Based on TokenInsight 2021 Crypto Buying and selling Trade Annual Evaluate, the trade continues to interrupt by means of, with buying and selling quantity for full-year 2021 reaching $112 trillion, about half of which is futures contracts ($57 trillion), in comparison with spot buying and selling, which 43% ($49 trillion). Moreover, whole crypto buying and selling quantity elevated 3.37x year-over-year. Extra particularly, futures are up almost 6x, spot is up 2.3x, and provide is simply 2.36x. The general information offered within the evaluate exhibits speedy development of the futures market in 2021. It has now overtaken the money market and develop into a mainstream funding channel, indicating the rising recognition of the market.

Contrasting with the dearth of selection within the spot market, futures, particularly linear contracts, enable customers to earn earnings by means of long-term holding and excessive leverage with out having to carry several types of cryptos. Due to such a bonus, increasingly more crypto buyers are venturing into the futures market. It’s clear that whereas the futures class has additionally grabbed the crypto highlight, a big group of buyers are recognizing the nice futures market prospects. Underneath such circumstances, crypto exchanges can solely acquire a foothold within the futures market and see speedy development in buying and selling quantity in the event that they enhance their futures merchandise whereas providing extra user-friendly buying and selling companies.

Though the futures market has develop into the first funding choice for a lot of crypto adopters, futures contracts stay inaccessible to most newcomers to this trade. To start with, the futures market, a venue for buying and selling crypto derivatives, is extremely fragmented and lacks constant requirements. Moreover, the futures contracts supplied by completely different crypto exchanges have completely different buildings and their phrases differ drastically. For instance, the futures contracts supplied by some exchanges are difficult and require excessive studying prices, whereas others provide skilled unique futures mechanisms that aren’t appropriate for inexperienced persons.

Along with safety and stability, buyers who’re simply entering into the futures market also needs to take into account product simplicity and ease of use when selecting an acceptable futures buying and selling platform. On this regard, CoinEx Futures is an efficient alternative because it strives to supply customers simpler futures buying and selling companies.

I. CoinEx Futures: A easy web site and an intuitive futures section

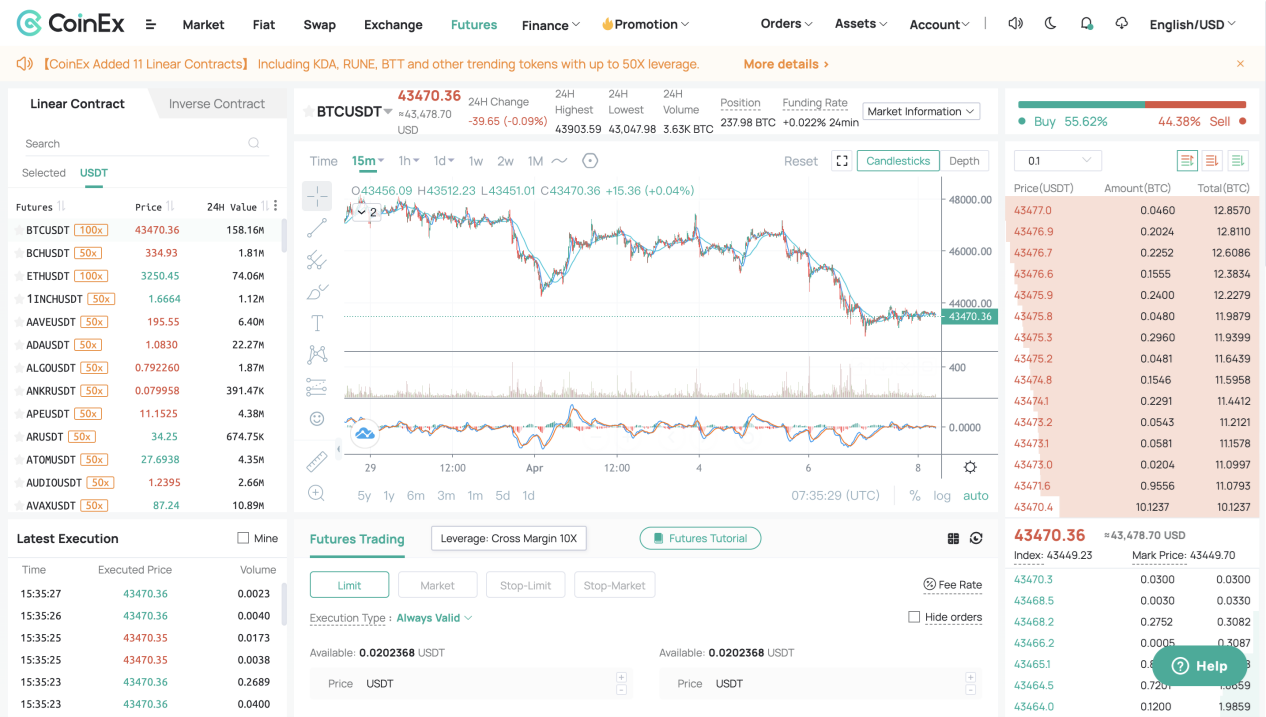

First off, CoinEx gives a easy, no-fuss futures buying and selling web site. After getting into the futures web page, customers can first choose a market to commerce linear/inverse contracts in keeping with their wants, and as soon as a market has been chosen, they may instantly see the present market circumstances and present orders.

