds. As thrilling as it could be, there should be dependable ramps with acceptable ranges of liquidity for a easy, trustless change of tokens.

Decentralized exchanges (DEXes) are launched by main good contracting platforms like Ethereum and the BNB chain and have comparatively high liquidity. Nonetheless, since there are greater than a dozen blockchains with lively crypto initiatives whose tokens have a market cap within the lots of of thousands and thousands, most merchants have been leaping between exchanges manually or utilizing liquidity DEX aggregators.

Aggregating DEXes, e.g. 1 inch, permits easy change of various tokens listed in several DEXes from one UI. On this approach, liquidity aggregating DEXes saves time and sources and encourages extra customers to funnel funds into DeFi.

Though liquidity aggregating DEXs play a large position in DeFi, most are single-chain and a few are multi-chain, permitting their customers to bridge their property, however none has cross-chain aggregation capabilities. Because of this, merchants obtain fewer tokens than if they may entry liquidity on a number of chains on the identical time… oh wait. Now they’ll.

Chainge Finance: Finest pricing, cross-chain and quick processing

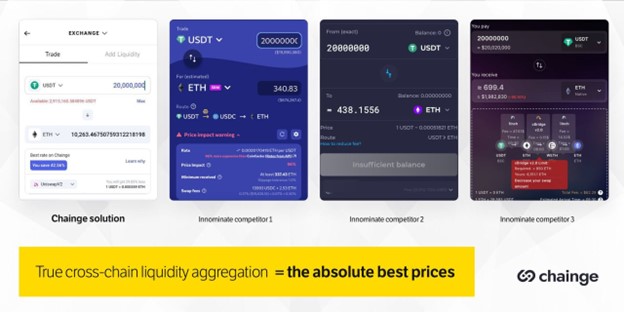

There’s a main subject that Chainge Finance is at present tackling. The builders of the cross-chain liquidity DEX aggregator have launched a blockchain-based trading platform targeted on making certain merchants commerce property in probably the most liquid atmosphere, making certain the most effective costs.

Token swapping through Chainge Finance is non-custodial and supplied by an easy-to-use cell interface. The platform additionally affords helpful asset administration instruments utilized by over 400,000 customers for a mixed TVL of greater than $160 million and aggregated complete liquidity of over $40 billion. The standout instruments accessible in Chainge Finance embody a spot, futures and choices DEX, common digital property with cross-chain roaming capabilities, a time framing module and extra.

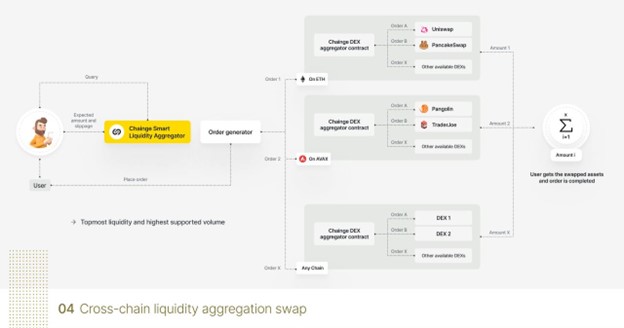

Each order initiated by Chainge Finance is queried in all 20 supported DEXes and “crawled” for the most effective costs. As soon as the chords are struck, the order is split into a number of liquid chains in order that the vendor will get the most effective costs. Participation will be simply considered within the order particulars of the app.

Chainge Finance does this by its proprietary good router that leverages DCRM expertise and a swap pathfinder algorithm. The Sensible Router software scans built-in DEXs throughout a number of chains for the most effective charges for lowered slippage, whereas making a route for quick execution.

sensible instance

When a person desires to change token A for token B, the good router polls the DEXs and determines the real-time liquidity for the A/B pair in all DEXs in every chain.

Taking gasoline prices into consideration, the good router returns the most effective route to meet the order.

For instance the fastened quantity of A tokens to swap on Ethereum in Uniswap DEX + the fastened quantity of A tokens to swap on the Ethereum chain in Sushiswap DEX + the fastened quantity of A tokens to swap on the BSC chain in Pancake DEX, and extra till the overall swap quantity is reached.

After the person locations the order, the next steps are carried out:

- Token A is wrapped within the fusion chain (it doesn’t matter what chain Token A is on)

- Transaction to burn all Token A-Common property at Fusion is signed

- The burn receipt is used to name completely different proxy swap good contracts on every chain to make use of token A on these particular chains to execute the swap.

- The swap order is executed inside the slippage margin.

NB: If the slippage margin is exceeded, the swap deal will solely be partially accomplished and the person will instantly get again the remaining a part of the A tokens.

This use case ought to exhibit the super advantages of utilizing the Chainge Finance cross-chain liquidity aggregator alias probably the most liquid DEX in the marketplace.

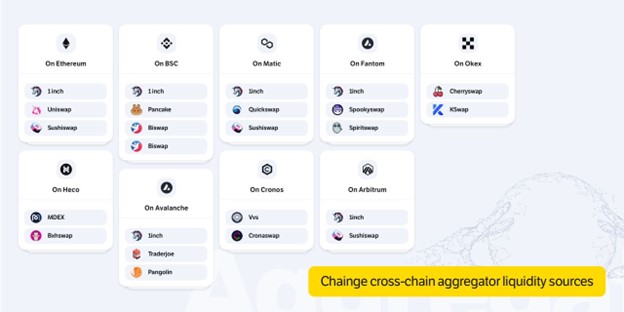

Chainge Finance has built-in 20+ DEXes and 1 Aggregator throughout 9 chains

Particularly, Change Finance’s DCRM expertise is patented and being developed by the Fusion Basis in collaboration with a few of the world’s main safety and cryptography consultants, together with Louis Goubin, Professor of Pc Science on the College of Versailles, and Pascal Paillier, Ph.D.

Chainge Finance has already built-in 20+ DEXes and 1 Aggregator on 9 in style blockchains (with many extra to come back over time). For instance, Chainge Finance integrates on Ethereum 1 inch, Uniswap and SushiSwap. They’ve since settled on VVS and Cronaswap on the Cronos blockchain.

This DeFi protocol is nicely thought out and stands out from the remainder. It’s purposefully designed to resolve present ache factors of uncomfortably low liquidity resulting in unfavorable swap charges and eliminates the necessity to use cross-chain bridges.

Finally, Chainge Finance has developed a platform the place merchants can securely commerce cross-chain property at the most effective change charges in extremely liquid environments and handle their crypto property backed by top-notch safety protocols.