Second, earlier than deciding on margin and beginning a place, customers can simply discover the futures tutorial on the appropriate to learn to commerce futures very quickly. By watching the video tutorials and finishing the quiz, inexperienced persons will develop into extra aware of the buying and selling course of earlier than opening a place.

II. KYC-free futures buying and selling: CoinEx maintains dealer anonymity

II. KYC-free futures buying and selling: CoinEx maintains dealer anonymity

Buying and selling futures on CoinEx doesn’t require customers to undergo KYC authentication, fixing an operational dilemma confronted by crypto customers in sure nations/areas. On the similar time, the alternate protects customers’ property with a number of safety methods. Together with an nameless, secure buying and selling setting, CoinEx additionally guarantees that every one crypto property are 100% reserved, so customers can open a place and make earnings with none worries.

III. CoinEx helps customers mitigate place dangers extra conveniently through a number of futures buying and selling mechanisms

To assist customers handle positions and simply management the related dangers, CoinEx has launched a number of futures mechanisms resembling auto-deleveraging (ADL), the insurance coverage fund, and the financing price. The CoinEx Futures index value is set by the common spot value recorded by a number of buying and selling platforms and has built-in exception processing logic. This enables the index value to fluctuate inside a standard vary when the worth offered by a single platform turns into considerably risky, giving futures merchants peace of thoughts.

IV. Futures Buying and selling Step-by-Step Tutorials in All-Inclusive Assist Middle

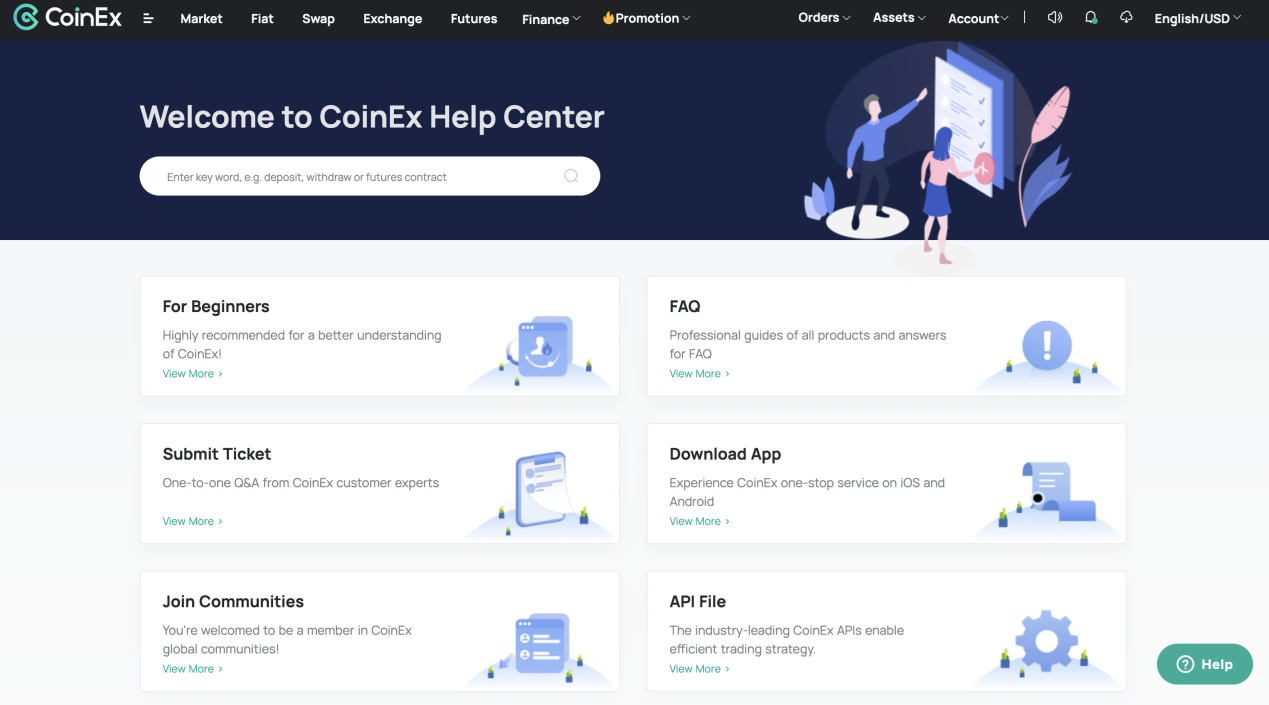

CoinEx gives an expert, all-inclusive Assist Middle that enables customers to dive proper into blockchain know-how and learn to commerce cryptos with step-by-step guides. By way of easy illustrated articles and movies, in addition to simulated futures trades, supplied by the Assist Middle, customers can develop into aware of futures very quickly. Within the meantime, you may as well seek for definitions of futures jargon by means of the Assist Middle.

Over the previous 5 years since its inception, CoinEx has garnered widespread consumer recognition with its well-established product ecosystem, clean, secure buying and selling experiences, and passable consumer companies. Based on information launched by CoinEx in 2021, the alternate made a significant breakthrough by way of its futures buying and selling quantity, which is compelling proof that CoinEx Futures is gaining recognition amongst crypto buyers. CoinEx presently gives over 100 futures markets. This yr, the alternate will proceed to prioritize futures, providing a extra diversified collection of futures markets and less complicated and extra handy buying and selling experiences.